According to Mirae Asset Securities senior consultant Pham Thanh Tien, although concerns are starting to appear in a negative trend in the coming time, this is only a positive adjustment phase for a new uptrend.

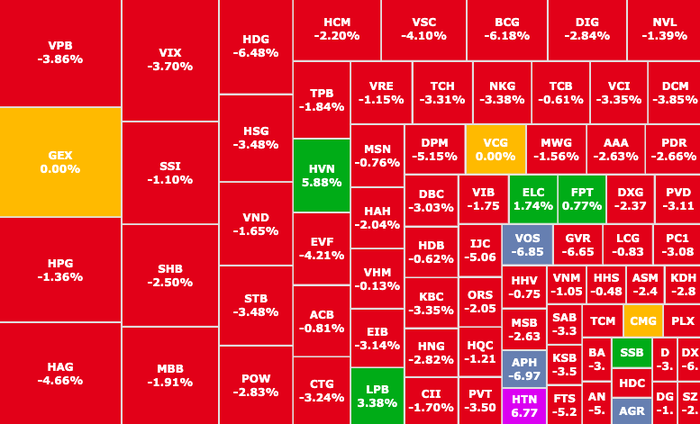

After a strong increase surpassing the record mark of 1,300 points after 2 years, VN-Index The index unexpectedly fell sharply by 21.6 points (-1.66%) last weekend, returning to the 1,280 point mark. The market was "dyed in red" with 366 stocks decreasing, 89 stocks increasing and 52 stocks remaining unchanged.

Market "red" at the end of the week

The total market transaction value was approximately VND33,700 billion. Of which, the HOSE floor reached VND29,300 billion, a significant increase compared to the previous session.

Selling pressure was widespread, most industry groups decreased sharply. In particular, banks led the sharp decline, notably VPB ( VPBank , HOSE) plummeted 3.86%.

The VN30 "basket" had 28 stocks decreasing and only 2 stocks "escaped": FPT (FPT, HOSE) increased slightly by 0.77% and SSB ( SeABank , HOSE) increased by 1.38%. Besides FPT, many information technology stocks played the role of rare "bright spots" that increased in price only in today's session.

Foreign investors net sold an additional 660 billion VND, focusing on stocksFPT (FPT, HOSE), MWG (Mobile World, HOSE), VHM (Vinhomes, HOSE) all over 100 billion VND.

Moc Chau Milk listed on HOSE from June 25

According to the announcement, 110 million MCM shares of Moc Chau Dairy Cattle Breeding JSC (Moc Chau Milk) will be listed on the HOSE from June 25 at a price of VND42,800/share.

Recent developments in MCM stock (Photo: SSI iBoard)

At the end of the trading session on June 13, MCM increased by 1.08% to VND 48,000/share, thus, MCM has increased by 23% since May 24 (the time HOSE approved the listing).

Regarding business results, in the first quarter of 2024, revenue reached VND 625.4 billion and net profit VND 50 billion, down 14.8% and 50.7% respectively over the same period.

In 2024, MCM plans to have revenue of VND 3,367.4 billion and profit after tax of VND 331.7 billion. After the first 3 months of the year, the company completed 18.6% and 15.1% of the year plan, respectively.

Vietnam's stock market aims for market upgrade

According to the latest report from MSCI (a US financial company), Vietnam is assessed to have improved in transferability thanks to the increase in off-exchange transactions and physical transfers that can be carried out without prior approval from the management agency.

In addition, MSCI continues to closely monitor progress on addressing a number of accessibility issues such as foreign ownership limits, pre-funding requirements, and the lack of English-language market disclosure.

Thus, Vietnam still has 8 criteria to improve to complete the set of 18 MSCI criteria.

Accordingly, in the outlook report, BIDV Securities Company (BSC) expects that in the near future, in June 2025, the Vietnamese stock market may be considered by MSCI to be included in the watch list for upgrading to an emerging market.

Stock codes approaching historical peaks

While the market needs time to adjust before entering a new wave, many stocks have recorded good growth in recent times and are approaching historical peaks.

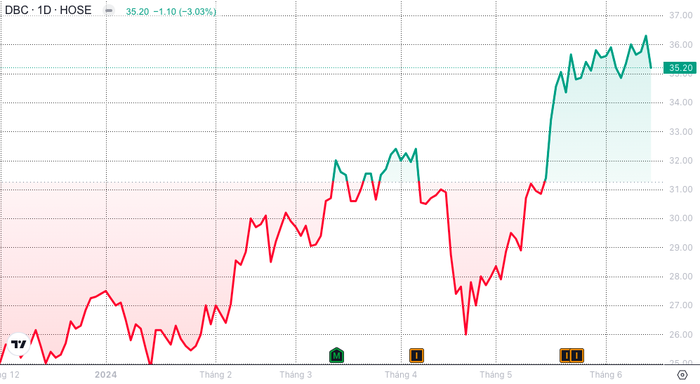

DBC stock price increases to near 2-month peak (Photo: SSI iBoard)

DBC shares (Dabaco Vietnam Group, HOSE) performed positively along with the general trend of the livestock industry when pork prices increased sharply. The market price increased by more than 34% in 2 months, at 35,200 VND/share, less than 10% from the historical peak at 38,000 VND/share.

DPR shares (Dong Phu Rubber JSC, HOSE) received many new signals from two waves of rubber and industrial real estate. The stock price has increased by more than 30% in the past 3 months, reaching 46,050 VND/share, surpassing the historical peak. However, market pressure caused DPR to retreat to 43,050 VND/share.

VGS shares (Viet Duc Steel Pipe JSC, HNX) increased by more than 550% from the bottom at the end of 2022 thanks to positive information in business activities, the market price is at 37,000 VND/share, less than 10% from the historical peak.

HAH shares (Hai An Transport and Stevedoring JSC, HOSE) increased by more than 15% to VND 48,000/share in just half a month, more than 20% away from the historical peak in June 2022.

Comments and recommendations

Mr. Pham Thanh Tien, senior consultant at Mirae Asset Securities, assessed that the VN-Index lost the 1,300-point mark quickly at the end of the week, mainly due to the market maintaining a long-term upward momentum over the past 2 months, causing the psychology of drastic action to increase at this level. Although concerns are starting to appear in a negative trend in the coming time, this is only a positive adjustment phase for the new upward momentum.

This week, active selling pressure will continue to dominate in the first few sessions of the week, the index may fall further before finding a balance zone, then differentiation will begin to appear between stock groups, many good stocks will soon increase again.

The end of June is the time when the semi-annual business results are "revealed". Therefore, the current adjustment is a good opportunity to buy stocks with growth potential in the next quarter. Investors need to have a thorough analysis and valuation process. Some industries of interest are: Retail, oil and gas, aviation and technology. As for short-term investors, portfolio risk management and margin management must always be put first in any market conditions.

BSC Securities commented that the market struggled at the end of the week and fell sharply by nearly 22 points. The market tilted to the negative side with 15/18 sectors losing points with large liquidity, the index could return to trading in the 1,275 - 1,285 point range.

KB Securities believes that although the current signal is quite negative in the short term, the VN-Index will have a recovery reaction at the support zone around 1,270 points. Investors are advised to avoid chasing in early recovery sessions, prioritize selling to take profits of opened trading positions and reduce the portfolio proportion to a safe threshold when the index approaches the resistance zones.

Dividend schedule

According to statistics, there are 37 businesses that have fixed dividend rights this week, of which 29 businesses pay in cash, 6 businesses pay in shares and 2 businesses pay combined dividends.

The highest rate is 45%, the lowest is 1.9%.

Petro Times Corporation ( PPT, HNX) has decided to pay dividends in shares, the ex-dividend date is June 17, at a rate of 10%.

Tien Giang Investment and Construction Joint Stock Company ( THG, HOSE) has decided to pay a combined dividend: in cash and shares. With the form of shares, the ex-right date is June 17, at a rate of 13%.

Bao Minh Securities Corporation ( BMS, UPCOM) has decided to pay dividends in shares, the ex-dividend date is June 18, at a rate of 10%.

Binh Dinh Pharmaceutical - Medical Equipment Joint Stock Company (BIDIPHAR) ( DBD, HOSE) closed the dividend payment by shares, the ex-right date is June 19, rate 25%.

Tipharco Pharmaceutical JSC ( DTG, HNX) closed the dividend payment in shares, the ex-dividend date is June 19, rate 15%.

Rong Viet Securities Corporation ( VDS, HOSE) has decided to pay dividends in shares, the ex-dividend date is June 21, at a rate of 11.5%.

Hai An Transport and Stevedoring JSC ( HAH, HOSE) has decided to pay dividends in shares, the ex-dividend date is June 21, at a rate of 15%.

Cash dividend payment schedule this week

*Ex-right date: is the transaction date on which the buyer, upon establishing ownership of shares, will not enjoy related rights such as the right to receive dividends, the right to purchase additional issued shares, but will still enjoy the right to attend the shareholders' meeting.

| Code | Floor | GDKHQ Day | Date TH | Proportion |

|---|---|---|---|---|

| NBC | HNX | June 17 | 15/8 | 8% |

| NQB | UPCOM | June 17 | 1/7 | 3.5% |

| TBW | UPCOM | June 17 | 2/7 | 1.9% (Batch 2021,2022) |

| TBW | UPCOM | June 17 | 2/7 | 11.9% (Batch 2023) |

| GTA | HOSE | June 17 | June 28 | 5.5% |

| NLS | UPCOM | June 17 | June 28 | 8% |

| PTX | UPCOM | June 17 | 1/7 | 15% |

| TRA | HOSE | June 17 | 4/7 | 20% |

| THG | HOSE | June 17 | 11/7 | 5% (Phase 1/2023) |

| THG | HOSE | June 17 | 11/10 | 5% (Batch 2/2023) |

| DOP | UPCOM | June 18 | 5/7 | 12% |

| CII | HOSE | June 18 | 3/7 | 4% |

| DNH | UPCOM | June 18 | 19/7 | 4.5% |

| VTE | UPCOM | June 19 | June 28 | 0.7% |

| VOC | UPCOM | June 19 | June 28 | 12% |

| HLC | HNX | June 19 | 7/23 | 8% |

| NBW | HNX | June 19 | 15/7 | 15.5% |

| SKN | UPCOM | June 19 | 4/7 | 3.5% |

| DLT | UPCOM | June 19 | 7/25 | 10% |

| HEC | UPCOM | June 19 | 5/7 | 45% |

| VCS | HNX | June 19 | June 28 | 20% |

| TBC | HOSE | June 19 | 11/7 | 10% |

| TCL | HOSE | June 19 | 7/25 | 23.3% |

| AMC | HNX | June 20 | 10/7 | 13% |

| LIX | HOSE | June 20 | 3/7 | 20% |

| TPB | HOSE | June 20 | 11/7 | 5% |

| CAG | HNX | June 20 | June 28 | 1.7% |

| BHP | UPCOM | June 20 | 1/7 | 2.5% |

| VTK | UPCOM | June 20 | 5/7 | 15% |

| VDT | UPCOM | June 21 | 4/7 | 10% |

| EIC | UPCOM | June 21 | 30/8 | 10% |

| TVT | HOSE | June 21 | 16/7 | 10% |

| PDB | HNX | June 21 | 4/7 | 5% |

Source: https://phunuvietnam.vn/chung-khoan-tu-ngay-17-21-6-giai-doan-dieu-chinh-tich-cuc-cho-da-tang-moi-20240617070129749.htm

![[VIDEO] Petrovietnam – 50 Years of Keeping the Heritage Torch, Building National Energy](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/9/3/3f5df73a4d394f2484f016fda7725e10)

Comment (0)