Demand dominated most trading sessions. Only the third trading session made investors "scared" when many stocks returned from purple to reference price or red points.

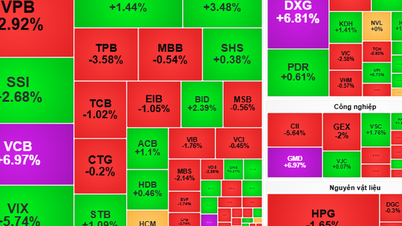

After that, the uptrend was maintained with consensus from both bluechips and small and medium-cap stocks, showing that the cash flow was increasingly strong as the index continuously conquered peak prices. Green spread across the market as trading sentiment was untied.

Notably, selling pressure appeared, causing the VN-Index to shake and at one point drop more than 16 points in the last session of the week, but demand was still very strong, helping the VN-Index recover and end the session in green.

Five consecutive sessions of increase helped VN-Index have a brilliant trading week from August 4 to August 8, stopping at 1,584.95 points - the highest closing level ever, up 89.74 points (+6%). During the week, the highest level ever recorded if calculated based on intra-session movements was 1,589.58 points on August 8.

Not only did it reach a record number of points, liquidity in the market was also at a high level. Accumulated to the end of the trading session, the average weekly liquidity on the Ho Chi Minh City Stock Exchange reached VND50,706 billion, up 3.96%.

Market breadth is positive, rotation and price increase are good in industry groups, codes have not increased much, good accumulation. Outstanding in steel, construction, fertilizer, agriculture , seafood, oil and gas, real estate, finance...

Foreign investors had a strong week of net selling with a value at the end of the week of nearly 13,000 billion VND.

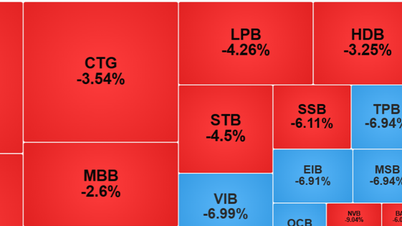

Experts from Vietnam Construction Securities Joint Stock Company said that the increasing momentum showed signs of weakening in the last two trading sessions of the week, indicating that the increasing momentum is slowing down and does not rule out the possibility of a correction in the sessions of next week.

“Therefore, we maintain a cautious stance, limit opening new buying positions and continue to prioritize a high cash ratio,” this business expert recommended.

Meanwhile, expert Phan Tan Nhat, Head of Analysis, Saigon - Hanoi Securities Joint Stock Company (SHS), said that with the momentum still maintaining quite strong at present when VN-Index has surpassed the historical peak in 2022. VN-Index is expected to head towards the next psychological zone around 1,600 points. The market is trading actively with cash flow circulating in the context of "the tide rises, the boat rises" when VN-Index surpasses the historical peak.

However, the market began to differentiate strongly, perhaps partly due to the phenomenon of tight margin room (margin trading). The codes that had increased strongly before started to have a situation of running out of loan limits, not attracting more increased cash flow, and had weaker price movements. While the codes that had not increased much attracted increased cash flow, had positive price movements when business results grew well.

This is a development that short-term speculative positions need to pay attention to in the current context in order to control short-term positions, as well as rotate cash flow appropriately, when the uptrend of VN-Index is still maintained.

Source: https://hanoimoi.vn/thi-truong-chung-khoan-lap-dinh-moi-trong-tuan-qua-712077.html

![[Photo] General Secretary To Lam attends the opening ceremony of the National Achievements Exhibition](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/d371751d37634474bb3d91c6f701be7f)

![[Photo] Red flag with yellow star flutters in France on National Day September 2](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/f6fc12215220488bb859230b86b9cc12)

![[Photo] General Secretary To Lam presents the 45-year Party membership badge to comrade Phan Dinh Trac](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/e2f08c400e504e38ac694bc6142ac331)

![[Photo] Prime Minister Pham Minh Chinh meets with Speaker of the New Zealand Parliament Gerry Brownlee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/cec2630220ec49efbb04030e664995db)

![[Photo] Politburo works with the Standing Committee of Cao Bang Provincial Party Committee and Hue City Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/fee8a847b1ff45188749eb0299c512b2)

Comment (0)