According to the recently released semi-annual audited financial report for 2025, Hoang Anh Gia Lai Joint Stock Company (HoSE: HAG) said that in the first 6 months of the year, it reported a net profit of nearly VND 834 billion, an increase of 74% over the same period last year.

This result helped Chairman Doan Nguyen Duc’s company end its accumulated losses that had lasted for many years. On the financial report, Hoang Anh Gia Lai’s undistributed profit after tax recorded a positive level of nearly 400 billion VND as of June 30.

With the first half of the year results, Hoang Anh Gia Lai has completed 58% of the profit plan, the target is expected to increase to 1,500 billion VND.

However, the semi-annual audited financial report conducted by Ernst & Young Vietnam continued to make an important note: Hoang Anh Gia Lai's short-term debt exceeded its short-term assets by more than VND2,767 billion, indicating a risk to its ability to continue operating. In addition, the company violated a number of bond commitments, delaying the payment of principal and interest on due bonds.

Auditors said Hoang Anh Gia Lai's short-term debt exceeded its short-term assets by thousands of billions of dong. (Photo: Quang Thinh).

Responding to this issue, Hoang Anh Gia Lai said that cash flow in the next 12 months is expected to come from the liquidation of part of financial investments, recovery of partner loans, issuance of individual bonds, bank credit and debt restructuring. The company is working with lenders to adjust the terms of violations, and at the same time, consulting shareholders on the plan to convert part of the debt into equity.

The Board of Directors affirmed that the financial statements are still prepared on the going concern basis, with revenue from banana and durian exports as the foundation.

As of June 30, Hoang Anh Gia Lai's total assets reached over VND26,000 billion, an increase of VND3,700 billion compared to the beginning of the year. Of which, short-term receivables accounted for nearly VND9,900 billion.

Liabilities are over VND 15,600 billion, an increase of nearly VND 2,700 billion, of which financial loans alone are over VND 9,300 billion. Outstanding bonds held by BIDV decreased from VND 3,105 billion at the end of 2024 to VND 1,099 billion.

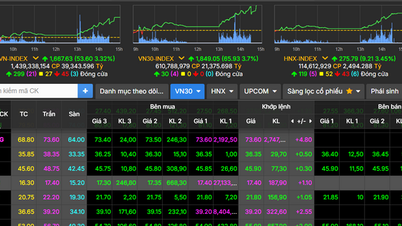

Another positive signal is that on August 22, the Ho Chi Minh City Stock Exchange (HoSE) decided to remove HAG shares from the warning list from August 26. Previously, this code was placed on warning from October 2022 after announcing a loss after tax in 2021. The recovery of accumulated losses has paved the way for HAG to escape the warning list, thereby strengthening investor sentiment in the market.

Source: https://vtcnews.vn/cong-ty-bau-duc-bi-nghi-ngo-kha-nang-hoat-dong-lien-tuc-ar961683.html

![[Photo] Hanoi: Authorities work hard to overcome the effects of heavy rain](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/380f98ee36a34e62a9b7894b020112a8)

![[Photo] Multi-colored cultural space at the Exhibition "80 years of the journey of Independence - Freedom - Happiness"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/fe69de34803e4ac1bf88ce49813d95d8)

Comment (0)