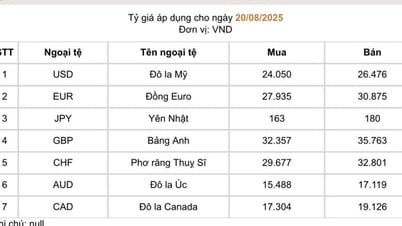

At the end of the week, the central exchange rate of the State Bank closed when the State Bank raised the central exchange rate by 25 VND, to 25,298 VND/USD. Thus, with a margin of +-5%, the floor exchange rate that commercial banks are allowed to trade is 24,033 VND/USD, and the ceiling exchange rate: 26,563 VND/USD. The reference exchange rate at the State Bank's Foreign Exchange Reserve Department: 24,084 VND/USD (buy) - 26,512 VND/USD (sell).

Overall for the week, the central exchange rate increased in 4/5 sessions, with an increase of 49 VND compared to the end of last week.

For commercial banks, in which, at the Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank), last week, the USD increased by 70 VND in both buying and selling prices, to 26,130 VND/USD (buying) - 26,520 VND/USD (selling); Joint Stock Commercial Bank for Investment and Development of Vietnam ( BIDV ) increased the USD price by 129 VND in buying prices and 111 VND in selling prices, to 26,220 VND/USD (buying) - 26,562 VND/USD (selling).

The "black market" also recorded an increase of 75 VND in both buying and selling directions, trading at the end of the week at 26,510 VND/USD (buy) - 26,580 VND/USD (sell).

Experts predict that the USD is likely to continue to increase due to the high demand for USD by businesses to pay for imported raw materials from now until the end of the year. However, experts also expect that the increase in remittances at the end of the year will create more foreign currency supply for the market, reducing the pressure of exchange rates on the currency market.

In the international market, the USD Index (DXY), a measure of the strength of the USD compared to other major currencies in the currency basket, increased to 98.65 points. According to financial experts, investors' expectations that the US Federal Reserve (Fed) will cut interest rates in September helped the USD increase in value, but the increase was not sudden because there were still concerns about inflation.

In contrast to the USD, other foreign currencies such as EUR and British Pound (GBP) turned to decrease, in which, Vietcombank listed EUR at 29,762 VND/EUR (buy) - 31,331 VND/EUR (sell), down 138 VND in the buying direction and down 145.9 VND in the selling direction. Or GBP decreased 272 VND (buy) - down 283.6 VND (sell), listed: 34,421 VND/GBP (buy) - 35,882 VND/GBP (sell).

For the open market, last week, on the mortgage channel, there were 103,444.6 billion VND in winning bids for the following terms: 7 days, 14 days, 28 days and 91 days, with an interest rate of 4%; up to 100,552.53 billion VND matured on the mortgage channel. The State Bank has not yet offered State Bank bills for bid.

In general calculation for the week, the State Bank injected a slight net amount of VND 2,892.07 billion through the open market channel. Along with that, VND 198,934.05 billion circulated on the mortgage channel, there were no more State Bank bills circulating on the market.

Regarding interbank interest rates, last week saw mixed movements across terms. Specifically, overnight rates fluctuated quite strongly, starting the week at 4.49% but falling to 3.78% on August 20 before rebounding to 4.47% on August 21, a slight decrease of 0.02% compared to the previous week. The 1-week term fell slightly by 0.03% to 4.66%; the 2-week term suffered the deepest downward pressure, falling by 0.12% to 4.99%.

In contrast, longer-term interest rates tended to increase. The 1-month term increased by 0.60 percentage points to 5.25%. Meanwhile, the 3-month term fluctuated slightly, decreasing by 0.07 percentage points to 5.42%.

Source: https://hanoimoi.vn/tuan-qua-dong-usd-tang-manh-trong-khi-eur-gbp-lai-quay-dau-giam-713713.html

![[Photo] General Secretary To Lam attends the 80th Anniversary of the Cultural Sector's Traditional Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/23/7a88e6b58502490aa153adf8f0eec2b2)

Comment (0)