Gold prices simultaneously broke out, increasing strongly like never before in early July

The domestic gold market on July 1, 2025 witnessed a strong upward trend in all major brands. This is a remarkable development when gold prices increased simultaneously in both buying and selling directions, showing the revival of the precious metal market. Specifically:

The price of SJC gold bars in Hanoi was listed at VND118.7 million/tael (buy) and VND120.7 million/tael (sell), an increase of VND1.2 million/tael compared to the previous session. Similarly, the gold price at DOJI Group also recorded a similar increase, reaching VND118.7 million/tael (buy) and VND120.7 million/tael (sell).

At Mi Hong Jewelry Company, the gold price today increased by VND800,000/tael, with the buying price being VND119.3 million/tael and the selling price being VND120.3 million/tael. This is also the general trend at Bao Tin Minh Chau, where the gold price was recorded at VND118.3 million/tael (buying) and VND120.3 million/tael (selling), an increase of VND800,000/tael in both directions.

Gold price at PNJ is also not out of the increasing trend, with the buying price reaching 114.5 million VND/tael, an increase of 700 thousand VND/tael, while the selling price closed at 117 million VND/tael, an increase of 700 thousand VND/tael.

In particular, gold prices at Phu Quy led the increase when the buying price reached 118.1 million VND/tael, an increase of 1.3 million VND/tael, and the selling price reached 120.7 million VND/tael, an increase of 1.2 million VND/tael.

Gold price trend forecast today 7/1/2025

Experts say the increase in domestic gold prices today reflects positive fluctuations in the international market, and is also a signal that investment demand for precious metals is increasing strongly.

Gold price list this afternoon 7/1/2025 in Vietnam in detail

| Gold price today | ||||

|---|---|---|---|---|

| Buy | Sell | |||

| SJC in Hanoi | 118.7 | ▲1200 | 120.7 | ▲1200 |

| DOJI Group | 118.7 | ▲1200 | 120.7 | ▲1200 |

| Red Eyelashes | 119.3 | ▲800 | 120.3 | ▲800 |

| PNJ | 114.5 | ▲700 | 117.0 | ▲700 |

| Vietinbank Gold | 120.7 | ▲1200 | ||

| Bao Tin Minh Chau | 118.3 | ▲800 | 120.3 | ▲800 |

| Phu Quy | 118.1 | ▲1300 | 120.7 | ▲1200 |

| 1. DOJI - Updated: 7/1/2025 15:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| AVPL/SJC HN | 118,700 ▲1200K | 120,700 ▲1200K |

| AVPL/SJC HCM | 118,700 ▲1200K | 120,700 ▲1200K |

| AVPL/SJC DN | 118,700 ▲1200K | 120,700 ▲1200K |

| Raw material 9999 - HN | 109,000 ▲700K | 112,000 ▲700K |

| Raw material 999 - HN | 108,900 ▲700K | 111,900 ▲700K |

| 2. PNJ - Updated: 7/1/2025 15:00 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| SJC PNJ gold bars | 118,700,000 ▲1,200,000 | 120,700,000 ▲1,200,000 |

| PNJ 9999 plain gold ring | 114,500,000 ▲700,000 | 117,000,000 ▲700,000 |

| Kim Bao 9999 Gold | 114,500,000 ▲700,000 | 117,000,000 ▲700,000 |

| Gold Phuc Loc Tai 9999 | 114,500,000 ▲700,000 | 117,000,000 ▲700,000 |

| PNJ Gold Bar - Phuong Hoang | 114,500,000 ▲700,000 | 117,000,000 ▲700,000 |

| PNJ 9999 Gold Jewelry | 113,900,000 ▲900,000 | 116,400,000 ▲900,000 |

| PNJ 24K Gold Jewelry | 113,780,000 ▲890,000 | 116,280,000 ▲890,000 |

| 99 gold jewelry | 112,840,000 ▲890,000 | 115,340,000 ▲890,000 |

| 916 Gold (22K) | 104,220,000 ▲820,000 | 106,720,000 ▲820,000 |

| 18K PNJ Gold | 79,950,000 ▲670,000 | 87,450,000 ▲670,000 |

| 680 Gold (16.3K) | 71,800,000 ▲610,000 | 79,300,000 ▲610,000 |

| 650 Gold (15.6K) | 68,310,000 ▲580,000 | 75,810,000 ▲580,000 |

| 610 Gold (14.6K) | 63,650,000 ▲540,000 | 71,150,000 ▲540,000 |

| 14K PNJ Gold | 60,740,000 ▲520,000 | 68,240,000 ▲520,000 |

| 416 Gold (10K) | 41,070,000 ▲370,000 | 48,570,000 ▲370,000 |

| 375 Gold (9K) | 36,300,000 ▲340,000 | 43,800,000 ▲340,000 |

| 333 Gold (8K) | 31,060,000 ▲290,000 | 38,560,000 ▲290,000 |

| 3. SJC - Updated: 1/7/2025 15:00 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 118,700 ▲1200K | 120,700 ▲1200K |

| SJC gold 5 chi | 118,700 ▲1200K | 120,720 ▲1200K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 118,700 ▲1200K | 120,730 ▲1200K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 114,000 ▲500K | 116,500 ▲500K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 114,000 ▲500K | 116,600 ▲500K |

| Jewelry 99.99% | 114,000 ▲500K | 115,900 ▲500K |

| Jewelry 99% | 110,252 ▲495K | 114,752 ▲495K |

| Jewelry 68% | 72,069 ▲340K | 78,969 ▲340K |

| Jewelry 41.7% | 41,585 ▲208K | 48,485 |

World gold price on July 1, 2025 increased due to weakening USD and concerns about US tariffs

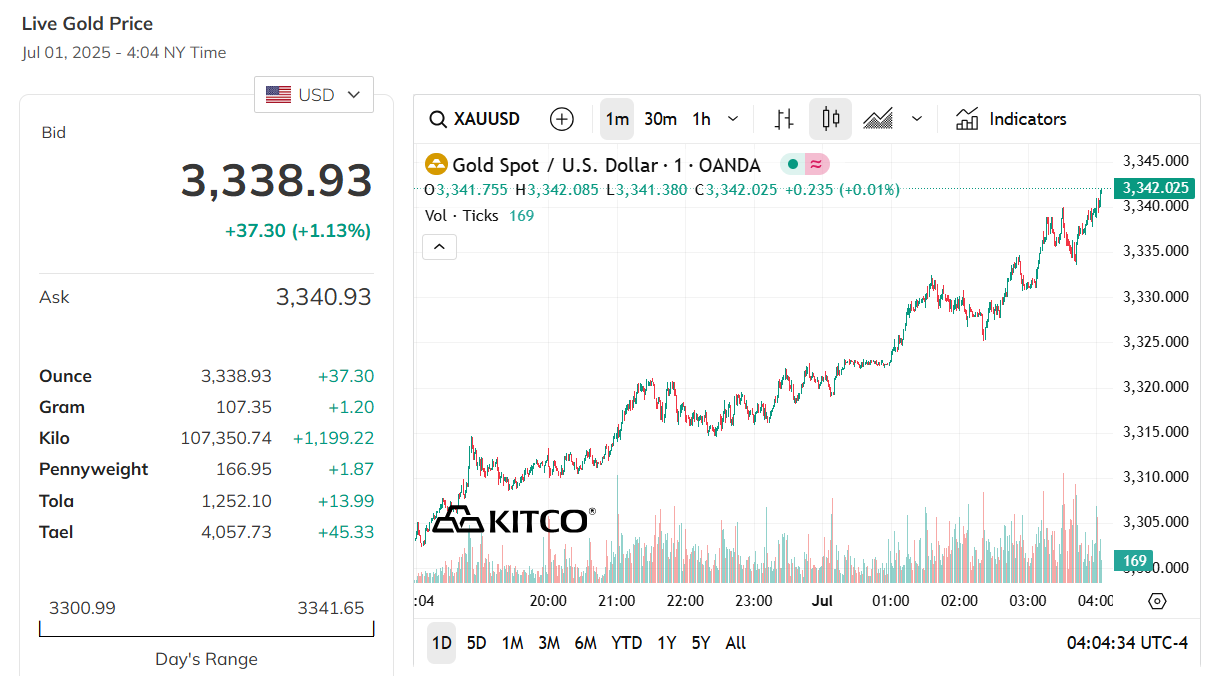

World gold price, at 3:00 p.m. on July 1, 2025 (Vietnam time), the world spot gold price was at 3,338.93 USD/ounce. Today's gold price increased by 37.3 USD compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,310 VND/USD), world gold is priced at about 110.19 million VND/tael (excluding taxes and fees). Compared to the domestic SJC gold bar price on the same day (118.7-120.7 million VND/tael), the current SJC gold price is about 10.51 million higher than the international gold price.

The price of gold today, July 1, 2025, in the world market increased slightly, attracting the attention of many people. According to information from the market, the spot gold price increased by 0.7%, reaching 3,325.79 USD per ounce, while the gold futures price in the US also increased by 0.9%, reaching 3,337.30 USD per ounce. The reason for the increase in gold price is due to the depreciation of the US dollar and concerns about upcoming trade policies, especially related to the tariff deadline set by US President Donald Trump on July 9. These factors make many people look to gold as a safe investment.

One of the main reasons for the rise in gold prices today is the weakening of the US dollar. When the value of the dollar falls, gold becomes cheaper for those using other currencies, thereby increasing demand for gold. In addition, the market is worried about trade negotiations between the US and other countries, especially Japan. President Trump has expressed dissatisfaction with the progress of US-Japan trade negotiations, and US Treasury Secretary Scott Bessent warned that countries could face much higher tariffs. These tariffs, ranging from 10% to 50%, are expected to take effect on July 9 if the negotiations do not produce results. These uncertainties make gold a more attractive option, as gold is often seen as a safe asset in times of volatility.

In addition, expectations that the US Federal Reserve will cut interest rates also contributed to the increase in gold prices today. Low interest rates reduce the opportunity cost of holding gold, meaning investors do not have to give up as much profit from other investments such as bonds or bank savings. President Trump recently urged the Fed to lower interest rates, even sending a list of interest rates from other central banks around the world, suggesting that the US should lower interest rates to levels as low as Japan (0.5%) or Denmark (1.75%). Market expert Nicholas Frappell of ABC Refinery said that this expectation is affecting gold prices, although he was a bit surprised that the market is so optimistic about the possibility of interest rate cuts.

Finally, investors are also closely watching US labor market reports this week, especially the official employment data due out on Thursday. This information could influence the Fed's decision on interest rates, which in turn could impact gold prices. Experts from Goldman Sachs predict the Fed will cut interest rates three times this year, starting in September, instead of just once in December as previously forecast. This further increases the appeal of gold, because when interest rates fall, gold often becomes a more attractive investment option. Overall, gold prices today on the world market are being supported by many factors, from a weak dollar, trade uncertainty, to expectations of lower interest rates in the future.

Source: https://baodanang.vn/gia-vang-chieu-nay-1-7-2025-vang-sjc-duoc-them-nhet-chuan-bi-co-them-dinh-moi-3264656.html

Comment (0)