Vietnam Weekly discussed with Mr. Duong Tien Dung - Deputy Director of the State Budget Department, Ministry of Finance about fiscal solutions to achieve the growth target of 8%.

Mr. Duong Tien Dung said : Implementing the Resolutions of the Party and the National Assembly, the fiscal policy is being effectively managed by the Government in the direction of reasonable expansion, with focus and key points to promote economic growth, especially after the Covid-19 pandemic. In 2025, this management orientation will continue to be maintained to achieve the GDP growth target of 8% or more.

In recent times, many mechanisms and legal policies have been reviewed, adjusted and issued to remove obstacles and unblock resources, allocate and effectively use resources for development. For example, in the field of state budget (NSNN), an important highlight is Law No. 56/2024/QH15 amending and supplementing a number of articles of the State Budget Law, which has helped to remove bottlenecks in public procurement, regular expenditure and accelerate public investment disbursement.

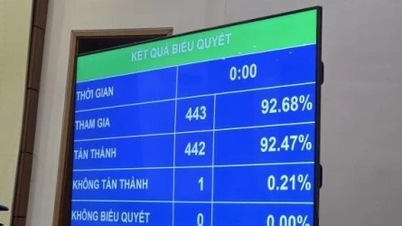

The Law on State Budget (amended) has just been passed by the National Assembly, with the spirit of promoting decentralization, delegation of power, giving more initiative to local budgets and budget-using units; at the same time, handling bottlenecks, focusing on prioritizing resources for investment, science and technology development, digital transformation and implementing important policies.

State budget expenditures will be managed proactively and flexibly in 2025 to realize socio-economic development goals, institutional reform and national capacity enhancement. Photo: Nguyen Hue

In particular, a number of new provisions of the Law will take effect from July 1, 2025, including content related to budget decentralization when organizing a two-level government apparatus and promoting the development of science and technology activities, innovation, and national digital transformation.

In parallel, the Ministry of Finance has submitted to the Government amendments to many decrees and issued circulars to facilitate production and business activities. These adjustments clearly demonstrate the Government's commitment to using fiscal policy as an important driving force to promote growth, improve the investment environment and unlock development resources.

Could you tell us how tax reduction and extension policies have been implemented to stimulate domestic investment and consumption, a very important pillar for economic growth?

In 2025, the Government will continue to implement policies to reduce and extend the payment deadline for taxes, fees, charges and budget revenues, in order to remove difficulties for businesses and people; control inflation, stabilize the macro-economy, and promote economic growth.

A number of policies have been proactively proposed by the Ministry of Finance to be issued from 2024 and take effect this year. Most recently, the National Assembly has approved a resolution to continue reducing value-added tax (VAT) rates as a solution to support businesses in recovering and adapting to difficulties in production and business, including impacts from US trade policies.

According to preliminary estimates, the scale of current fiscal support policies has reached over VND230 trillion, a significant increase compared to about VND200 trillion in 2024, showing a trend of continuing to expand fiscal policies on the revenue side, to support economic recovery and growth.

In addition to continuing to reduce value-added tax (VAT) until the end of 2026, many other policies are being implemented to reduce costs for businesses and people. Specifically, reducing environmental protection tax rates on gasoline and oil; reducing fees and registration fees for battery-powered electric cars; reducing import and export taxes; extending the deadline for paying special consumption tax for domestically produced and assembled cars; extending the deadline for paying VAT, corporate income tax, personal income tax and land rent.

Development investment is the focus

Sir, what is the 2025 budget spending orientation to support growth and reorganize the state apparatus?

In 2025, the Government will operate fiscal policy in a reasonable, focused and key expansion direction to achieve the GDP growth target of 8% or more. In particular, development investment spending continues to be identified as the focus. The National Assembly also allows the management and adjustment of the budget deficit to 4-4.5% of GDP if necessary - higher than the estimated level of 3.8%.

The management of state budget expenditures must be tight and effective, within the budget estimates decided by the National Assembly, thoroughly saving regular expenditures, increasing resources for development investment. At the same time, in the management of 2025, there has been an increase in expenditures to implement major policies of the Party and State to achieve the target of GDP growth of 8% or more in 2025, double-digit growth in the 2026-2030 period; implementing the restructuring of the state apparatus; breakthrough in science, technology, innovation and national digital transformation, tuition exemption for students from preschool to public high school, the Ministry of Finance has advised the Government to submit to the National Assembly a supplementary budget to pay for regimes and policies for cadres, civil servants, public employees and workers when implementing the arrangement and consolidation of the apparatus organization prescribed in Decrees No. 178/2024/ND-CP and Decree No. 67/2025/ND-CP of the Government; allowing the transfer of funding sources to implement the tuition exemption policy, perform tasks arising from the arrangement of the apparatus organization; balancing and arranging 3% of the total state budget expenditure in 2025 for science, technology, innovation and national digital transformation to meet the requirements of Resolution No. 57-NQ/TW.

All these moves show that state budget expenditures will be managed proactively and flexibly in 2025 to realize socio-economic development goals, institutional reform and enhance national capacity in strategic areas.

Can you compare the speed of public investment expansion this year, the last year of the 2021-2025 planning period?

In 2025, public investment spending will continue to be boosted to restore and promote economic growth. The National Assembly has decided on the 2025 development investment expenditure estimate of VND 790.7 trillion, an increase of 16.7% compared to the previous year's VND 677.3 trillion. In addition, it will be supplemented from transitional sources and increased central budget revenue in 2024. It is expected that the total scale of public investment capital in 2025 could reach nearly one million billion VND - a record high, clearly reflecting the determination to promote economic growth, including the driving force from public investment.

In the first half of this year, disbursement is estimated to reach 32.5% of the plan assigned by the Prime Minister, higher than the rate of 28.2% in the same period in 2024. Photo: Hoang Ha

Continue to promote the structure of public investment, overcoming the situation of dispersion and fragmentation. This year's investment capital is focused on key national projects, especially in the field of strategic infrastructure such as highways, airports, and key transport works that play a role in inter-regional connectivity, creating momentum for regional and national development.

Prioritizing investment in infrastructure not only creates momentum for the economy but also realizes the direction of expanding, flexible, focused and key fiscal management that the Government has consistently implemented throughout its term. This is also one of the key solutions to achieve the GDP growth target of 8% or more in 2025.

Disbursement rate improved significantly

Can you sketch out the revenue and expenditure picture for the first half of this year?

The state budget picture in the first 6 months of 2025 recorded many positive signals. Total budget revenue is estimated to reach about 66.2% of the annual estimate. This is a relatively high revenue level, creating a favorable foundation for fiscal policy management in the second half of the year.

Budget revenue increased sharply thanks to many factors. First of all, thanks to the continued economic recovery, contributing to maintaining a stable and growing revenue source; revenues arising in the previous year, as prescribed, were declared and paid at the beginning of the budget year such as corporate income tax, personal income tax, etc., increased significantly. Along with that, tax and customs authorities have stepped up revenue management, increased inspection, examination and collection in areas such as e-commerce, management of contracted business households, electronic invoices and combating commercial fraud.

A notable point is that the revenue from land use fees has increased sharply. If last year, the rate of land use fee collection after 6 months only reached over 40% of the estimate, this year, this figure exceeded 91% of the estimate, increasing both in rate and absolute value.

Regarding state budget expenditure in the first 6 months, it is estimated to reach 42.2% of the estimate, a significant increase compared to the same period of previous years, showing changes in disbursement and implementation of spending tasks, especially development investment, the disbursement rate has improved significantly in recent months.

Since April, the progress of investment capital disbursement has improved significantly. The total investment capital disbursed in the first 6 months of the year reached about 268 trillion VND, a sharp increase compared to the same period last year (about 188 trillion VND), an increase of about 42.3% in absolute value. In the first half of this year, disbursement is estimated to reach 32.5% of the plan assigned by the Prime Minister, higher than the rate of 28.2% in the same period in 2024. This increase is considered positive and consistent with the policy of fiscal policy management, promoting economic growth.

This is an effort that the Government, the Prime Minister, Deputy Prime Ministers and Ministers have closely directed, and established many working groups to urge progress. Ministries, branches and localities are required to closely coordinate, review and remove obstacles.

To achieve the GDP growth target of about 8% in 2025, in addition to the tasks implemented in the public investment plan, the Government is submitting to competent authorities a plan to allocate increased central budget revenue in 2024, of which an important part will be used to increase spending on development investment.

This means that the scale of investment spending in 2025 is not only large in terms of the estimated figure, but also significantly supplemented from sources outside the estimate. This is an important fiscal preparation to support growth and implement medium- and long-term infrastructure development goals.

Sir, some international financial institutions recommend that Vietnam use fiscal policy as a tool to boost the economy due to its low public debt/GDP ratio. What is your comment on this recommendation?

In the coming time, many large projects will begin to be implemented, notably the Urban Railway Project in Hanoi and Ho Chi Minh City; the Hanoi - Hai Phong - Lao Cai railway project; other strategic infrastructure projects in the national transport planning, requiring careful preparation from ministries, branches and localities to proactively balance resource allocation and organize effective implementation, creating momentum to promote economic growth from 2025 onwards.

Vietnamnet.vn

Source: https://vietnamnet.vn/co-1-trieu-ty-dong-chi-dau-tu-phat-trien-de-ho-tro-muc-tieu-tang-truong-8-2416177.html

![[Infographic] Circular guiding the functions, tasks and powers of the provincial Department of Culture, Sports and Tourism and the commune-level Department of Culture and Social Affairs](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/6/29/877f24989bb946358f33a80e4a4f4ef5)

Comment (0)