The latest document sent by the Tax Department ( Ministry of Finance ) to the Department for Development of Private Enterprises and Collective Economy (Ministry of Finance) has provided instructions on how to use business address information after changing administrative boundaries from July 1.

The Tax Department stated that the taxpayer's address determined according to the valid business registration certificate and the address updated by the tax authority according to the two-level administrative area are both legally valid for use on invoices.

Therefore, for businesses (buyers or sellers) that are subject to joint registration with business registration and continue to use the business registration certificate with the old address (address before the change of administrative boundaries), there are 2 cases.

In case the business address information has been updated by the tax authority according to the corresponding 2-level administrative area and this information has been synchronized to the electronic invoice system, the address information on the invoice is the address information that has been updated by the tax authority.

Taxpayers use the tax authority's notice to provide information to relevant agencies or customers in cases where the address stated on the invoice is an address that has been updated according to the new administrative area list, but the information on the business registration certificate is still the address according to the old administrative area list.

In case the business address information has been updated by the tax authority according to the corresponding 2-level administrative area but has not been synchronized to the electronic invoice system, the address information on the invoice is the address information on the business registration certificate.

In case the buyer is not subject to registration linked with business registration, the Tax Department guides the address on the invoice to be the address that has been updated by the tax authority according to the 2-level administrative area on the tax industry's application system and notifies the taxpayer.

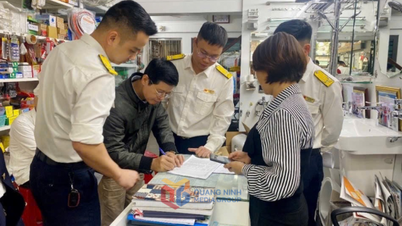

Taxpayer addresses according to 2-level administrative areas will be synchronized for all tax industry applications (Illustration: Tien Tuan).

The tax authority said it has issued an official dispatch on reviewing and standardizing the corresponding taxpayer directory.

This unit will update tax registration information about the taxpayer's address on the tax industry's application system based on the decision to organize a new administrative unit by the competent authority, and at the same time notify the taxpayer without requiring the taxpayer to carry out change procedures with the tax authority.

Taxpayer address information according to 2-level administrative areas will be synchronized for all tax industry applications, or automatically updated by the electronic invoice solution provider on the electronic invoice system provided to taxpayers.

Source: https://dantri.com.vn/kinh-doanh/ghi-dia-chi-tren-hoa-don-dien-tu-theo-dia-ban-hanh-chinh-2-cap-ra-sao-20250714011535417.htm

![[Photo] Prime Minister begins trip to attend SCO Summit 2025 in China](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/31/054128fff4b94a42811f22b249388d4f)

![[Photo] Chairman of the National People's Congress of China Zhao Leji begins official visit to Vietnam](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/31/fcfa5a4c54b245499a7992f9c6bf993a)

![[Photo] First Secretary and President of Cuba begins State visit to Vietnam](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/31/f169c1546ec74be7bf8ccf6801ee0c55)

![[Infographic] Traditional relations and special friendship between Vietnam and Cuba](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/31/c4c2b14e48554227b4305c632fc740af)

Comment (0)