Hanoi Transformer and Electrical Materials Manufacturing Joint Stock Company (stock code: BTH) has just announced a plan to pay cash dividends in 2024 of up to 260%. Specifically, the company will divide into 2 dividend periods of 10% and 250%, equivalent to VND 25 billion and VND 625 billion, respectively. The expected time to pay dividends to shareholders is November this year.

This dividend level is considered to be among the most generous paying businesses of the year.

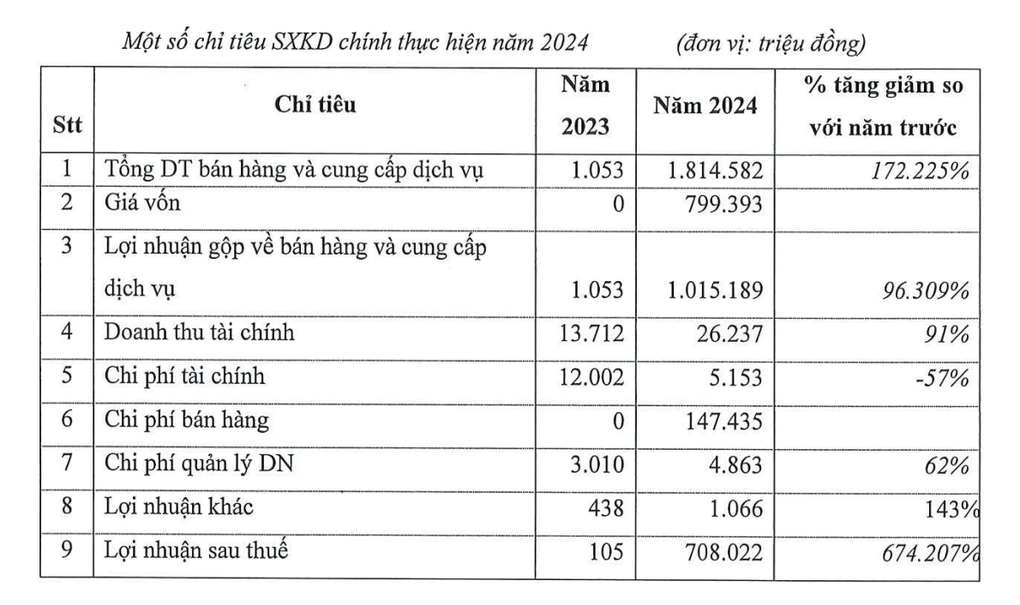

Despite having a charter capital of VND250 billion, the company "generously" spent VND650 billion on shareholders. In 2024, the company recorded more than VND1,814 billion in total net revenue, 1,723 times higher than in 2023. Profit after tax was VND708 billion, 6,743 times higher than VND105 million in 2023.

Business results of the enterprise in 2024 (Source: 2025 Shareholders' Meeting Documents).

The company's business activities have flourished from real estate business, especially in the mixed-use housing, kindergarten and green space project at 55 K2 Street, Cau Dien Ward, Nam Tu Liem District, Hanoi (commercial name is Hoang Thanh Pearl). The company said it has handed over 326/330 apartments and 8/15 low-rise apartments in this project.

In 2025, Hanoi Transformer and Electrical Materials Manufacturing Joint Stock Company plans to have revenue of VND194 billion and profit after tax of VND100.8 billion. In the first quarter, the company achieved revenue of VND12 billion and profit after tax of VND10.7 billion.

The company's shares are currently traded on the UpCoM floor at a price of about VND53,000/share.

According to the self-introduction information, Hoang Thanh Pearl project has a total area of 14,786m2, the construction land is 12,776m2 with a 30-storey apartment building, 3 basements. The project investor is Hoang Thanh Infrastructure Investment and Development Joint Stock Company - Hanoi Transformer and Electrical Materials Manufacturing Joint Stock Company.

The company's 2007 prospectus stated that in September 2005, Hanoi Transformer and Electrical Materials Manufacturing Joint Stock Company was established on the basis of merging Hanoi Electrical Equipment Joint Stock Company and Hanoi Transformer Manufacturing Joint Stock Company according to Decision No. 105/2005 of the General Corporation of Electrical Engineering Equipment ( Gelex - stock code: GEX).

In August 2007, Gelex owned 45% of the shares of Hanoi Transformer and Electrical Materials Manufacturing Joint Stock Company.

By November 2014, Gelex had divested all 49.49% of its shares at Hanoi Transformer and Electrical Materials Manufacturing Joint Stock Company by negotiation. The party that acquired all the shares was Hoang Thanh Infrastructure Investment and Development Company (Hoang Thanh Group).

Gelex's 2014 annual report shows that the current Chairman of Gelex's Board of Directors is Mr. Nguyen Hoa Cuong. Ms. Nguyen Thi Bich Ngoc - Member of Gelex's Board of Directors - is also the Chairman of Hoang Thanh Group's Board of Directors.

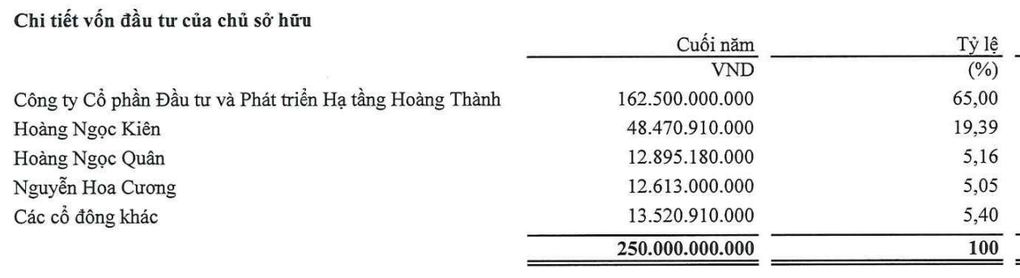

Shareholder structure of Hanoi Transformer and Electrical Materials Manufacturing Joint Stock Company as of December 31, 2024 (Photo: Financial Statements).

In 2017, the general meeting of shareholders of Hanoi Transformer and Electrical Materials Manufacturing Joint Stock Company approved the policy of stopping production, continuing to maintain commercial activities and implementing real estate project investments.

In 2018, the company increased its capital to VND250 billion by issuing 21.5 million shares to three strategic investors: Hoang Thanh Group (14.52 million shares) and two individuals: Mr. Nguyen Hoa Cuong (1.25 million shares) and Mr. Hoang Ngoc Kien (5.73 million shares).

Figures in the 2024 audited financial report show that at the end of last year, Hoang Thanh Group held 65% of the equity of Hanoi Transformer and Electrical Materials Manufacturing Joint Stock Company. Mr. Nguyen Hoa Cuong held 5.05% of the capital. Mr. Hoang Ngoc Kien held 19.39%. Mr. Hoang Ngoc Quan held 5.16%.

The 2024 management report of Hanoi Transformer and Electrical Materials Manufacturing Joint Stock Company shows that Mr. Hoang Ngoc Kien and Mr. Hoang Ngoc Quan are the sons of Ms. Nguyen Thi Bich Ngoc.

Information about Ms. Nguyen Thi Bich Ngoc and Mr. Hoang Ngoc Quan, Hoang Ngoc Kien (Screenshot).

Hoang Thanh Infrastructure Investment and Development Joint Stock Company was established in 2004 with initial charter capital of VND 27 billion and increased to VND 1,359 billion in 2022.

Some projects that this enterprise has developed and is developing include Hoang Thanh Tower, Mulberry Lane luxury apartment complex, Seasons Avenue, and Hoang Thanh Villas project.

Source: https://dantri.com.vn/kinh-doanh/lai-gap-hon-6700-lan-chu-du-an-chung-cu-dat-vang-cau-dien-chi-co-tuc-dam-20250623144746745.htm

![[Photo] General Secretary To Lam meets with the Group of Young National Assembly Deputies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/24/618b5c3b8c92431686f2217f61dbf4f6)

![[Photo] The 9th Party Congress of the National Political Publishing House Truth](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/24/ade0561f18954dd1a6a491bdadfa84f1)

![[Photo] Close-up of modernized Thu Thiem, connecting new life with District 1](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/24/d360fb27c6924b0087bf4f288c24b2f2)

Comment (0)