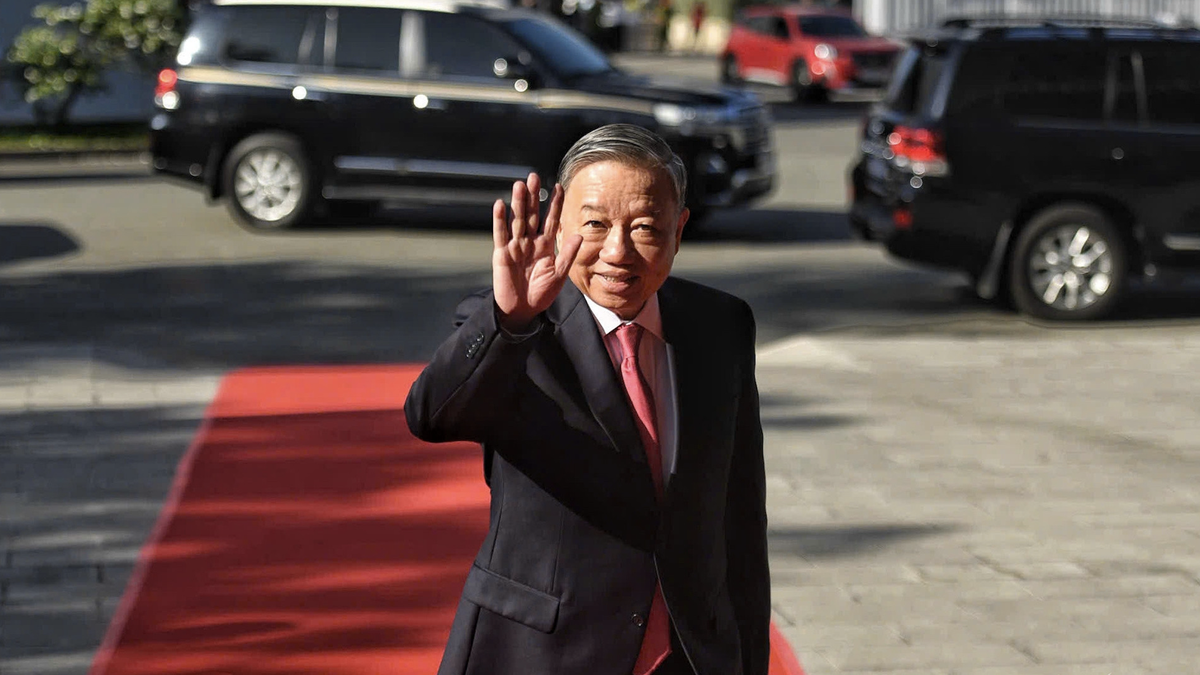

The strong recovery of stocks has made many investors breathe a sigh of relief - Photo: BONG MAI

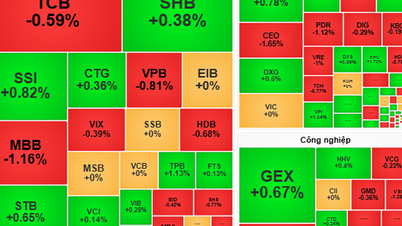

Since the beginning of June, VN-Index has been struggling continuously but still broke through by 39 points, last week alone it gained more than 22 points.

The index is currently anchored at 1,371 points, up more than 25% from its bottom in April, when the market was shaken by the shock of the US imposing tariffs on Vietnam and many other countries. The market has recovered strongly, but the outcome of the tariff negotiations remains an unpredictable unknown.

Waiting for US tax negotiations, avoiding spreading 'spending money' on Vietnamese stock market

Understanding the stock market situation, Mr. Nguyen The Minh - Director of Research and Development for Individual Clients at Yuanta Securities - said: "The results of the tariff negotiations will be the story of interest in the next few weeks."

According to Mr. Minh, contrary to the cautious sentiment a few weeks ago, many countries have now begun to be more optimistic about the prospect of reaching trade agreements. It is expected that there will be 10-12 initial trade agreements, followed by about 20 other agreements to be promoted.

The US also sent a message that it does not want to “separate”, showing signs of softening in negotiations. US-China tensions are easing, and the possibility of the US and Vietnam reaching a common voice in negotiations is very positive. Note that Vietnam is still an important link in the US global supply chain.

“Therefore, tariff scenarios for Vietnamese goods may change as tensions cool down. We are more optimistic about the negotiation results because we still assess the importance of Vietnam's supply chain to the US economy ,” said Mr. Minh.

Therefore, when trade tensions are eased, Vietnam has every reason to expect positive negotiation results, contributing to strengthening its strategic role in the global supply chain.

Yuanta presented three scenarios for tariff negotiations between the US and Vietnam.

The first, less feasible scenario is to maintain the current 10% tax rate, applied equally to all goods, to help Vietnamese goods maintain competitiveness and a stable investment environment.

The more likely scenario is to impose sectoral tariffs of 10-15%, focusing on sectors that use a lot of raw materials from China, such as textiles and footwear. Despite the cost pressure, Vietnam still has advantages in terms of labor and location.

The most unfavorable scenario is a flat tax of 15% or more - a relatively low probability of occurrence, which could affect industries dependent on the US market and slow down foreign direct investment (FDI) flows into our country.

Regarding strategy, Mr. Minh said that the price strength of the VN-Index has improved but remains in the neutral zone, showing that the Vietnamese stock market will continue to diversify.

In this context, investors should limit disbursement and prioritize holding groups of stocks that tend to outperform the general level.

Long Term: Stock Market Bullish Probability Still Prevails

With a long-term perspective, Mr. Dinh Duc Minh - senior investment director at VinaCapital - assessed the prospects of the Vietnamese stock market in the coming time in a positive way: "We see more factors supporting the market than risks. The possibility of the market going up is greater than the possibility of going down."

Mr. Duc Minh cited that since the beginning of the year, the Government has issued many important policies to promote the development of domestic private enterprises, as well as drastic administrative reforms. Along with that is the trend of increasing public investment, the recovery of the real estate market.

VinaCapital experts said that the stock market often fluctuates based on two main factors: P/E valuation (market price compared to stock earnings) and the growth potential of the business.

Accordingly, the current P/E ratio is at 11.5 times, the lowest in the past 10 years, a good opportunity to invest in stocks or fund certificates. From a long-term perspective, the ability to make a profit in the future is very high, because buying stocks is cheaper than the real value of the business.

Calculations from investment funds show that listed companies on the Vietnamese stock market are expected to maintain double-digit profit growth in 2025. Not to mention the possibility that Vietnam will be upgraded from a frontier market to an emerging market in the near future.

VinaCapital said that President Donald Trump's policies in the coming time are still difficult to predict, but "the biggest risks seem to have passed".

At the same time, geopolitical tensions in many countries are not expected to have too great an impact on the Vietnamese stock market, because over the past few years, the world has become accustomed to frequent conflicts in many regions.

Mr. Dinh Duc Minh emphasized that it is difficult for anyone to "buy at the bottom and sell at the top". However, it is possible to rely on valuations and market developments to know whether a stock is expensive or cheap, and whether to buy it or not.

VinaCapital forecasts that listed company profits in 2025 will fluctuate strongly depending on the US tariff rate applied. If the tax rate is kept at 10%, the total market profit could increase by 17% but will decrease to 13%, 8.6% and 6.4% at the tax rates of 20%, 35% and 46%, respectively.

Some industries such as insurance, information technology, utilities... still have positive growth, while industrial parks and aviation are heavily affected.

Source: https://tuoitre.vn/o-at-lao-vao-mua-co-phieu-cua-loi-dang-mo-to-hay-rui-ro-rinh-rap-20250629170530122.htm

Comment (0)