At the end of the session on August 27, the VN-Index closed at 1,672 points, up slightly by 5 points (equivalent to 0.31%).

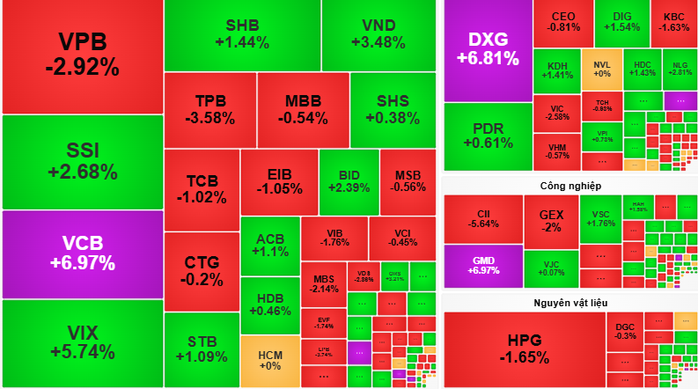

The stock market session on August 27 started positively when the VN-Index opened up 10 points and remained green throughout the morning session. Large-cap stocks such as VCB, BID andFPT played a pivotal role, contributing significantly to the overall index's growth. However, selling pressure from stocks such as VIC, VHM and VPB put pressure on the market.

Securities and real estate stocks continued to attract cash flow, with many codes recording impressive increases of 5%-7% such as VIX, VND and DXG. Liquidity in the morning session increased sharply, showing the excitement in transactions.

Entering the afternoon session, VN-Index continued to fluctuate around the 1,670 point mark, under pressure from large-cap stocks. Notably, the group of seaport stocks began to attract attention with GMD hitting the ceiling, while securities and real estate stocks maintained their strength until the end of the session.

Market sentiment was in favor of buyers, with 11 stocks hitting the ceiling, 169 stocks gaining points, and 149 stocks losing points. Total market liquidity reached VND47,000 billion, up more than 30% from the previous session. However, foreign investors continued to sell strongly, with a value of more than VND4,000 billion, focusing on HPG and VPB stocks.

At the end of the session, the VN-Index closed at 1,672 points, up slightly by 5 points (equivalent to 0.31%).

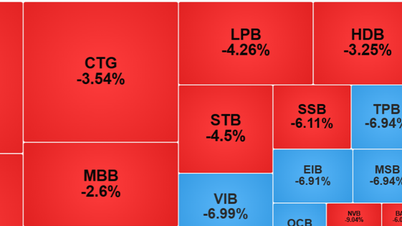

According to Vietcombank Securities Company (VCBS), VN-Index is experiencing strong fluctuations around the 1,670 point threshold, under pressure from large-cap stocks.

After 2 previous sessions of strong decline and 1 session of recovery with an increase of nearly 54 points, the market showed signs of slowing down in terms of points.

VCBS forecasts that the market will continue to fluctuate with a large amplitude in the session of August 28. Therefore, investors should not buy in the uptrend, but wait for the fluctuations to disburse into the industry groups that are attracting cash flow such as Banking, Real Estate and Retail.

Dragon Capital Securities Company (VDSC) commented that the market's upward momentum was restrained as it approached the resistance zone of 1,700 points, indicating increased profit-taking pressure. Liquidity increased compared to the previous session, reflecting strong profit-taking supply, especially when foreign investors continued to net sell.

VDSC expects the market to continue to fluctuate and struggle on August 28, but is likely to be supported at 1,665 points and recover to challenge the resistance zone of 1,680 - 1,700 points. Investors need to closely observe supply and demand developments to assess the possibility of an increase, while also being wary of risks if large supply returns.

Source: https://nld.com.vn/chung-khoan-ngay-28-8-canh-nhip-rung-lac-giai-ngan-vao-co-phieu-tiem-nang-196250827180608554.htm

![[Photo] Parade blocks pass through Hang Khay-Trang Tien during the preliminary rehearsal](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/27/456962fff72d40269327ac1d01426969)

![[Photo] Images of the State-level preliminary rehearsal of the military parade at Ba Dinh Square](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/27/807e4479c81f408ca16b916ba381b667)

Comment (0)