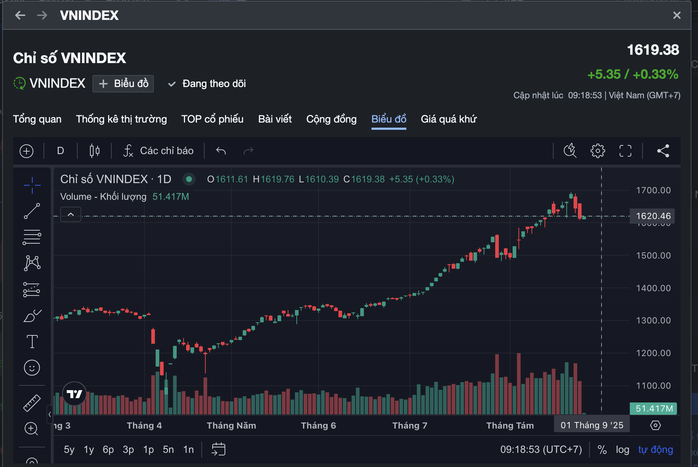

Opening the morning session on August 26, the stock market continued to be immersed in red when the VN-Index fell close to the 1,600-point mark. This was the third consecutive decline, after the VN-Index lost about 75 points in the previous two sessions, equivalent to 4.47% compared to its historical peak.

Bank stocks are out of wave?

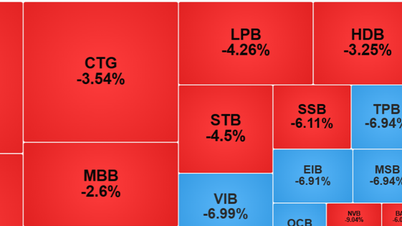

The focus of this correction came from the banking stocks group, when a series of codes were sold off, even hitting the floor for 2 consecutive sessions, causing many new investors to suffer losses before receiving their shares.

In the session of August 25, bank codes such as VPB, TPB, MSB,OCB , VIB and NAB all hit the floor. Notably, VPB hit the floor for two consecutive sessions, causing investors who bought at the end of last week to lose up to 14% in just a few days, and if using financial leverage (margin), the loss would be even heavier.

This development has many investors wondering: Is the banking stock wave over or are they just entering a correction phase after a series of hot increases?

According to Vietnam Construction Securities Company (CSI), the overwhelming selling pressure in the session of August 25 with a decrease of 3.96% of the banking group was the reason for the market's decline. The sharp decrease in liquidity reflects weak demand in the 1,610-point area, with most investors not rushing to "buy the bottom". Therefore, VN-Index is likely to remain in the process of short-term adjustment.

The stock market continued to be red when it opened this morning's trading session.

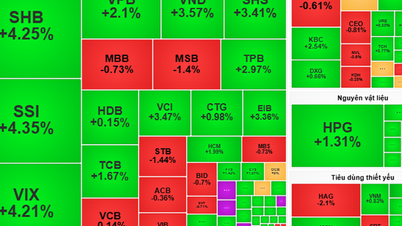

Bank stocks: There is still room for growth

However, many experts believe that this adjustment is necessary and can open up opportunities for the next period. Mr. Dao Hong Duong, Director of Industry and Stock Analysis - VPBankS Securities Company, said that in the past 4 weeks, banking has been the leading industry group in the market, attracting strong cash flow with an average matched value of up to 18,800 billion VND/session, accounting for 34% of the entire floor. Transactions increased from 13,700 billion to 18,800 billion VND/session in just one month, showing that this group is showing signs of accumulation, waiting for a breakthrough rather than entering a distribution cycle.

According to Mr. Duong, the valuation of bank stocks is not too high at present. Most banks have a P/B ratio (book value) of less than 2.4 times, while credit this year is expected to increase by 16% and many banks' profits may exceed 20%. This shows that there is still room for growth in the banking group.

Sharing the same view, Mr. Dinh Minh Tri, Director of Individual Customer Analysis - Mirae Asset Securities Company, emphasized that the cash flow in the market is still abundant. The balance of investors' deposits at securities companies in the second quarter of 2025 is very high, showing that resources waiting for disbursement are still available.

According to Mr. Tri, the current adjustment period could be a reasonable entry point for medium and long-term investors, as long as they focus on stocks with good fundamentals.

Mr. Tri predicts that there are 5 notable industry groups including banking, securities, public investment, import-export - seaports and retail. Of which, banking, although having just experienced a series of hot growth, is still expected thanks to positive profit prospects.

Thus, the VN-Index is in a short-term correction phase after a period of increase that lasted for many months. For short-term investors, the risk is still present, but from a long-term perspective, this could be an opportunity to accumulate stocks, especially in pillar industries such as banking.

VN-Index is in a short-term correction trend after a series of hot increases in recent months.

Source: https://nld.com.vn/bank-stocks-are-being-traded-against-the-opposition-196250826092037151.htm

![[Photo] Prime Minister Pham Minh Chinh meets with Speaker of the New Zealand Parliament Gerry Brownlee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/cec2630220ec49efbb04030e664995db)

![[Photo] General Secretary To Lam attends the opening ceremony of the National Achievements Exhibition](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/d371751d37634474bb3d91c6f701be7f)

![[Photo] Red flag with yellow star flutters in France on National Day September 2](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/f6fc12215220488bb859230b86b9cc12)

![[Photo] Politburo works with the Standing Committee of Cao Bang Provincial Party Committee and Hue City Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/fee8a847b1ff45188749eb0299c512b2)

![[Photo] General Secretary To Lam presents the 45-year Party membership badge to comrade Phan Dinh Trac](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/e2f08c400e504e38ac694bc6142ac331)

Comment (0)