SJC gold bar price hits 125 million VND/tael for the first time - Photo: THANH HIEP

SJC gold bar price increases continuously

At the end of today, August 18, the selling price of SJC gold bars increased by 500,000 VND/tael, to 125 million VND/tael - also the highest price ever.

Notably, the buying price of SJC gold bars increased by 1.5 million VND/tael, from 122.5 million VND/tael to 124 million VND/tael.

The difference between buying and selling prices has narrowed to only 1 million VND/tael due to the scarce supply of gold in the market.

The selling price of 9999 gold rings at SJC Company at the end of today also increased by 400,000 VND/tael, to 119.5 million VND/tael, buying at 117 million VND/tael.

Compared to the price of SJC gold bars, the price of 9999 gold rings is 5.5 million VND/tael lower for selling and 7 million VND/tael lower for buying.

In recent days, the price of SJC gold bars has continuously increased the gap with gold rings, while previously the price of gold bars and gold rings were quite close to each other.

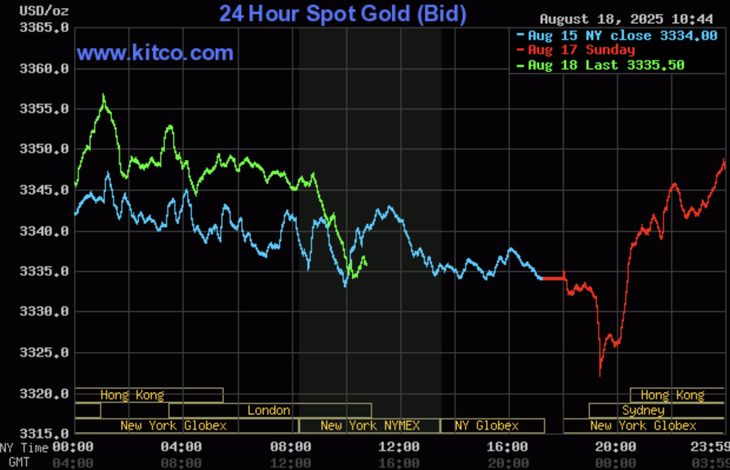

Meanwhile, tonight, the world gold price tends to decrease, to 3,335 USD/ounce. Converted according to the exchange rate listed at the bank, the world gold price is equivalent to 106.4 million VND/tael.

Compared to the converted world gold price, the price of SJC gold bars is 18.6 million VND/tael higher. This is a very high difference compared to the target of reducing the difference between domestic and world gold prices to around 1-2% as directed by the Prime Minister .

The reason why the price of SJC gold bars is being pushed up higher and higher, according to experts, is due to the supply factor. The demand for gold is increasing, while the supply is somewhat limited because for many years, businesses have not been licensed to import raw gold nor to produce more SJC gold bars.

Gold prices await interest rate news

World gold price tonight tends to go down - Screenshot

In the world market, this week there are a number of events that are of interest to global investors.

US Federal Reserve (Fed) Chairman Jerome Powell is expected to deliver the most important policy speech of the year on August 22 at the annual Jackson Hole Economic Symposium.

The event, which takes place in late August, is an opportunity for U.S. monetary policymakers to reveal upcoming interest rate moves. Wall Street is almost certain that the Federal Reserve will cut interest rates in September.

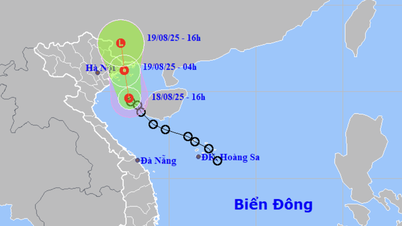

In addition, investors are also watching for news surrounding US President Donald Trump’s efforts to end the war in Ukraine. If Russia, the US and Ukraine reach an agreement, gold prices could come under pressure.

Many experts believe that gold prices will continue to fluctuate in the short term and the market will be cautious ahead of the conference in Jackson Hole.

However, some analysts do not see a Fed rate cut in September as a near certainty.

Source: https://tuoitre.vn/gia-vang-mieng-sjc-lan-dau-cham-moc-125-trieu-dong-luong-20250818221332584.htm

![[Photo] Prime Minister Pham Minh Chinh attends the opening ceremony of the National Data Center](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/18/b5724a9c982b429790fdbd2438a0db44)

Comment (0)