The Vietnam Association of Financial Investors (VAFI) has just proposed opinions on the Draft Decree amending Decree 126/2020, emphasizing the issue of taxing bonus shares.

Individuals who receive bonus shares and stock dividends will be directly affected by this tax policy. These changes may have a major impact on investors’ income and future investment decisions. Therefore, VAFI hopes that the Ministry of Finance will consider carefully to ensure investors’ rights.

VAFI is concerned that taxing bonus shares will affect the stock market.

Not true to nature?

According to the draft decree, all individuals receiving bonus shares and stock dividends will have to pay personal income tax immediately upon receipt. Enterprises paying bonus shares will have to make a list of shareholders, declare taxes and pay taxes on behalf of shareholders.

VAFI believes that applying personal income tax immediately upon receiving bonus shares is unreasonable. Because distributing bonus shares does not increase the company's equity, does not reduce profits, nor does it change the shareholders' ownership ratio. In fact, shareholders only generate income when they sell bonus shares, at which point the ownership ratio decreases and there is a profit (or loss).

In addition, receiving bonus shares does not mean that there is a guarantee of profit. Many investors after receiving bonus shares may encounter situations where the company suffers losses, goes bankrupt, the shares lose value or even cannot be sold. Therefore, taxing immediately upon receiving bonus shares is not consistent with the principle of income taxation.

Proposal to collect tax when selling bonus shares

According to VAFI, currently, the software of the Stock Exchange, the Depository Center and securities companies can easily calculate the cost price of bonus shares. Therefore, it is completely possible to determine the profit/loss when selling shares to calculate personal income tax accurately.

This association proposes that when individuals sell bonus shares, there is no need to consider whether there is a profit or loss, and personal income tax is still calculated based on the formula: total value of bonus shares calculated at par value (VND 10,000/share) multiplied by a tax rate of 0.5%.

For institutional investors, if fully accounted for, in case of loss when selling bonus shares, the cost price will be recorded as expense, thereby reducing corporate income tax liability, unlike individual investors.

Concerns about the impact on the stock market

VAFI emphasized that if the new regulation as drafted - requiring listed companies to pay taxes on behalf of tens of thousands of shareholders, including foreign shareholders - is applied, it is very difficult to implement, even going against the regulations on corporate governance and finance. According to the Enterprise Law, the company is not responsible for paying taxes on behalf of shareholders in this regard.

In addition, suddenly requiring millions of individual investors to pay "personal income tax arrears" on bonus shares could force them to sell securities to pay taxes, leading to the risk of affecting the stock market, creating unnecessary selling pressure.

In the long term, VAFI recommends that the Ministry of Finance consider applying a capital gain tax to replace the current securities transaction tax. This approach would be more appropriate, avoiding the situation where investors suffer losses but still have to pay taxes.

Source: https://nld.com.vn/de-xuat-danh-thue-co-phieu-thuong-co-the-anh-huong-thi-truong-chung-khoan-196250708142417044.htm

![[Photo] General Secretary To Lam receives Chairman of the National People's Congress of China Zhao Leji](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/31/5af9b8d4ba2143348afe1c7ce6b7fa04)

![[Photo] National Assembly Chairman Tran Thanh Man welcomes and holds talks with Chairman of the National People's Congress of China Zhao Leji](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/31/9fa5b4d3f67d450682c03d35cabba711)

![[Photo] The first meeting of the Cooperation Committee between the National Assembly of Vietnam and the National People's Congress of China](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/31/f5ed4def2e8f48e1a69b31464d355e12)

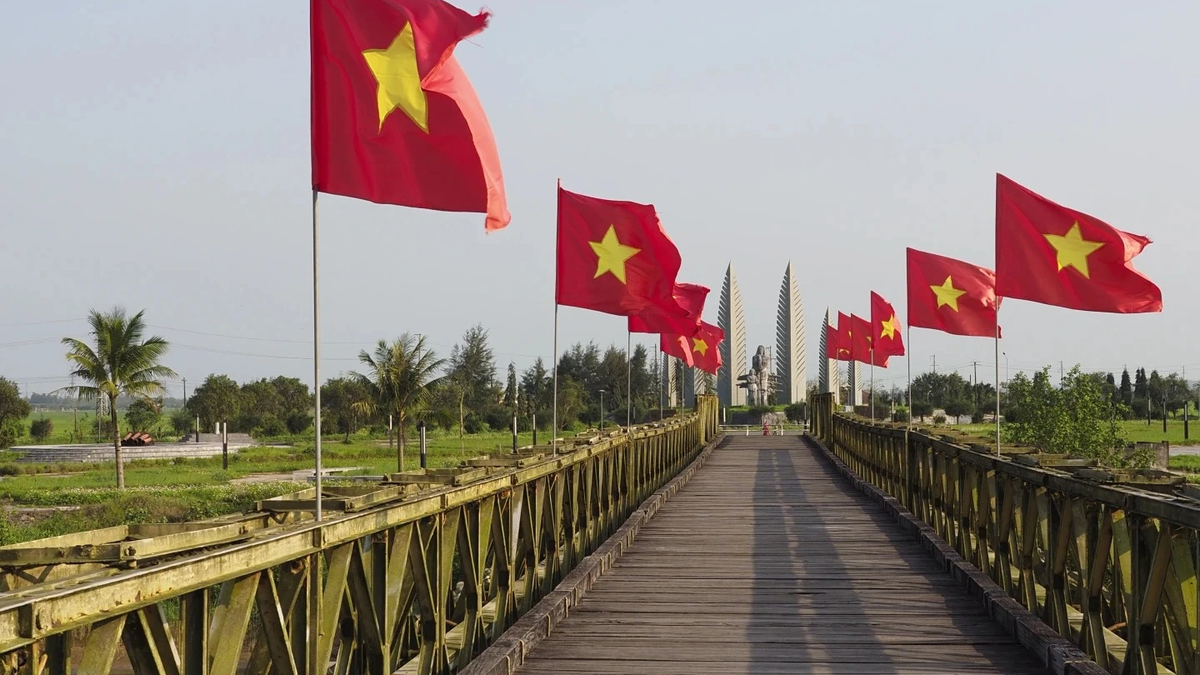

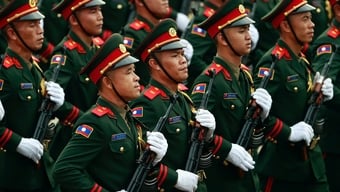

![[Photo] Marching together in the hearts of the people](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/31/8b778f9202e54a60919734e6f1d938c3)

Comment (0)