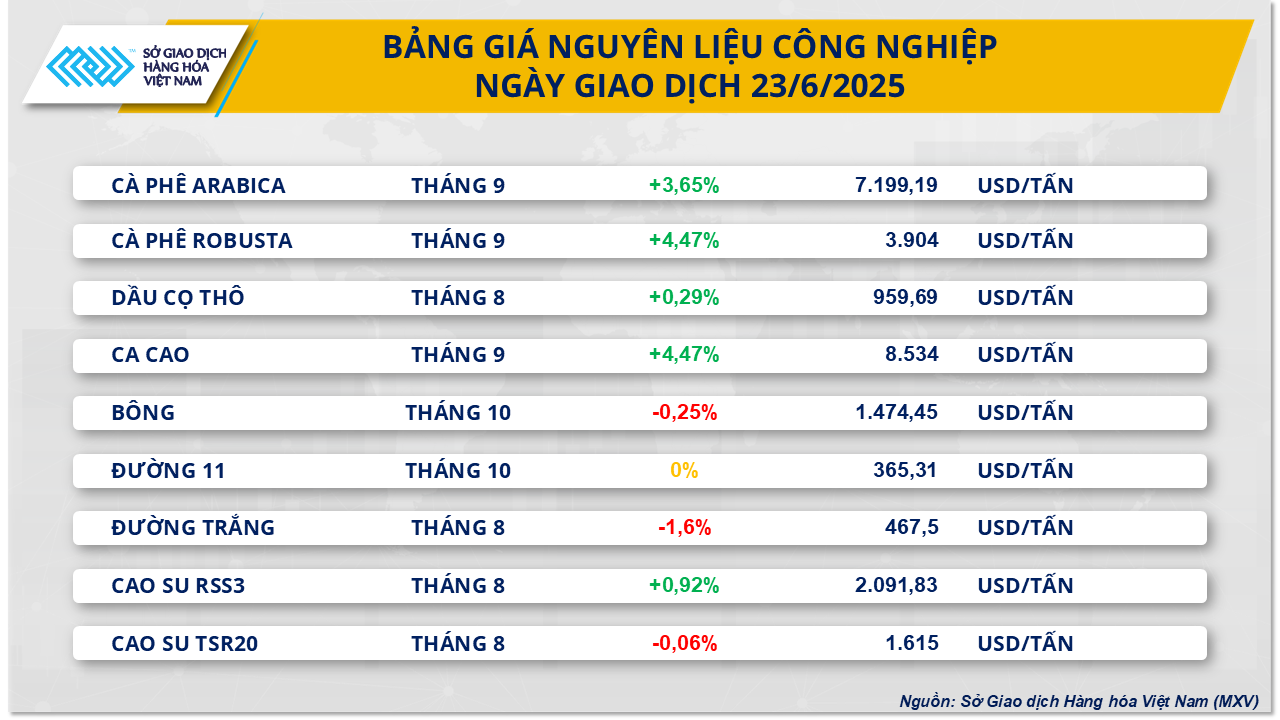

For the industrial raw material group, at the end of yesterday's trading session, the industrial raw material group attracted the attention of the market when recording overwhelming buying power on most key commodities. In particular, the price of Arabica coffee recorded an increase of more than 3.6%, returning to 7,199 USD/ton, the price of Robusta coffee also recovered more than 4.4% to 3,904 USD/ton. The main reason supporting the prices of the above two commodities mainly came from concerns about the weather situation in Brazil.

According to Brazil’s weather agency, a strong cold air mass is moving towards the southeastern region of the country, which is expected to cause a sudden change in weather starting June 24. This cold air mass will cause temperatures in the states of São Paulo, Minas Gerais and Rio de Janeiro to drop sharply, with many places likely to set new records for minimum temperatures in June.

The prolonged low temperatures are expected to bring some areas to their coldest point in decades, with widespread frost risk, especially at higher elevations. Frost not only delays harvest but can also cause significant damage to coffee plants, directly affecting the yield and quality of agricultural products in Brazil – the world’s largest coffee producer.

The ECMWF model's Extreme Forecast Index (EFI) reached its maximum (0.8 – 1.0) in many areas of Brazil on June 24 and 25, signaling temperatures would be in the lowest 1% ever recorded in climate data for these regions.

In addition, Brazil's coffee exports remain a factor supporting coffee prices on the international market, especially for Arabica. According to data recently released by the Brazilian Foreign Trade Agency (Secex), in the first 14 working days of June, the average daily export volume of unroasted coffee reached 7,085 tons, down 30.3% compared to the average of 10,163 tons/day for the entire month of June 2024.

In addition, although Brazil's total coffee output is forecast to increase this year, the supply of Arabica is still facing the risk of shortage. In Minas Gerais - Brazil's largest coffee-producing state with a dominant proportion of Arabica, the output in 2024 is estimated at 28.1 million bags, down 3.1% compared to the previous year. Forecasts from Brazil's National Supply Agency (Conab) show that in 2025, Arabica output in this state could continue to decline sharply by 11.6%, down to 24.8 million bags. The main reason is the two-year yield rotation cycle of coffee trees - one year of high yield, one year of low yield, along with unfavorable climatic factors, which directly affect the harvest output.

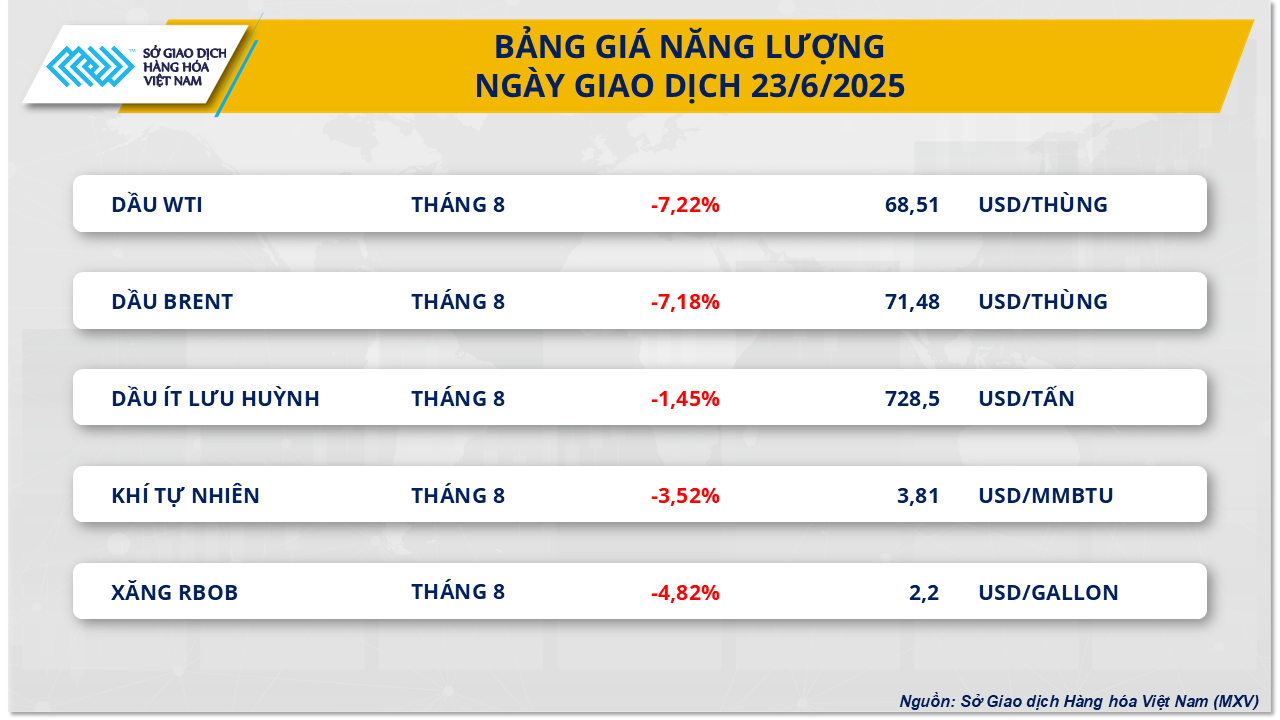

In the energy market, according to MXV, the energy market's rally was halted yesterday when concerns about global oil supply disruptions temporarily subsided.

At the end of the trading session, the energy market was covered in red with both crude oil products falling by 7.2%. WTI oil price once again fell below the threshold of 70 USD/barrel, specifically stopping at 68.51 USD/barrel; while Brent oil price also returned to 71.48 USD/barrel, recording the sharpest drop since August 2022.

In the early hours of the trading session, oil prices were under strong pressure due to the US's unexpected military intervention in the Israel-Iran conflict that took place on June 21. This event raised concerns about the risk of escalating tensions as well as the possibility that Iran would close the Strait of Hormuz - a vital transport route for the global oil industry.

At one point, Brent crude oil prices exceeded $80 a barrel when the Iranian parliament approved a proposal to block the strait in response to US airstrikes on Iran’s nuclear facilities. Many forecasts also said that if Iran’s Supreme National Security Council officially approved the plan, world oil prices could skyrocket to over $120 a barrel.

However, the latest developments yesterday have eased those concerns. Accordingly, Iran launched an airstrike on the US Al Udeid air base in Qatar in response, but caused no damage to people or military infrastructure. Qatar's airspace was reopened just hours after the incident, which has somewhat eased concerns about the risk of disrupting oil supplies from the Persian Gulf region as well as the possibility of further conflict escalation.

Source: https://baodaknong.vn/thi-truong-hang-hoa-24-6-gia-ca-phe-dao-chieu-tang-vot-gia-dau-tho-lao-doc-256505.html

![[Photo] The 9th Party Congress of the National Political Publishing House Truth](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/24/ade0561f18954dd1a6a491bdadfa84f1)

![[Photo] Close-up of modernized Thu Thiem, connecting new life with District 1](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/24/d360fb27c6924b0087bf4f288c24b2f2)

![[Photo] General Secretary To Lam meets with the Group of Young National Assembly Deputies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/24/618b5c3b8c92431686f2217f61dbf4f6)

Comment (0)