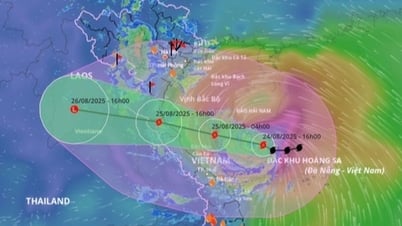

Outstanding loans of securities companies under banks are large in scale compared to the general market - Photo: BK

The outstanding margin debt of the stock market is currently around 300,000 billion VND.

Margin interest rate competition

Shinhan Securities (SSV) offers a 0% interest rate for 2 months for a limit of VND500 million, and an interest rate of 6.8% for the next 4 months for a limit of up to VND10 billion. SSI Securities offers a 9% interest rate and T+7 interest-free period for large customers. Meanwhile, VPBankS offers margin interest rates from only 6.6%/year...

In general, T+ interest-free programs for swing trading are becoming a competitive "weapon". Low-interest packages often come with strict conditions: borrowing in a designated stock portfolio, applying to new customers, or limiting outstanding balances.

According to Mr. Nguyen The Minh, director of research and development of individual customers of Yuanta Securities Vietnam, the actual margin interest rate fluctuates between 11-12%/year.

"There is not much room left to compete by lowering interest rates, because securities companies find it difficult to sacrifice more profits to lower interest rates," said Mr. Minh. Mr. Minh even believes that with the market continuously heating up and many securities companies approaching their lending limits, margin interest rates may increase in the near future.

Most major banks own securities companies, such as Vietcombank, Vietinbank, BIDV , Techcombank, VPBank...

The reason, according to the general director of a securities company, is that compared to banks, the net interest margin (NIM) of securities companies is superior. With the ability to lend on margin twice the owner's equity, securities companies can actually achieve a NIM of 6-7%. Meanwhile, the NIM of banks is 3-4% even though they have the ability to lend 7-10 times the owner's equity.

He explained: NIM for margin lending at securities companies is higher because the cost of raising capital through bank loans or issuing bonds is only about 5-7%/year, but the lending interest rate for customers is commonly at 11-14%/year, creating a higher profit margin. The general director admitted that they are under great competitive pressure from securities companies with "backed" banks that have emerged strongly in recent years.

"A delicious piece of cake" from the margin lending segment, banks are increasingly increasing their ownership of securities companies. Mr. Phan Duy Hung, CFA, MBA, director - senior analyst at VIS Rating - said that in the past six months, a number of private banks have announced plans to buy shares (such as Sacombank, SeABank, MSB) or enter into strategic cooperation (such asOCB , VIB) with securities companies.

Beware of general risks

In the race for market share in brokerage and margin lending, bank-affiliated securities companies are showing a clear advantage over independent securities companies. With a large charter capital base and favorable capital mobilization ability thanks to support from parent banks, this group of companies has the conditions to expand the scale of margin lending with competitive interest rates, thereby contributing to reshaping the market landscape.

According to Mr. Phan Duy Hung, in the past three years, securities companies associated with private banks have risen significantly to the top 30 in terms of asset size thanks to large capital increases. The margin lending market share of these companies has also increased from 19% in 2022 to 30% in 2024.

"Bank-affiliated companies often leverage their parent banks' capital and customer network to expand their brokerage and bond distribution market share - an advantage that independent securities companies find difficult to compete with. Therefore, they will continue to lead the industry's profit growth in the next 12-18 months," Mr. Hung said. In contrast, profit growth of foreign-invested and small-scale domestic securities companies will be slower.

Also according to the director - senior analyst at VIS Rating, banks and associated securities companies often cooperate closely to lend to large enterprises - mainly in the real estate and renewable energy sectors - through customer loans, bond investments and/or margin lending.

Some businesses have recently been caught up in legal issues related to projects and/or delayed corporate bond payments. Mr. Hung warned that banks and securities companies focusing on large businesses are increasing operational risks and will be vulnerable to credit risks related to each large customer, which could lead to a situation of mass withdrawals from customers.

Sharing the same view, Mr. Nguyen The Minh said that the traditional securities company model is easily "inferior" to banks because there are no regulations on investment banking like in developed countries.

Mr. Phan Duy Hung said that traditional bank lending activities are under fierce competitive pressure, thinner profit margins and credit growth limits. In the first three months of 2025, banks' net interest margins (NIM) fell 35 basis points to 2.9% compared to the same period last year.

Therefore, more and more banks are increasing their securities brokerage and capital market services - areas with higher profit margins - to strengthen and develop the financial ecosystem.

Banks still believe that expanding into this sector generally improves profitability. In 2024, some bank-affiliated securities companies such as TCBS contributed significantly - nearly 20% - to the parent bank's profits. However, "investing in subsidiaries in the securities sector can reduce capital adequacy ratios in the short term," Mr. Hung warned.

"Having a bank behind you often has the advantage of cheap capital"

Mr. Nguyen Duc Thong - General Director of SSI Securities - admitted that in terms of margin lending alone, it is true that securities companies with banks behind them often have the advantage of cheap capital.

"But traditional companies like SSI also have their own strengths. This helps businesses mobilize necessary capital at reasonable costs, optimize capital efficiency and maintain high margin growth," Mr. Thong emphasized.

Beware of the risk of "underground banking"

Securities companies are shifting to promoting preferential margin interest rate programs to attract investors - Photo: QUANG DINH

The margin activities of securities companies are often labeled in international terminology as "shadow banking", which somewhat misleads about the level of risk. In fact, "shadow banking" is a parallel bank that provides quick capital through securities companies and investment funds.

Mr. Nguyen The Minh emphasized: "Shadow banking is not as bad as it is called. When bank credit is tightened by regulations on interest rates and outstanding debt, owning securities companies helps to lend quickly, easily handle collateral and especially has high interest rates. Margin disbursement is faster than credit applications and securities companies can handle margin immediately when the value of collateral does not meet requirements.

The DIG and PDR mortgage liquidations during the recent tariff shock are evidence of the risk management capabilities of securities companies.

However, it should be noted that the risk of margin "condensation" into financial stocks (banks, securities) will make the market less healthy. Instead, margin should spread to more industry groups.

Mr. Minh commented: "Developing digital assets, such as asset tokenization (RWA), will open up new development space for investment banking activities at securities companies operating under the traditional model and avoid being disadvantaged by banks". But at the same time, the "fever of opening exchanges" will push banks to quickly own and invest in securities companies in the coming time after 5 trading floors are licensed.

Source: https://tuoitre.vn/dua-ha-lai-margin-va-song-ngan-hang-ngam-20250824233933676.htm

![[Photo] General Secretary To Lam attends the 80th anniversary of Vietnam's diplomacy](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/25/3dc715efdbf74937b6fe8072bac5cb30)

![[E-Magazine] Petrovietnam – Strong steps to realize the “Epochal Transformation”](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/8/25/e745baade70f4e1e96f5314f65eac658)

Comment (0)