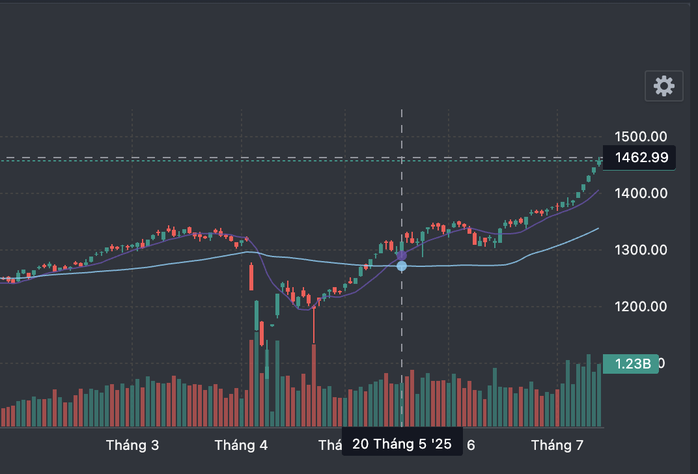

The Vietnamese stock market recorded an impressive trading week from July 7 to 11, with the VN-Index hitting a historic peak of 1,457.76 points, up 5.1% from the previous week. The VN30 Index was no slouch, rising 7.07% to 1,594.07 points, breaking the previous record. This development reinforced investors’ confidence in a sustainable recovery cycle, especially as cash flow into bluechips remains strong.

An atmosphere of optimism prevails.

An optimistic atmosphere prevailed in stock forums and groups as investors continuously shared their expectations and predictions that the VN-Index would soon reach a new peak, even surpassing the 1,500-point mark. However, behind that excitement, there was also concern and even disappointment among investors who had not yet reached shore when their stock portfolios only moved sideways or decreased slightly, even though the general market was booming. This reflected the fact that the breadth of the market was showing clear signs of differentiation.

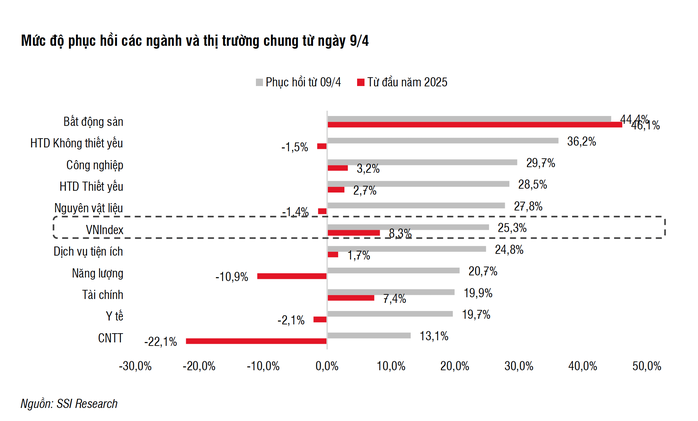

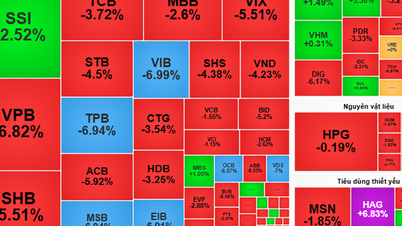

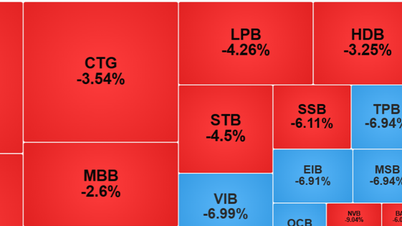

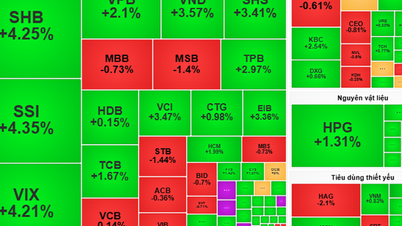

According to analysis from SHS Securities Company, in just one week, VN-Index has made a spectacular breakthrough from the 1,380 point area to above 1,450 points. However, not all stock groups benefited from the uptrend. The increase mainly focused on Vingroup stocks, steel, banking, securities and large-cap stocks, which were strongly supported by the continuous net buying activities of foreign investors.

Meanwhile, many midcap stocks and other industry groups are still under pressure to adjust and accumulate, showing that cash flow is being more selective, only prioritizing flowing into businesses with solid fundamentals or directly benefiting from the uptrend.

Recovery level of sectors and VN-Index after the decline in early April until now

Within each industry, stocks are also differentiated. Ms. Thuy Minh (living in Phuoc Long ward, Ho Chi Minh City) complained that many real estate stocks increased sharply, continuously hitting the ceiling price such as VIC, VHM, LDG, DLG, NTL, NDN, DXG, TCH, but the stocks she holds, KDH and DIG, did not increase too strongly.

Many other investors also complained that they were "not too happy" because they did not hold stocks that were increasing strongly.

Mr. Nguyen Tan Phong, analyst at Pinetree Securities Company, commented that investor sentiment was much more excited last week when a series of good information was released about tariffs, JP Morgan (USA) recommended buying stocks in the Vietnamese market, the Prime Minister promoted the FTSE upgrade of the Vietnamese stock market...

However, the market still has certain differentiation when cash flow only focuses on large-cap stocks (bluechips), while the midcap group only moves sideways or makes slight adjustments.

"This leads to the situation where the VN-Index increases sharply but many investor accounts only move sideways if they do not buy the right stocks that increase. With the strong net buying power of foreign investors and the strong cash flow into pillar stocks, the short-term trend of the VN-Index is positive. However, it is too early to predict that this is the "leg wave" before the market upgrade. Because foreign organizations buy strongly but only focus on allocating to SSI, FPT andSHB and midcap stocks - in contrast to the fact that before the market upgrade, the cash flow must be allocated to stocks such as HPG, VNM, or large bank stocks" - Mr. Phong stated his opinion.

Many investors' accounts have not increased as expected, if holding stocks has not increased sharply in recent days.

VN-Index forecast to reach historic peak and has potential to reach 1,500 points in the near future

According to some securities companies, investors should not be too FOMO (fear of missing out) on new stocks at the moment. For investors who are holding stocks, there is no need to sell immediately.

In the short term, SSI Securities Company believes that the market may witness strong fluctuations in July and early August due to profit-taking pressure during the business results season at the end of July. The room for further loosening of monetary policy is limited in the context of the exchange rate increasing by more than 3% in the first half of this year.

The impact of tariffs has begun to become more evident, as shown in export figures and third quarter business results of a number of related industries such as textiles, seafood, industrial parks, etc.

VN-Index has been rising in a V-shape in just over the past 3 months.

"SSI maintains a positive view on the market in the long term with the target of VN-Index reaching 1,500 by the end of 2025 thanks to a stable macro economy; sustainable corporate profit growth; cooling tariff uncertainty; low interest rate environment..." - experts of this securities company forecast.

Source: https://nld.com.vn/vn-index-lap-dinh-tai-khoan-chung-khoan-nhieu-nha-dau-tu-van-chua-ve-bo-19625071312145661.htm

![[Photo] Prime Minister Pham Minh Chinh meets with Speaker of the New Zealand Parliament Gerry Brownlee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/cec2630220ec49efbb04030e664995db)

![[Photo] General Secretary To Lam attends the opening ceremony of the National Achievements Exhibition](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/d371751d37634474bb3d91c6f701be7f)

![[Photo] Politburo works with the Standing Committee of Cao Bang Provincial Party Committee and Hue City Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/fee8a847b1ff45188749eb0299c512b2)

![[Photo] Red flag with yellow star flutters in France on National Day September 2](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/f6fc12215220488bb859230b86b9cc12)

![[Photo] General Secretary To Lam presents the 45-year Party membership badge to comrade Phan Dinh Trac](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/e2f08c400e504e38ac694bc6142ac331)

Comment (0)