According to the State Bank of Vietnam (SBV), up to now, the interbank electronic payment system processes an average of about VND820 trillion per day; while the financial switching and electronic clearing system processes about 26 million transactions per day.

The national credit information infrastructure has been upgraded to increase processing capacity and automatic data updating, with the successful update rate from credit institutions reaching over 98%.

To date, more than 117 million individual customer records (equivalent to nearly 100% of individual accounts with digital transactions) and more than 927 thousand institutional customer records have been biometrically verified, with a completion rate of more than 75%.

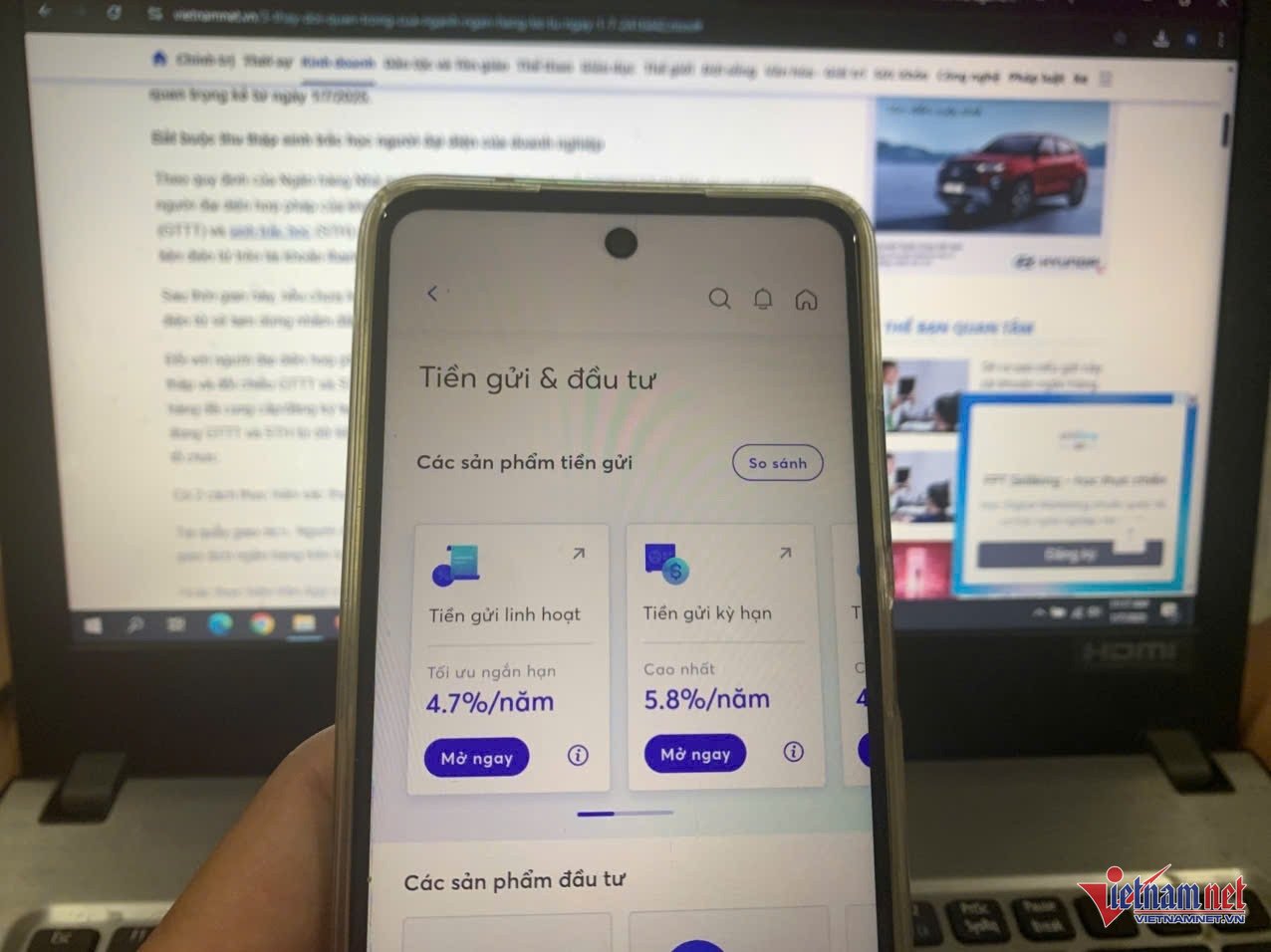

Many friendly and convenient banking products and services bring practical value to meet the diverse needs of customers. Many basic operations have been 100% digitized.

Nearly 87% of Vietnamese adults have bank accounts; the value of non-cash payments in 2024 is equivalent to 25 times the national GDP.

The above information was shared by the State Bank at the seminar "Implementation of Decree 94/2025/ND-CP dated April 29, 2025 regulating the Controlled Testing Mechanism in the Banking Sector" (Decree 94, effective from July 1), which took place on the morning of July 1.

The seminar is an opportunity for management agencies and related units to inform, share basic contents and answer policy contents in Decree 94.

Thereby, credit institutions, foreign bank branches, Fintech companies, competent state agencies, customers, other relevant organizations and individuals can grasp the contents correctly and fully to effectively organize the implementation of Decree 94; meet the requirements of unified implementation of new regulations, ensuring safety and efficiency during the testing process.

The opinions of experts at the seminar contributed significantly to the process of implementing the testing mechanism, promoting financial technology innovation to serve the goal of developing the national digital economy , improving access to financial services and modernizing the banking system.

Decree 94 is a fundamental legal document in the Fintech sector, creating a controlled testing mechanism for financial technology solutions in a real environment. This is an important step to encourage innovation, while supporting management agencies to monitor and supervise risks and perfect the legal framework in line with the development of the digital economy.

Source: https://vietnamnet.vn/hon-927-nghin-ho-so-khach-hang-to-chuc-da-duoc-doi-chieu-sinh-trac-hoc-2417045.html

![[Photo] Hanoi: Authorities work hard to overcome the effects of heavy rain](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/380f98ee36a34e62a9b7894b020112a8)

![[Photo] Multi-colored cultural space at the Exhibition "80 years of the journey of Independence - Freedom - Happiness"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/fe69de34803e4ac1bf88ce49813d95d8)

Comment (0)