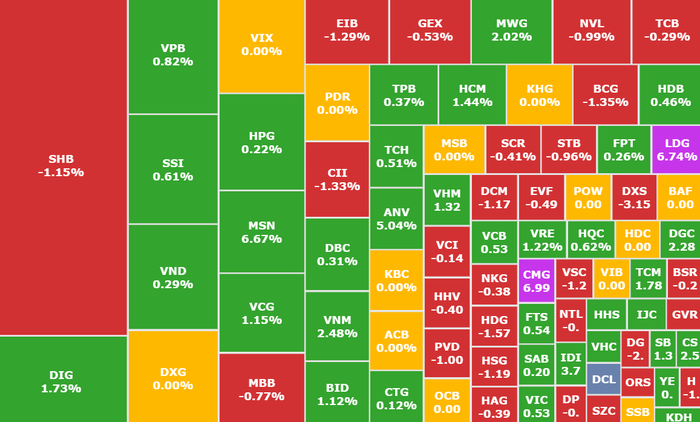

VN-Index had positive developments last week

Continuing the excitement, the market maintained positive developments with high demand, closing the week with an increase of 1.64% (equivalent to 22.09 points), up to 1,371.44 points.

Liquidity decreased slightly compared to the previous week, 9.8% lower than the 20-week average. Accumulated to the end of the trading session, the average weekly liquidity on the HOSE floor reached 833 million shares (down 1.3%), equivalent to a value of VND 21,455 billion (up 3.71%).

Regarding industry groups, "green" covered 16/21 industry groups increasing points, of which: Real estate increased by 6.93%, Industrial Park Real Estate increased by 4.9% and Consumer Food increased by 3.94%, these were the three industry groups with the strongest increase in points. On the contrary, the three groups under the strongest adjustment pressure were Oil and Gas, Fertilizer and Pharmaceuticals, decreasing by 3.48%, 1.97%, 1.32% respectively.

Foreign investors had a balanced trading week with net selling reaching approximately 42 billion VND. In terms of net buying, the focus was on VND (VNDirect Securities, HOSE) with 393 billion VND, SSI (SSI Securities, HOSE) with 368 billion VND and HPG (Hoa Phat Steel, HOSE) with 298 billion VND. In the opposite direction, STB ( Sacombank , HOSE) was 212 billion VND, FPT (FPT, HOSE) was 184 billion VND and VCB (Vietcombank, HOSE) - the 3 codes under the strongest selling pressure.

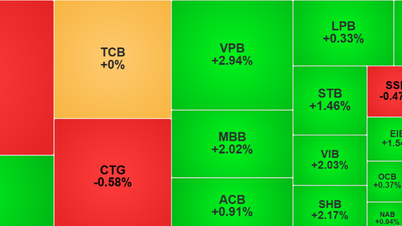

VN30 group forecast Q3/2025: 1 name can be replaced

Based on a recent report by SSI Research, based on data as of June 25, DGC (Duc Giang Chemicals, HOSE) shares are likely to be added to the VN30 basket in the third quarter restructuring, while BVH (Bao Viet, HOSE) is at risk of being eliminated due to not meeting the liquidity criteria (order matching value is only about 26 billion VND, lower than the threshold of 30 billion VND).

The HOSE-Index and sectoral indices, including VN30 and VNFIN Lead, will announce their composition on July 21, complete the adjustment on August 1 and officially take effect from August 4. Meanwhile, VNDiamond, VNFIN Select and the entire VNX-Index will only update data and recalculate the weight without changing the component basket.

The upcoming VN30 restructuring is expected to cause ETFs to sell about 310,000 BVH shares, more than 1.8 million VIC units ( Vingroup , HOSE) and nearly 1.6 million VHM shares (Vinhomes, HOSE), while buying over 2 million DGC shares.

With the VNFIN Lead index, SSI Research does not forecast any new stocks but believes that LPB (LPBank, HOSE) will be removed from the portfolio. The SSIAM VNFIN Lead ETF currently manages about VND398 billion (USD15 million) and plans to sell more than 741,000 LPB (LPBank, HOSE) shares, while increasing its ownership of nearly 806,000SHB (SHB, HOSE) shares, more than 376,000 MBB (MBBank, HOSE) shares and a series of other bank stocks such as VPB (VPBank, HOSE), STB (Sacombank, HOSE), ACB (ACB, HOSE), HDB (HDBank, HOSE), VCB (Vietcombank, HOSE) and CTG (VietinBank, HOSE).

Many "bank stocks" listed on HOSE

Ho Chi Minh City Stock Exchange (HOSE) has just decided to approve the listing of shares of VietABank (VAB).

Accordingly, HOSE approved VietABank to list nearly 540 million VAB shares, equivalent to charter capital of nearly VND 5,400 billion.

Previously, VAB was traded on UPCoM from July 20, 2021 at VND13,500/share. At the end of the trading session on June 27, this stock was at VND15,200/share, up 63% compared to the beginning of the year.

VAB stock price movement from the beginning of the year until now

The plan to list on the HOSE has been approved by VietABank's 2025 annual general meeting of shareholders. According to VAB's leadership, this listing aims to enhance the prestige, position, and brand of VietABank, facilitating stock trading. At the same time, taking advantage of the opportunity to attract investment capital to promote the bank's operations to foreign strategic investors and international financial institutions. After listing on the HOSE, VAB will become the 19th bank stock listed on the HOSE.

It is worth noting that this year, many banks also expect to "debut" on HOSE. For example, Kienlongbank (KLB, UPCoM), at the 2025 annual shareholders' meeting, the bank said that it had assigned the Board of Directors to select the Ho Chi Minh City Stock Exchange for listing, with the goal of completing it in the last quarter of this year.

Or, BVBank (BVB, UPCoM) has also approved a plan to list shares on the HOSE this year after the bank did not make the transfer as planned in 2024.

VietBank also assigned the Board of Directors to list VAB shares on HOSE when the market is favorable at the 2024 shareholders' meeting.

Saigonbank (SGB, UPCoM) has also signed a contract with a consulting unit on transferring the floor from UPCoM to HOSE or HNX.

Comments and recommendations

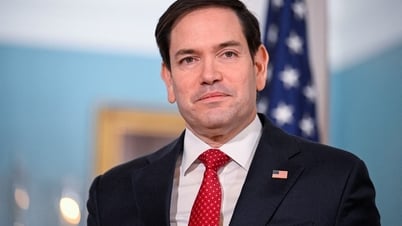

Grandfather Dang Van Cuong, Head of Investment Consulting, Mirae Asset Securities (Vietnam), assessed that after a week of positive trading, the stock market entered a new week facing news about tariffs when the 90-day extension period will end on July 9. With relatively optimistic news about the negotiation process, expecting Vietnam to achieve favorable results, the stock market thereby received positivity, moving towards higher prices.

In addition, in the first week of the third quarter, more information about the macro picture of the second quarter will be announced, and the semi-annual financial reports of listed companies are expected to be positive, which will add momentum to the index, especially for industry groups with high business growth compared to the same period.

Stock market moves positively but strongly differentiates before tariffs and Q2/2025 financial statements

Regarding sectors and stocks, the stock market is expected to continue to be strongly differentiated, requiring a selective investment strategy with the Banking group continuing to lead the wave thanks to key policy drivers as well as optimistic forecasted business results.

Next is Real Estate, benefiting from strong credit growth and legal measures being implemented. Finally, Retail and Consumer groups benefit from recovering purchasing power, reinforced by expectations that the 2% VAT reduction policy will be extended until the end of 2026.

In the short term, information about tariffs will dominate the airwaves, so caution should be given priority, and stock exposure should be appropriately allocated to wait for clear tariff results.

Entering the 2025 Q2/2025 and semi-annual financial reporting season, this is a period that is expected to have great differentiation based on the actual business results of each enterprise. Investors need to prioritize focusing on stocks with solid fundamentals and especially positive Q2 business results prospects with attractive valuations; flexibly restructuring the portfolio to anticipate the financial reporting season will be the key to optimizing investment efficiency during this period.

BETA Securities believes that at the present stage, the market may need more time to accumulate before entering a new growth phase. For stocks that have reached expectations, short-term investors should consider taking partial profits, gradually reducing the proportion in high price areas to preserve results and proactively control risks. As for medium- and long-term investors, the uptrend is still maintained thanks to good technical trends, stable cash flow and positive expectations for the second quarter business results reporting season, so it is possible to continue holding stocks with solid fundamentals, reasonable valuations and growth potential in the coming time.

Phu Hung Securities believes that the balance trend is still dominant in the market. The market is likely to continue to fluctuate, moving sideways around the 1,365 point mark to test demand. Support to maintain the trend is raised to 1,340 points, while the near resistance is at 1,380 points. Therefore, the general strategy is to hold. For investors with high risk appetite, they can add a portion of their weight to participate in short-term surfing positions following the cash flow. Priority groups to pay attention to: Banking, Retail, Public Investment, Consumption, Technology.

Dividend schedule this week

According to statistics, there are 18 enterprises that have decided to pay dividends for the week of June 30 - July 4, of which 25 enterprises pay in cash, 17 enterprises pay in shares and 1 enterprise gives bonus shares.

The highest rate is 50%, the lowest is 1%.

1 company pays by stock:

IDICO Petroleum Construction Investment Joint Stock Company (ICN, UPCoM), ex-right trading date is July 3, rate 50%.

Cash dividend payment schedule

*Ex-right date: is the transaction date on which the buyer, upon establishing ownership of shares, will not enjoy related rights such as the right to receive dividends, the right to purchase additional issued shares, but will still enjoy the right to attend the shareholders' meeting.

| Code | Floor | GDKHQ Day | Date TH | Proportion |

|---|---|---|---|---|

| SAB | HOSE | June 30 | 31/7 | 30% |

| DBD | HOSE | June 30 | 31/7 | 20% |

| HFB | UPCOM | 1/7 | 17/7 | 6% |

| CH5 | UPCOM | 1/7 | 24/7 | 10% |

| BHH | UPCOM | 1/7 | 15/7 | 7% |

| VPW | UPCOM | 2/7 | 7/28 | 1% |

| QTP | UPCOM | 2/7 | 18/7 | 2% |

| APF | UPCOM | 2/7 | 18/7 | 15% |

| CMD | UPCOM | 2/7 | 15/7 | 10% |

| TLT | UPCOM | 3/7 | 4/8 | 15% |

| DTT | HOSE | 3/7 | 7/21 | 8% |

| M10 | UPCOM | 3/7 | 7/25 | 5% |

| KCB | UPCOM | 3/7 | 18/7 | 5% |

| VTK | UPCOM | 3/7 | 15/7 | 15% |

| VPR | UPCOM | 4/7 | 7/22 | 5% |

| HMG | UPCOM | 4/7 | 1/8 | 8% |

| CLC | HOSE | 4/7 | 17/7 | 25% |

Source: https://phunuvietnam.vn/chung-khoan-tuan-30-6-4-7-vn-index-tang-tich-cuc-nhung-phan-hoa-manh-20250626101236293.htm

![[Photo] National Assembly Chairman Tran Thanh Man meets with First Secretary and President of Cuba Miguel Diaz-Canel Bermudez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/2/c6a0120a426e415b897096f1112fac5a)

![[Photo] National Assembly Chairman Tran Thanh Man receives First Vice Chairman of the Federation Council of Russia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/2/3aaff46372704918b3567b980220272a)

Comment (0)