Investing is not the privilege of the rich

Ms. Minh Anh (36 years old), a middle manager at a multinational corporation, used to think that investing was a distant thing, only for those with large capital or deep expertise. But in 2019, after a seminar on personal financial management, she started setting aside 10 million VND per month to regularly invest in open-end stock funds - a modern form of investment that is increasingly popular in Vietnam.

“I realized that I can invest in stocks even if I don’t have much time to learn about the market. Investing regularly is like saving, but my money is invested systematically and with discipline,” she shared.

After 5 years, that regular investment has brought a positive result: not only a significant increase in assets, but also an initiative in long-term financial planning - from buying a house to preparing a child's education fund.

Open-end funds are a form of collective investment where investors pool their capital and entrust portfolio management to professional investment experts. With the advantages of flexibility, transparency and the ability to start with a small amount of money, open-end funds are becoming an ideal choice for young people and busy people who want to invest long-term but do not have much time or expertise to invest themselves.

Compared to investment channels such as real estate or gold, investors can participate in open-end funds more conveniently because they only need to start with a capital of a few hundred thousand VND, and can withdraw capital at any time.

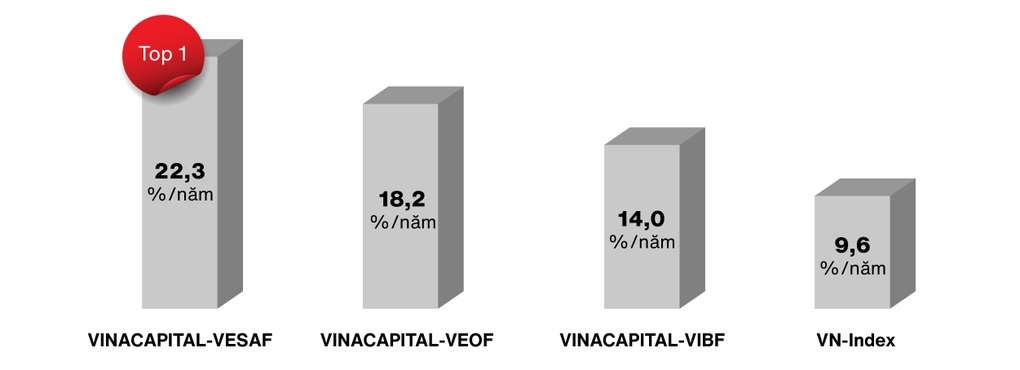

According to data from VinaCapital Fund Management Company, in the 5-year cycle up to June 15, open-end funds managed by this unit have recorded impressive growth, despite strong market corrections. For example, VINACAPITAL-VESAF and VINACAPITAL-VEOF funds achieved average compound annual returns of 22.3% and 18.2%, respectively, far exceeding the 9.6%/year of the benchmark VN-Index in the same period.

To put this into perspective, if you invest 10 million VND/month in a stock fund for 5 years, the total amount of money you contribute will be 600 million VND. With an assumed average return of only 12%/year, you can accumulate about 817 million VND.

Average 5-year compound returns of equity funds and balanced funds managed by VinaCapital as of June 15 (Photo: VinaCapital).

Investing and Saving: Two Inseparable Pieces

Many people mistakenly think that investing is a substitute for saving, but financial experts say that the two tools should go hand in hand. Savings are meant to ensure liquidity in the short term, for emergencies such as illness, unemployment or unexpected spending needs. Meanwhile, investing is a tool for growing assets in the medium and long term, helping to realize big goals such as buying a house, retiring early or investing in children'seducation .

A common rule of thumb is to maintain savings equivalent to 3-6 months of living expenses, with the remainder allocated to investment channels with the potential to generate returns. By starting early and maintaining discipline, investors can take advantage of the power of compound interest - an important factor in building long-term wealth.

According to Ms. Nguyen Hoai Thu, CFA, Deputy General Director of VinaCapital Fund Management Company, for open-end fund investors, the most important factor is to have a long-term investment mindset, maintain a stable mentality and not pay too much attention to short-term market fluctuations.

“The reason is that VinaCapital has selected the best long-term growth businesses and bought them at reasonable prices. As the business grows, the investment value will automatically increase over time,” Ms. Thu explained.

It can be said that investing is no longer the privilege of the rich or those who understand the market. With the development of open-end funds, anyone can start investing in a simple, systematic and effective way, including busy people or those with small capital.

Investing and saving are not two opposing choices, but rather complementary pieces. Knowing how to combine both, everyone can build a more stable, flexible and proactive financial future.

Source: https://dantri.com.vn/kinh-doanh/dau-tu-quy-mo-lua-chon-thong-minh-cho-nha-dau-tu-muon-tai-san-tang-ben-vung-20250621091124473.htm

![[Maritime News] Wan Hai Lines invests $150 million to buy 48,000 containers](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/6/20/c945a62aff624b4bb5c25e67e9bcc1cb)

Comment (0)