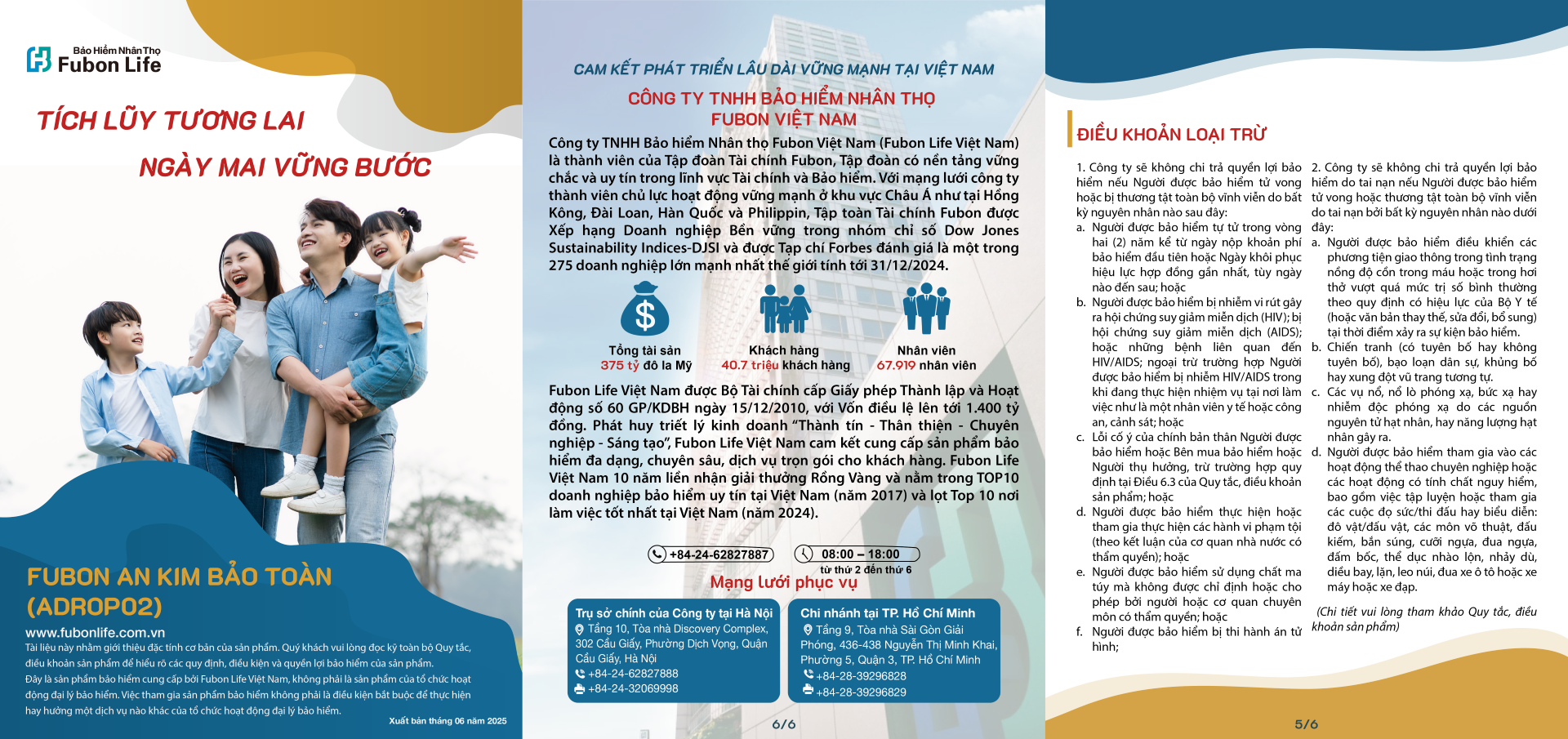

As many young families become more concerned about personal financial management and long-term financial security, life insurance products that integrate savings and protection are gradually becoming a popular choice. Instead of focusing solely on investment or savings, many young Vietnamese people today tend to look for flexible solutions that help them proactively prepare for the future without being tied down by long-term financial obligations.

When his first son was born, Mr. Duong - a 35-year-old IT employee in Hanoi - began to think further. It was not just about the cost of diapers, milk, tuition or medical expenses, but also about a long journey: if one day he was no longer able to work, who would take care of his wife and children?

“I’m not afraid of difficulties, I’m just afraid of not preparing anything for tomorrow,” Mr. Duong shared. And that’s why he turned to life insurance.

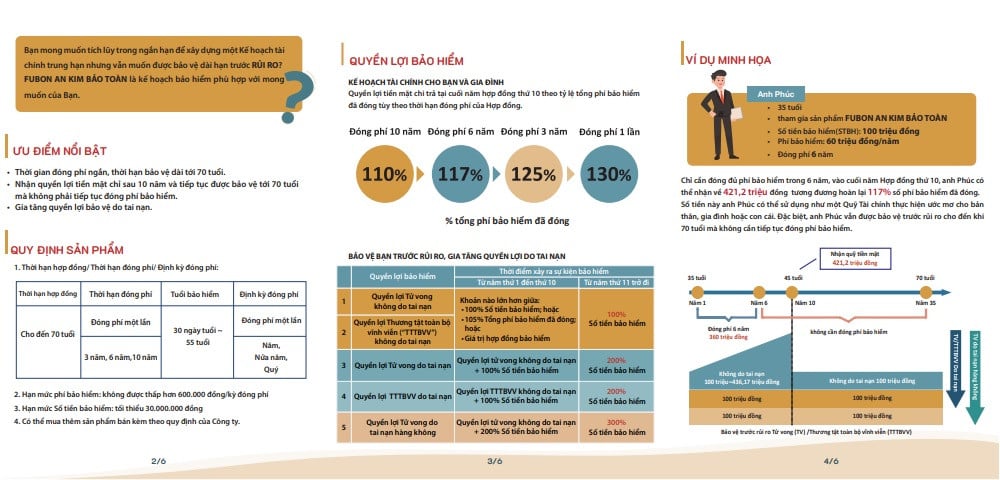

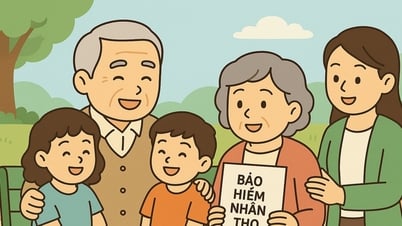

Fubon introduced a product called Fubon An Kim Bao Toan. The company representative said: “Participants only need to pay premiums for a short period of time, but are protected long-term up to age 70. The notable point is that this product allows participants to only pay premiums once or for a short period of 3-10 years, but after the 10th contract year, customers can receive cash benefits and still be protected without having to continue paying premiums. This helps buyers to “close the book” early, reducing financial pressure in the long term, while still maintaining protection benefits.”

In addition, the product also integrates increased accident protection benefits, meeting the actual protection needs in modern society. The minimum insurance amount is from 30 million VND depending on the customer's choice, suitable for many customer segments.

Ms. Huyen - a secondary school teacher in Hai Duong once experienced a health incident that prevented her from working for nearly a year. "If I hadn't had the insurance contract payment at that time, I would have had to sell my house," she said. Now, Ms. Huyen continues to participate in the Fubon An Kim Bao Toan product to both accumulate and have peace of mind to prevent unexpected events.

“In the context of increasingly high medical costs, being proactive in financial risk management is a wise choice, not only for yourself, but also for your loved ones who are relying on you,” Ms. Huyen shared.

Ms. Lo Mei-Fang - General Director of Fubon Life Vietnam shared: "We understand that every customer wants flexibility in their financial plan, especially when facing unexpected changes in life. With Fubon An Kim Bao Toan, we not only bring an insurance product, but also an effective and sustainable financial planning tool."

Fubon Life Vietnam is a member of Fubon Financial Group. With a strong network of member companies operating in Asia such as Hong Kong (China), Taiwan (China), Korea and the Philippines, Fubon Financial Group is ranked as a Sustainable Enterprise in the Dow Jones Sustainability Indices-DJSI and is rated by Forbes Magazine as one of the 275 largest enterprises in the world (data as of December 31, 2024). The Group has total assets of 375 billion USD with 67,919 employees (Data as of December 2024) and is constantly growing strongly to serve more than 40.7 million customers worldwide. Fubon Life Vietnam has received the Golden Dragon Award for 10 consecutive years and is in the Top 10 prestigious insurance companies in Vietnam (2017) and in the Top 10 best places to work in Vietnam (2024). In an effort to fulfill corporate social responsibility, Fubon Life Vietnam actively participates in social charity work, with activities such as: building warm homes, taking care of children, donating school supplies, etc. |

(Source: Fubon Life Vietnam)

Source: https://vietnamnet.vn/fubon-ra-mat-san-pham-bao-hiem-nhan-tho-dong-phi-ngan-han-3-10-nam-2417124.html

Comment (0)