Accordingly, the groups of subjects not subject to value added tax include products of crops, planted forests, livestock, aquaculture, and fishing that have not been processed into other products or have only undergone conventional preliminary processing by organizations and individuals that produce, catch, sell, and import themselves, specified with specific characteristics of the product. In case it cannot be determined, the Ministry of Agriculture and Environment is responsible for basing on the production process provided by the taxpayer to determine whether the product has not been processed into other products or has only undergone conventional preliminary processing by organizations and individuals that produce, catch, sell, and import themselves according to the provisions of law.

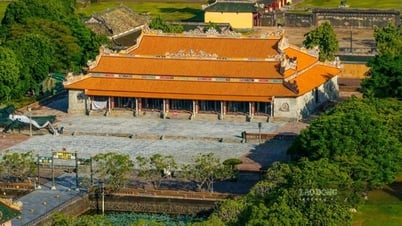

The second group is public housing sold by the State to tenants, including public housing according to the provisions of the law on housing. The third group is the transfer of land use rights according to the provisions of the law on land. The fourth group is financial services, banking, securities trading, and trade according to regulations. The fifth group is funeral services including funeral home rental services and funeral cars. The sixth group is maintenance, repair, and construction activities using capital contributed by the people and humanitarian aid capital (accounting for 50% or more of the total capital used for the project) for historical-cultural relics, scenic spots, cultural and artistic works, public service works, infrastructure, and housing for social policy beneficiaries.

Seventh is teaching and vocational training activities according to the provisions of the law on education and vocational education. Eighth is publishing, importing, distributing newspapers, magazines, newsletters, special issues, political books, textbooks, teaching materials, legal documents, science and technology books, books serving foreign information, books printed in ethnic minority languages and propaganda pictures, photos, posters, including in the form of audio and video tapes or discs, electronic data; money, printing money.

In addition, machinery, equipment, spare parts and materials that cannot be produced domestically need to be imported for direct use in scientific research and technological development activities; machinery, equipment, spare parts, specialized means of transport and materials that cannot be produced domestically need to be imported for conducting exploration and development activities of oil and gas fields;

Other groups such as public passenger transport services by bus, train, inland waterway vehicles operating within the province, within urban areas and on neighboring routes outside the province with stops to pick up and drop off passengers are also included in the group of subjects not subject to tax.

Source: https://baodanang.vn/cac-doi-tuong-khong-chiu-thue-gia-tri-gia-tang-tu-ngay-1-7-3264879.html

![[Photo] Hanoi is ready to serve the occasion of the 80th National Day Celebration on September 2nd](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/29/c838ac82931a4ab9ba58119b5e2c5ffe)

![[Photo] Prime Minister Pham Minh Chinh meets with Speaker of the New Zealand Parliament Gerry Brownlee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/cec2630220ec49efbb04030e664995db)

Comment (0)