At the end of the session, Vingroup Corporation's VIC shares hit the ceiling price of VND101,600/share. A total of more than 7 million VIC shares were traded during the session and at the end of the session, there were still over 1 million units left to buy at the ceiling price.

Since the beginning of the year, VIC has increased by about 140%, making it one of the stocks with the strongest growth on the stock exchange. This is also the main reason why billionaire Pham Nhat Vuong's assets have reached a record of 10.9 billion USD according to Forbes. He is currently the 254th richest person on the list of world billionaires compiled by this magazine.

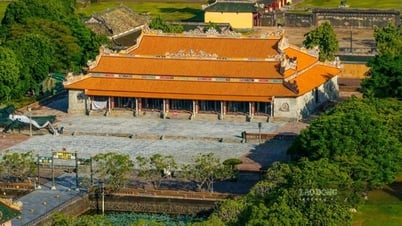

Perspective of Can Gio urban area by Vingroup

PHOTO: VIG

In addition, other stocks in the Vingroup ecosystem also had good growth momentum in this session, such as VHM up 5.13%, VRE up nearly the ceiling with 6.16%, and VPL down slightly by 0.43%. VIC shares continuously increased when Vingroup had many activities. Including the Can Gio coastal urban tourism project, which was invested in and started construction at the end of April with a total area of 2,870 hectares. This is a project with the leading scale in Vietnam and globally, such as the largest theater complex in Southeast Asia, the largest artificial lake in the world, 2 international-class golf courses; a 108-storey multi-purpose tower, a chain of modern hotels and shopping centers, a large modular entertainment complex, etc.

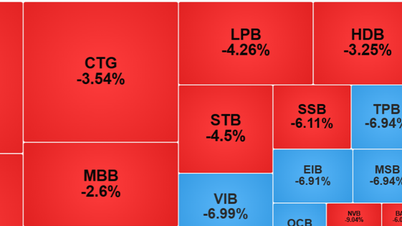

In addition to the Vin group of stocks, blue-chips also increased strongly such as FPT, MSN, VJC, PLX, SSI... which pushed the VN-Index to continue to rise. At the end of the session, the VN-Index increased by 14.32 points, equivalent to an increase of 1% to 1,445.64 points and was the highest level in more than 3 years. In contrast, the HNX-Index decreased by 0.08% to 238.44 points. The liquidity of the whole market remained high with more than 30,431 billion VND.

Investors' optimism continues to increase after a series of consecutive days of stock market growth. The Market Analysis and Strategy Department of ACB Securities Company has adjusted its forecast for 2025 post-tax profit growth of listed companies in its analysis portfolio to reach 11.6% year-on-year. This corresponds to the VN-Index fluctuating between 1,350 - 1,500 points and liquidity increasing by 20% compared to 2024. Improved liquidity, especially from foreign capital flows, are factors supporting the market's growth momentum.

Source: https://thanhnien.vn/co-phieu-vingroup-tang-kich-tran-dua-tai-san-ti-phu-pham-nhat-vuong-len-ky-luc-18525071015340381.htm

![[Photo] Hanoi is ready to serve the occasion of the 80th National Day Celebration on September 2nd](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/29/c838ac82931a4ab9ba58119b5e2c5ffe)

Comment (0)