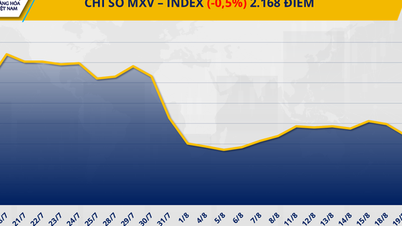

Oil prices jump on supply disruption concerns

On Monday (August 18), the Vietnam Commodity Exchange (MXV) said that the world raw material market opened the new week with mixed developments, in which oil prices increased due to concerns about supply disruptions from Russia.

The energy market was relatively quiet in the first trading session of the week as investors focused on the latest developments related to the resolution of the Russia-Ukraine conflict that has lasted for more than 3 years. However, world oil prices still recorded a recovery of about 1%, with Brent crude closing at 66.6 USD/barrel, corresponding to an increase of about 1.14%; while WTI crude also increased by nearly 1%, to 63.42 USD/barrel.

The main reason for the increase in oil prices is believed to be concerns about the risk of supply disruption from Russia and the risk of supply disruption via the Druzhba pipeline to Hungary and Slovakia, following a series of attacks on energy facilities in Russia. The market is currently closely monitoring the moves of the US Federal Reserve (FED), especially signals about the possibility of adjusting interest rates in the near future.

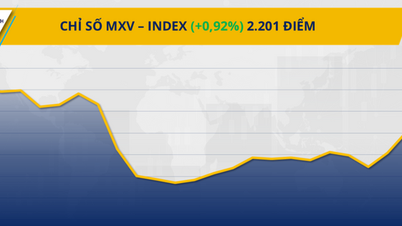

Oil prices continued to recover for the fourth day (August 20) thanks to expectations that demand in the US will improve.

According to MXV, the mid-week trading session saw strong buying power return to the energy market. In particular, Brent oil prices edged up to 66.84 USD/barrel, an increase of about 1.6%; while WTI oil prices also recorded an increase of about 1.38%, to 63.21 USD/barrel compared to the previous day.

This increase mainly came from positive consumption prospects after the US Energy Information Administration (EIA) announced data that commercial crude oil reserves in the US in the week ending August 15 decreased by more than 6 million barrels, marking the sharpest decline in more than two months.

The reason was attributed to the surge in crude oil exports in the US, at nearly 800,000 barrels per day. At the same time, the total amount of crude oil consumed by US refineries last week also increased by 28,000 barrels per day.

In addition, US gasoline inventories also fell by nearly 3 million barrels last week, marking the fifth consecutive week of decline, signaling stable domestic demand.

Crude oil prices hit two-week high

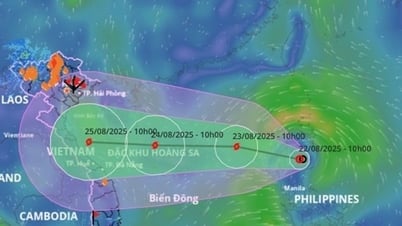

On the 5th trading day (August 21), MXV said that crude oil prices reached a two-week peak as Russia-Ukraine tensions showed no positive signs, increasing supply risks.

The trading session on August 21 witnessed a strong increase in the energy market when all 5 commodities in the group increased in price. Of which, Brent oil price climbed to the highest level in the past two weeks, stopping at 67.67 USD/barrel, corresponding to an increase of about 1.24%. Similarly, WTI oil price also recorded an increase of about 1.29%, reaching 63.52 USD/barrel, the highest level in the past 7 days.

The tension between Russia and Ukraine is still complicated and continues to be a factor that strongly affects oil prices. In addition, oil prices are also supported by stable demand, shown by two weekly reports from the American Petroleum Institute (API) and the US Energy Information Administration (EIA). Investors are also waiting for the next moves from the US Federal Reserve (FED) on the possibility of cutting interest rates.

At the same time, newly released economic indicators showed relatively positive signals, notably the preliminary reports on the manufacturing PMI and composite PMI indexes for August from S&P Global, in the US, the European Union and India, contributing to supporting economic growth and energy demand.

Recorded this morning, August 23, world oil prices continued to increase when information about the stalled peace negotiations in Ukraine. Specifically, Brent oil prices increased by 0.22%, to 67.82 USD/barrel; WTI oil prices increased by 0.39%, to 63.77 USD/barrel.

For the week, Brent crude rose 2.9%, while WTI crude rose 1.4%.

Source: https://hanoimoi.vn/tuan-bat-tang-lien-tiep-cua-gia-dau-tho-713706.html

![[Photo] Prime Minister Pham Minh Chinh chairs the meeting of the Government Party Committee Standing Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/23/8e94aa3d26424d1ab1528c3e4bbacc45)

![[Photo] General Secretary To Lam attends the 80th Anniversary of the Cultural Sector's Traditional Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/23/7a88e6b58502490aa153adf8f0eec2b2)

Comment (0)