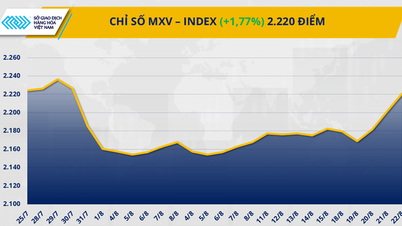

Buying pressure prevailed at the end of the session, helping the MXV-Index reverse, increasing 0.3% to 2,217 points.

Energy commodity market is "bright green". Source: MXV

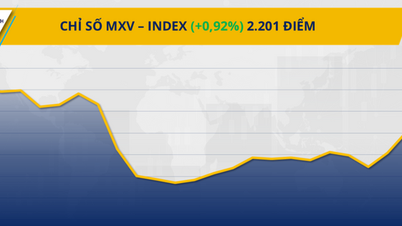

Yesterday's energy market received a series of positive information from the American Petroleum Institute (API) and the US Energy Information Administration (EIA).

With positive signals, the prices of both crude oil products increased by more than 1%. Specifically, Brent oil price recovered to 68.05 USD/barrel, equivalent to an increase of 1.23%; while WTI oil price also recorded an increase of about 1.42%, stopping at 64.15 USD/barrel.

API data showed a relatively modest drawdown in crude oil inventories of just under 1 million barrels, while EIA data showed a much larger drawdown of nearly 2.4 million barrels.

At the same time, US gasoline inventories continued to decline for the sixth consecutive week, down 1.24 million barrels.

Thus, in just the last 7 days, world crude oil prices have recorded an increase of 1.5 - 2%.

Agricultural commodity market is "bright red". Source: MXV

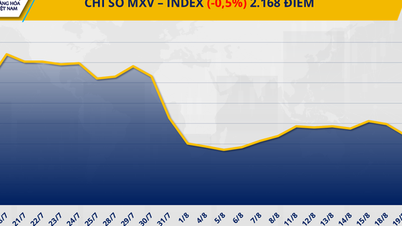

On the other hand, the agricultural market was in the red as all seven commodities fell in price. Notably, corn fell 0.85% to 159.8 USD/ton, under pressure from both supply and demand.

On the supply side, the USDA ’s weekly crop report shows a high potential for harvest. In addition, many US farmers are pushing to sell old corn crops to free up storage for the new crop, contributing to adding more goods to the market in the short term.

On the trade front, the outlook for US corn exports is not very bright. Analysts forecast that export volume in the week ending August 21 will only reach about 1-2 million tons, down sharply from 2.83 million tons last week.

With abundant supplies from the US, Brazil and Ukraine, while export demand and domestic consumption weaken, world corn prices are likely to continue to be under downward pressure in the short term.

Source: https://hanoimoi.vn/supply-in-the-direction-of-the-dien-bien-thi-truong-hang-hoa-714296.html

![[Photo] General Secretary To Lam attends the opening ceremony of the National Achievements Exhibition](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/d371751d37634474bb3d91c6f701be7f)

![[Photo] Red flag with yellow star flutters in France on National Day September 2](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/f6fc12215220488bb859230b86b9cc12)

![[Photo] National Assembly Chairman Tran Thanh Man holds talks with New Zealand Parliament Chairman](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/c90fcbe09a1d4a028b7623ae366b741d)

![[Photo] General Secretary To Lam presents the 45-year Party membership badge to comrade Phan Dinh Trac](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/e2f08c400e504e38ac694bc6142ac331)

![[Photo] Politburo works with the Standing Committee of Cao Bang Provincial Party Committee and Hue City Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/fee8a847b1ff45188749eb0299c512b2)

Comment (0)