Guide taxpayers to fulfill tax obligations accurately and correctly

According to the Tax Department, this is an important step of the Tax Department to accompany the business community in sustainable development and avoid errors in fulfilling tax obligations in the context of the increasingly growing digital economy and diversified business models, the activities of individuals and business households are no longer limited to traditional forms such as stores or fixed locations.

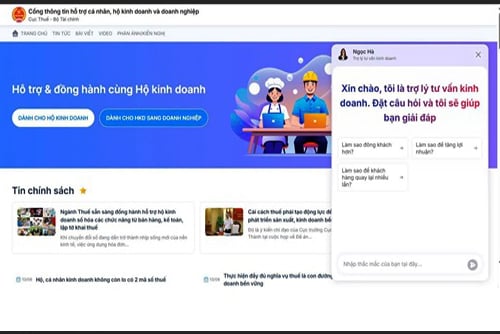

To respond to changes and modernize tax management, the Tax Department has coordinated with MISA Joint Stock Company to proactively build a Support Portal to ensure that all taxpayers can access complete, accurate, easy and quick tax information.

The purpose of the Portal is to help individuals, business households and enterprises grasp the State's tax regulations, and at the same time support and guide them to fulfill their tax obligations accurately and correctly.

This is a practical tool that helps taxpayers look up information quickly, minimizes unnecessary errors, and contributes to maintaining transparency and accuracy in tax collection.

Chatbot provides business development consulting, providing useful knowledge for individuals, business households and enterprises.

AI assistant for business consulting, helping individuals, businesses, and enterprises improve sales efficiency

The content on the Portal is compiled directly by the tax authority, ensuring high accuracy and being presented vividly and easily understood through short articles and videos , helping users access knowledge quickly and apply it promptly to their business.

In particular, the Portal integrates an AI business consulting assistant chatbot to help individuals, business households and enterprises access useful knowledge and improve sales efficiency.

The portal has been completed thanks to close coordination between MISA and professional units, absorbing practical opinions from localities to develop into an effective support channel for individuals, business households, and enterprises nationwide.

The Tax Department expects to develop the Portal into a powerful tool, helping taxpayers fulfill their obligations conveniently, minimizing errors and enhancing transparency in tax transactions, promoting the sustainable development of the Vietnamese economy.

Source: https://phunuvietnam.vn/sang-18-8-cuc-thue-ra-mat-cong-thong-tin-ho-tro-ca-nhan-ho-kinh-doanh-va-doanh-nghiep-20250817213439282.htm

![[Photo] Party and State leaders visit President Ho Chi Minh's Mausoleum and offer incense to commemorate Heroes and Martyrs](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/8/17/ca4f4b61522f4945b3715b12ee1ac46c)

Comment (0)