Accordingly, the Law on Tax Administration No. 38/2019/QH14 took effect from July 1, 2020. After more than 5 years of implementation, the Law has made an important contribution to modernizing tax administration, reforming administrative procedures, strengthening discipline in state budget collection, and at the same time creating favorable conditions for taxpayers to fulfill their obligations. However, in the context of rapid socio -economic development, e-commerce, digital economy and new business models emerging, digital transformation is taking place strongly, many breakthrough policies and orientations of the Party and State have been issued to remove bottlenecks, unblock resources and promote economic development. That reality requires comprehensive amendments to the Law on Tax Administration to meet the new requirements of the country.

Previously, on August 1, the National Assembly Standing Committee issued Resolution No. 92/2025/UBTVQH15 adjusting the 2025 Legislative Program. Accordingly, the Law on Tax Administration (amended) has been added to the 2025 Legislative Program. The Ministry of Finance (Tax Department) is urgently completing the draft Law with the goal of comprehensively reforming tax administration, meeting practical requirements and institutionalizing the guidelines and policies in the Central Resolutions: Resolution No. 57-NQ/TW on breakthroughs in science and technology development, innovation and national digital transformation, Resolution No. 59-NQ/TW on international integration in the new situation, Resolution No. 66-NQ/TW on innovation in law-making and enforcement to meet the requirements of national development in the new era and Resolution No. 68-NQ/TW on private economic development.

Accordingly, the new draft Law focuses on key contents, promoting the modernization and comprehensive digital transformation of tax collection management, applying modern information technology, with connectivity and integration to promote digital transformation in tax management with three main pillars: facilitating taxpayers; improving the effectiveness and level of tax management; promoting digitalization of tax management processes.

In addition, promote voluntary compliance based on taxpayers' level of compliance and risk level.

At the same time, promote the reduction of administrative procedures, reduce costs of implementing administrative procedures; enhance coordination between state agencies and organizations and individuals related to tax authorities in sharing data, connecting to implement tax laws and tax management.

In addition, promote decentralization and delegation of authority; carry out administrative procedures online throughout the process towards creating a centralized, single "one window", independent of administrative boundaries.

In particular, overcome the shortcomings of the Law on Tax Administration, ensure consistency and synchronization with related laws; perfect the legal framework to manage new economic models, technology-based business and digital platforms, tax management for business households and individual businesses after eliminating the form of tax assignment, and encourage business households to switch to operating under the enterprise model.

The Ministry of Finance has issued Official Letter No. 12624/BTC-CT to solicit public comments on the content of the draft Law. With a spirit of openness and responsibility, the Tax Department requests that businesses, business households and taxpayers nationwide actively participate in contributing comments to the Draft Law on Tax Administration (amended).

According to the Tax Department, comments from the business community and taxpayers are important factors contributing to building a modern, effective, efficient and fair tax management system - for the common benefit of the nation, the business community, and each citizen.

Source: https://hanoimoi.vn/cuc-thue-keu-goi-nguoi-nop-thue-gop-y-vao-du-thao-luat-quan-ly-thue-sua-doi-713989.html

![[Photo] Prime Minister Pham Minh Chinh chairs meeting of National Steering Committee on International Integration](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/9d34a506f9fb42ac90a48179fc89abb3)

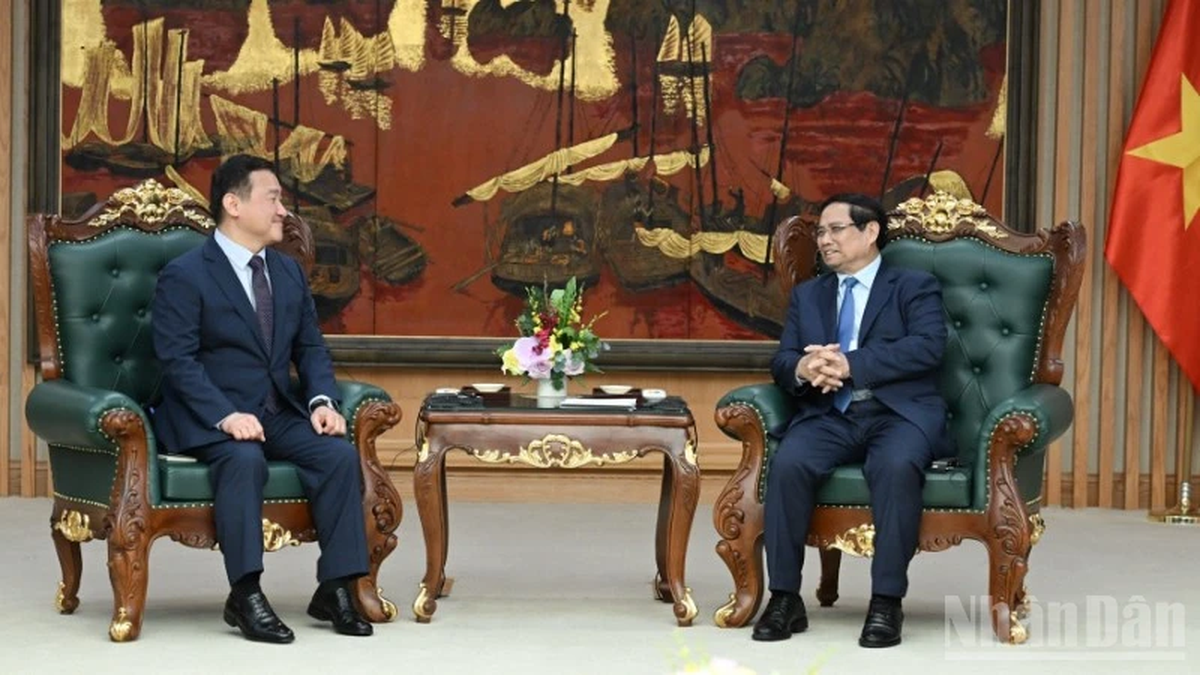

![[Photo] Prime Minister Pham Minh Chinh receives CEO of Samsung Electronics](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/373f5db99f704e6eb1321c787485c3c2)

![[Photo] Multi-colored cultural space at the Exhibition "80 years of the journey of Independence - Freedom - Happiness"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/fe69de34803e4ac1bf88ce49813d95d8)

Comment (0)