|

Tesla's electric car alongside rival Waymo. Photo: Bloomberg . |

At a time when Tesla is clearly in decline, the introduction of self-driving cars is a good sign to revive public interest. The event of some Model Y cars starting to carry paying passengers on June 22 in Texas was a memorable milestone for the company.

The potential of the self-driving car market is huge, pushing Tesla's stock up. Many investors expect Tesla to become a leader in the field in the coming years. But last week's robotaxi launch revealed a number of small glitches that did not live up to Elon Musk's hype.

Potential comes with risk

The introduction of such a cutting-edge model is likely to be a burden. As Bloomberg observed, these self-driving cars are defined by clear limitations, such as operating only in narrow areas, serving invited guests, and each car must have a safety supervisor sitting inside.

Meanwhile, Tesla promotes its cars as having the hardware to be robotaxi, and its self-driving software, trained by test drivers, can handle almost any situation. Promising robotaxi everywhere, but with only a few cars with people inside, does not give Tesla credibility.

Moreover, the technology car company is suspected of overstating expectations for robotaxis, while the reality is very limited and limited. According to Bloomberg , the core electric vehicle business accounts for 75% of Tesla's gross profit but sales are falling. In fact, the value can only be estimated at about $50 /share, which is only 15% of the current value.

|

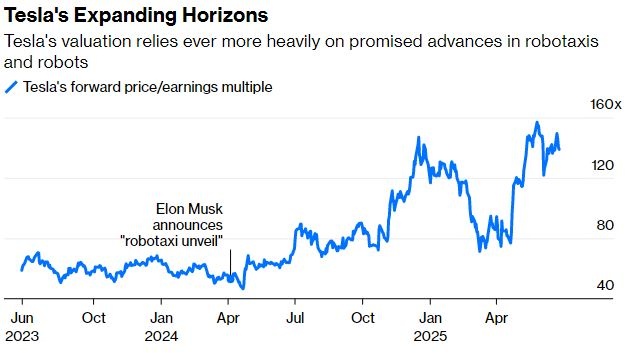

Tesla's forward P/E valuation ratio changes. Photo: Bloomberg. |

The rest (85%) comes from confidence in the future of robotaxis and self-driving software. RBC Capital believes that 59% of Tesla’s stock price ( $181 ) comes from robotaxis expectations, with another $53 coming from monetizing self-driving software.

In total, the stock is valued at $815 billion , based on double-digit earnings multiples, but that’s based on assumed revenue, not actual profits. That’s only 10 to 15 years from now, because right now, these are still businesses that are barely profitable.

Tesla’s electric vehicle business has stalled over the past two years. Its once-promising low-cost models remain elusive, and profits have slumped. But since Elon Musk pivoted aggressively to robotaxis and robots in early 2024, Tesla’s valuation has doubled.

Valuation multiples reflect investor confidence. With a market of 2 billion personal vehicles on the road globally, the potential for robotaxis is huge. While it’s unclear when, many believe Elon Musk and Tesla will be the leaders.

The Trust Problem for Tesla

For now, that belief is misplaced. After mocking Alphabet’s self-driving rival Waymo for its cautious, city-by-city approach, Tesla is starting to roll out its service in a similar fashion.

To date, only one incident involving a Tesla robotaxi safety issue has been reported on the city of Austin's online portal. However, federal regulators have begun investigating several instances of Tesla robotaxi allegedly violating traffic laws, which have been captured on video .

According to Bloomberg , the robotaxi launch means Tesla’s time is running out. The key is to scale up the fleet and prove the strategy. An expected value of $800 billion doesn’t leave much room for early hiccups like that.

For example, one of Tesla’s supposed biggest advantages is its “sensor-less” approach, which eliminates systems like LiDAR, making robotaxis cheaper than tech-heavy vehicles like Waymo’s. But the rival can spread that expensive cost over the more than 250,000 rides it provides each week. Meanwhile, other competitors, like Amazon’s Zoox, are also consolidating their positions in the market.

|

Waymo has just reached an agreement to provide self-driving software with Toyota. Photo: Waymo. |

In a market this new and volatile, the ultimate outcome can be hard to predict. A recent analyst report from Goldman Sachs, which simulated various sizes and profit levels for Tesla’s hypothetical robotaxi fleet in 2040, came up with values ranging from $2.50 to $81.75 per share.

Previously, Elon Musk affirmed that all Tesla cars sold since 2016 already have hardware, and only need software updates to become robotaxes in the future. However, Business Insider updated that the company is installing new hardware for cars used as robotaxes such as sound sensors, camera protection, and a second telecommunications device.

Waymo is leading the race to license its robotaxi technology to other automakers, having just reached a preliminary partnership agreement with Toyota Motor. Shares of Mobileye Global, which provides autonomous and driver-assistance technology to many automakers, have also risen 25% this week.

A year from now, users may be surprised by the speed of Tesla's progress, but with what has just been released, Tesla has not met any confidence in that expectation. Most importantly, Elon Musk's company now has no more room to delay.

Source: https://znews.vn/con-dao-hai-luoi-voi-tesla-post1564393.html

![[Infographic] Circular guiding the functions, tasks and powers of the provincial Department of Culture, Sports and Tourism and the commune-level Department of Culture and Social Affairs](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/6/29/877f24989bb946358f33a80e4a4f4ef5)

Comment (0)