At the press conference announcing the results of the 9th session of the 15th National Assembly held on June 27, delegate Pham Thi Hong Yen - Full-time member of the National Assembly's Economic and Financial Committee - provided information on the process of adjusting the family deduction level in the Personal Income Tax Law.

According to Ms. Yen, based on current regulations, if the consumer price index (CPI) fluctuates by more than 20% compared to the time the law took effect or the most recent adjustment, the Government will submit to the National Assembly Standing Committee (NASC) for consideration to adjust the family deduction level. This is to ensure that the tax policy is close to the actual fluctuations in prices.

She also said that the Government is planning to comprehensively amend the Personal Income Tax Law and is expected to submit it to the National Assembly for consideration at its 10th session later this year. In this draft amendment, the issue of family deductions will be included in the central content.

However, in case the Government submits to the Standing Committee of the National Assembly to adjust the prescribed family deduction level, without amending the law, the Standing Committee of the National Assembly will issue a resolution within its authority to adjust the family deduction level.

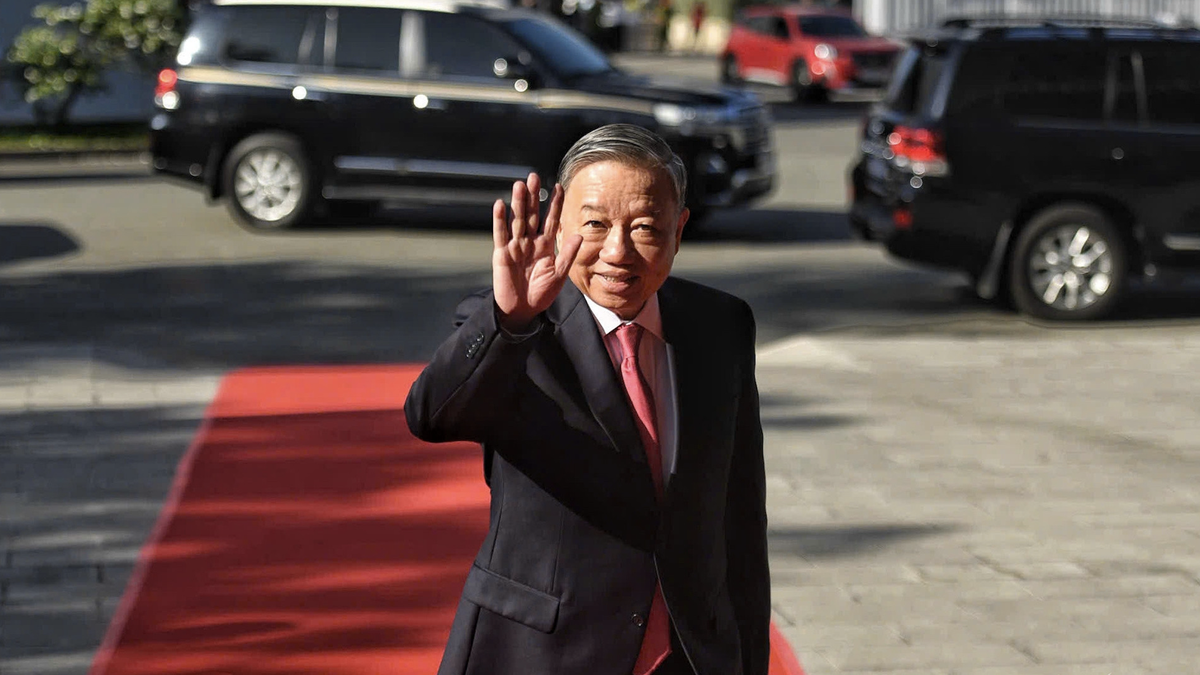

Notable information announced by Minister of Finance Nguyen Van Thang at the question-and-answer session on June 19 shows that the Ministry is advising the Government to submit to the Standing Committee of the National Assembly a resolution to adjust the family deduction level, in order to support people and businesses in the context of weak purchasing power and high spending pressure.

Previously, delegate Tran Hoang Ngan (Ho Chi Minh City) emphasized at the National Assembly forum that the current deduction level is outdated and "adjustment cannot be delayed any longer". Currently, the deduction level for individual taxpayers is 11 million VND/month and for each dependent is 4.4 million VND/month - a level that is considered no longer suitable in the context of continuously increasing prices in recent years.

The resolution on questioning passed by the National Assembly on the morning of June 27 also clearly stated the request for the Government and ministries to urgently study and supplement tax policies to stimulate consumption and support the internal strength of the economy, including improving the family deduction level.

This adjustment of tax policy is not only a matter of legislative technique, but also an important step demonstrating the State's support for the people in the context of many economic difficulties.

Source: https://baoquangninh.vn/khi-nao-muc-giam-tru-gia-canh-duoc-dieu-chinh-3364644.html

Comment (0)