The State Bank injected a net VND7,354 billion, but interbank interest rates remained high, with overnight rates reaching 6.6%.

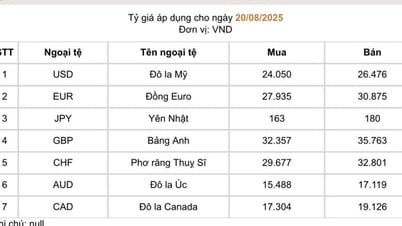

At the closing session of the week, the State Bank announced the central exchange rate at 25,228 VND/USD, down 11 VND compared to the previous session.

Thus, with a margin of 5%, commercial banks are currently allowed to trade USD in the range of 23,967 VND/USD (ceiling rate) - 26,489 VND/USD (floor rate).

At the State Bank of Vietnam, the reference exchange rate is 24,017 VND/USD (buy) - 26,439 VND/USD (sell).

Meanwhile, USD selling prices at many major commercial banks remained unchanged or slightly decreased compared to the previous session.

Specifically, at the Joint Stock Commercial Bank for Foreign Trade of Vietnam ( Vietcombank ), the USD exchange rate only slightly increased to 26,010 VND/USD (buy) - 26,400 VND/USD (sell), an increase of 10 VND in both directions.

Joint Stock Commercial Bank for Investment and Development of Vietnam ( BIDV ) increased to 26,044 - 26,404 VND/USD, up 14 VND.

On the free market, the "black market" exchange rate remains unchanged, fluctuating around 26,420 VND/USD - 26,480 VND/USD.

Overall for the week, the USD/VND exchange rate decreased slightly in both official and free channels, with a significantly narrower fluctuation range than last week.

Accordingly, in the official market, the central exchange rate announced by the State Bank decreased by a total of 21 VND, with 3 sessions of decrease and only 2 sessions of increase, reversing the strong increase last week (increased by 85 VND).

The domestic exchange rate decreased due to the strong impact of the international market decline. Accordingly, in the international market, the DXY index measuring the strength of the USD compared to other major currencies in the currency basket decreased, falling to about 98.26 points, continuing to lie deep below the 100-point threshold after the previous week of strong increases.

For other foreign currencies, including the EUR, there was a sharp increase last week, of which, at Vietcombank, it was listed at: 29,779 VND/EUR (buy) - 31,350 VND/EUR (sell), corresponding to an increase of 619 VND in the buying direction - 651 VND in the selling direction.

BIDV listed 30,110 VND/EUR (buy) - 31,346 VND/EUR (sell), respectively increasing 559 VND for buying and 584 VND for selling.

The British Pound (GBP) also increased sharply, to 34,322 VND/GBP (buy) - 35,779 VND/GBP (sell), an increase of 580 - 642 VND.

According to experts, the increase in interbank exchange rates has slowed down due to the support of the narrowing of the VND-USD interest rate gap amid the continuous high overnight interbank interest rates. In addition, the exchange rate is also supported by vibrant export activities with a positive trade surplus.

However, the exchange rate is still under pressure from subjective domestic factors, as well as objective factors from the world economic situation.

In fact, the USD-VND interest rate gap continues to be a factor that can keep the domestic exchange rate high, plus the news that the US Federal Reserve (FED) may cut interest rates to 4% also affects the domestic exchange rate.

The average exchange rate in 2025 is forecast to fluctuate between 26,600 - 26,750 VND/USD, an increase of 4.5 - 5% compared to the beginning of the year.

According to Tien Phong Securities Joint Stock Company (TPS), exchange rate pressure is expected to decrease in the second half of the year due to the FED's interest rate cut and the downward trend of the USD in the international market.

In addition, FDI will recover; international tourists will increase sharply, bringing foreign exchange supply; exports may recover due to feasible negotiation results.

For the open market, last week, in the mortgage channel, there were 125,479.72 billion VND in winning bids at the terms: 7 days, 14 days, 28 days and 91 days and 118,125.18 billion VND maturing on the mortgage channel.

The State Bank has stopped bidding for State Bank bills. Thus, the State Bank injected a net VND7,354.54 billion last week through the open market channel. There were VND216,459.65 billion circulating on the mortgage channel, no more State Bank bills circulating on the market.

Source: https://hanoimoi.vn/ty-gia-usd-ha-nhiet-trong-tuan-qua-711997.html

Comment (0)