Domestic gold price today 7/25/2025

Gold price information as of 4:30 a.m. on July 25, 2025, domestic gold bar price according to yesterday's closing price, July 23. Specifically:

DOJI Group listed the price of SJC gold bars at 119.7-121.7 million VND/tael (buy - sell), a decrease of 1 million VND/tael in both buying and selling directions compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 119.7-121.7 million VND/tael (buy - sell), a decrease of 1 million VND/tael in both buying and selling directions compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 120.5-121.7 million VND/tael for buying and selling. Compared to yesterday, the gold price decreased by 1 million VND/tael for both buying and selling.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 119.7-121.7 million VND/tael (buy - sell), the price decreased by 1 million VND/tael in both buying and selling directions compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 119.2-121.7 million VND/tael (buy - sell), gold price decreased 1 million VND/tael in both buying and selling directions compared to yesterday.

As of 4:30 a.m. on July 25, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 116.5-119 million VND/tael (buy - sell); the price decreased by 500 thousand VND/tael in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 116.7-119.7 million VND/tael (buy - sell); the gold price decreased by 500 thousand VND/tael in both buying and selling directions compared to yesterday.

The latest gold price list today, July 25, 2025 is as follows:

| Gold price today | July 24, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 119.7 | 121.7 | -1000 | -1000 |

| DOJI Group | 119.7 | 121.7 | -1000 | -1000 |

| Red Eyelashes | 120.5 | 121.7 | -1000 | -1000 |

| PNJ | 119.7 | 121.7 | -1000 | -1000 |

| Bao Tin Minh Chau | 119.7 | 121.7 | -1000 | -1000 |

| Phu Quy | 119.2 | 121.7 | -1000 | -1000 |

| 1. DOJI - Updated: 7/25/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 119,700 ▼1000K | 121,700 ▼1000K |

| AVPL/SJC HCM | 119,700 ▼1000K | 121,700 ▼1000K |

| AVPL/SJC DN | 119,700 ▼1000K | 121,700 ▼1000K |

| Raw material 9999 - HN | 109,000 ▼500K | 110,000 ▼500K |

| Raw material 999 - HN | 108,900 ▼500K | 109,900 ▼500K |

| 2. PNJ - Updated: July 25, 2025 04:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 116,000 ▼600K | 118,800 ▼400K |

| Hanoi - PNJ | 116,000 ▼600K | 118,800 ▼400K |

| Da Nang - PNJ | 116,000 ▼600K | 118,800 ▼400K |

| Western Region - PNJ | 116,000 ▼600K | 118,800 ▼400K |

| Central Highlands - PNJ | 116,000 ▼600K | 118,800 ▼400K |

| Southeast - PNJ | 116,000 ▼600K | 118,800 ▼400K |

| 3. SJC - Updated: 7/25/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 119,700 ▼1000K | 121,700 ▼1000K |

| SJC gold 5 chi | 119,700 ▼1000K | 121,720 ▼1000K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 119,700 ▼1000K | 121,730 ▼1000K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 115,000 ▼500K | 117,500 ▼500K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 115,000 ▼500K | 117,600 ▼500K |

| Jewelry 99.99% | 115,000 ▼500K | 116,900 ▼500K |

| Jewelry 99% | 111,242 ▼495K | 115,742 ▼495K |

| Jewelry 68% | 72,750 ▼340K | 79,650 ▼340K |

| Jewelry 41.7% | 42,002 ▼208K | 49,902 ▼208K |

World gold price today 7/25/2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 a.m. on July 25, Vietnam time, was 3,366.21 USD/ounce. Today's gold price decreased by 51.71 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,320 VND/USD), the world gold price is about 110.28 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 11.42 million VND/tael higher than the international gold price.

.png)

Gold prices recorded a sharp decline, mainly due to profit-taking by short-term investors along with cutting losses from previous buying positions.

Specifically, spot gold price decreased 1.38% to 3,366.21 USD/ounce, while gold futures in the US also decreased 0.9% to 3,367.40 USD.

The upbeat jobs data helped gold prices slow their decline, although selling pressure remained. The U.S. Department of Labor reported that initial claims for unemployment benefits came in at a seasonally adjusted 217,000 for the week ending July 19, below the 228,000 expected. The figure was also down slightly from the previous week, when it was unchanged at 221,000.

The market is optimistic about trade deals, especially between the US and Japan and possibly the European Union, said Aakash Doshi, an expert at State Street Investment Management. He added that strong growth in the stock market and low volatility have made it difficult for gold to rise.

In the latest developments, the US and the EU are moving closer to a trade deal that could include a 15% tariff on EU goods, but also potentially exempt some items. The move comes shortly after the Washington administration announced a separate deal with Japan.

In a long-awaited decision, the ECB announced that it would keep its main interest rates unchanged: the deposit rate at 2%, the main refinancing rate at 2.15% and the marginal lending rate at 2.4%. Notably, the bank did not provide much clarity on its future monetary policy. The ECB's decision did not make much of a difference to the ups and downs of gold.

Another notable event was President Trump's rare visit to the Federal Reserve headquarters to inspect the construction site, which he has criticized for cost overruns. According to CNBC, this is the first time in at least 20 years that a sitting president has visited the Fed.

Any interference in the Fed’s independence could support gold prices in the medium to long term, Doshi said. Currently, the market expects the Fed to keep interest rates unchanged at its July 29-30 meeting, but is still betting on a rate cut in September.

Other precious metals also fell. Silver fell 1% to $38.87 an ounce, while palladium fell 2.2% to $1,247.68 and platinum fell 0.8% to $1,400.18.

Gold Price Forecast

Gold prices have just had a correction after a period of price increase, this is a fairly familiar development in recent times. The main reason comes from the fact that many investors decided to sell to take profits after gold prices reached high levels. This phenomenon is considered a natural law of the market, when price increases are often interspersed with short-term adjustments.

"Gold prices fell this morning due to positive news on global trade. This reduces the risk of an economic recession and strengthens the risk-on sentiment in financial markets," said Carsten Menke, an analyst at Julius Baer.

According to experts, although demand for gold from investors seeking safe havens has decreased, buying activity from central banks has remained stable, although not as strong as at the beginning of the year. Mr. Menke said that in the long term, gold prices still have the potential to increase again due to the low interest rate environment and underlying economic instability factors.

Many experts and major financial institutions remain optimistic about the long-term prospects of gold. The main reason comes from the trend of countries gradually reducing their dependence on the US dollar and increasing their gold purchases for reserves. Meanwhile, the greenback is forecast to continue to depreciate in the long term, which is often favorable for gold prices.

Another important factor is the monetary policy of the US Federal Reserve (Fed). If the Fed really moves to loosen monetary policy by cutting interest rates, gold prices have the opportunity to surpass the $3,400/ounce threshold and set a new record, possibly even reaching $3,500 in the near future.

US Treasury Secretary Scott Bessent has expressed optimism about the progress of trade negotiations with China. The two sides are likely to extend the deadline for imposing tariffs before August 12. The important meeting in Stockholm on July 28-29 is expected to discuss not only tariffs but also other hot issues such as China's overproduction and its oil purchases from Russia and Iran.

Positive signals from trade negotiations have made investors more confident, and money is pouring into the stock market, especially US stocks. When the stock market increases strongly, gold is often under pressure to decrease in price as investors tend to switch to investment channels that bring higher profits in the short term.

Gold is traditionally seen as a safe haven asset and tends to rise in price during times of economic uncertainty or when interest rates are low. However, risk appetite is currently dominating the market, putting gold prices under strong downward pressure.

This weekend, the market will receive an important report on US durable goods orders for June, scheduled to be released on Friday morning. This index reflects the long-term investment situation of businesses and is considered one of the important indicators of economic health. This information will continue to strongly affect the trend of gold prices in the coming days.

Source: https://baonghean.vn/gia-vang-hom-nay-25-7-2025-gia-vang-trong-nuoc-va-the-gioi-giam-manh-nhung-la-quy-luat-tu-nhien-cua-thi-truong-10303106.html

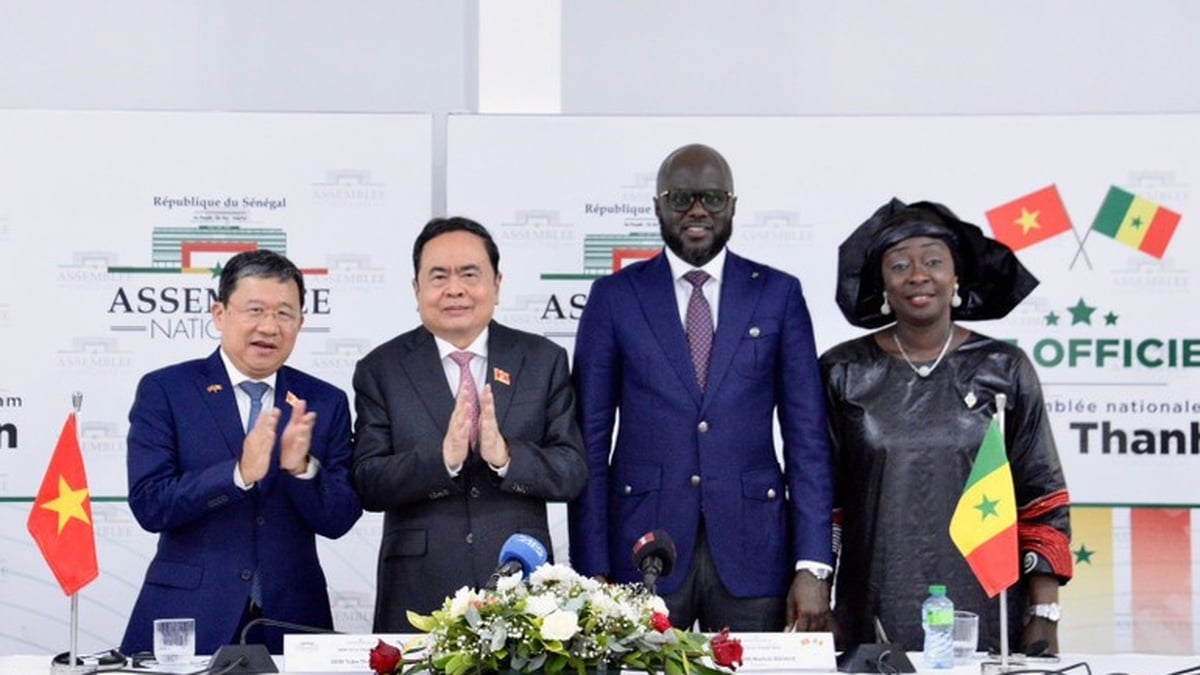

![[Photo] Signing of cooperation between ministries, branches and localities of Vietnam and Senegal](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/24/6147c654b0ae4f2793188e982e272651)

Comment (0)