2025 Annual General Meeting of Shareholders (AGM) of Vietnam Technological and Commercial Joint Stock Bank ( Techcombank ) - Photo: VGP/HT

This is the content discussed at the 2025 Annual General Meeting of Shareholders (AGM) of Vietnam Technological and Commercial Joint Stock Bank (Techcombank) held on April 26, in Hanoi .

Impressive financial results

Techcombank recorded impressive financial results in 2024, with total operating income increasing by 17.3% and profit before tax (PBT) increasing by 20.3% year-on-year, exceeding the plan approved by the General Meeting of Shareholders. The bad debt ratio (group 3-5) decreased to 1.17% with credit costs controlled at 0.8%, both of which are low in the industry. The cost-to-income ratio (CIR) decreased to 32.7%, compared to 33.1% last year, contributing to an improvement in return on equity (ROE) by 70 basis points, reflecting the bank's effective cost control and solid profitability.

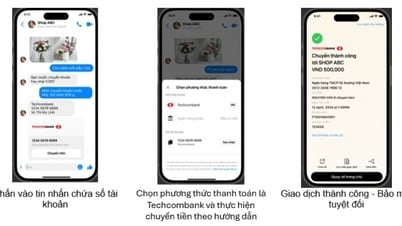

In particular, in 2024, Techcombank created a buzz in the market with the outstanding success of a series of new customer value propositions, redefining the financial industry in Vietnam such as Techcombank Automatic Profit, the improved version of Techcombank Automatic Profit 2.0, the Techcombank Rewards loyalty platform or tailor-made services for retailers, merchants, etc., thereby achieving credit growth of the parent bank up to 20.85%, setting a new record for demand deposit balance (CASA) at VND 231 trillion, up 27.0% over the previous year, serving nearly 15.4 million customers. With customer satisfaction, Techcombank has succeeded in becoming and maintaining the position of the No. 1 transaction bank in Vietnam in both issuance and payment (according to the National Payment Corporation of Vietnam (NAPAS) with about 15% market share).

Notably, the General Meeting of Shareholders approved all proposals and resolutions, including the 2025 Business Plan, the plan to pay cash dividends of VND 1,000/share and the plan to increase charter capital through issuing shares under the employee stock option program (ESOP).

Techcombank's brand also reached new heights when its Brand Health Index (BEI) increased by 61%, becoming the bank with the strongest brand index in Vietnam by the end of 2024. The Bank's Net Promoter Score (NPS) also reached 91 in the fourth quarter, ranking 2nd in the industry.

Previously, on April 21, the Bank also announced very positive business results for the first quarter of 2025 with a pre-tax profit of VND 7.2 trillion, the balance of CASA for individual customers continued to increase and key operating indicators were maintained at a stable level. In addition, Techcombank also announced that the Bank's NAPAS market share continued to increase to 17.6% (issuance), 16.4% (payment), increasing customer satisfaction and engagement (NPS in the first quarter of 2025 rose to No. 1), creating favorable conditions for the Bank and its partners in the ecosystem to continue to expand and continuously improve services and customer experiences.

CEO Jens Lottner shares key strategic directions for the next development phase - Photo: VGP/HT

Strategic vision in the digital age

Within the framework of the Annual General Meeting of Shareholders, Chairman of the Board of Directors Ho Hung Anh and General Director Jens Lottner shared key strategic directions for the next development phase of Techcombank, in the context of the Vietnamese economy entering a strong "Era of Growth", but at the same time facing many challenges from global trade tensions and geopolitical instability.

At the Congress, Techcombank's Board of Directors emphasized the bank's pioneering role in building and operating a comprehensive digital ecosystem model, a strategy that is not new but has proven to be extremely effective in changing the game. Unlike the multi-industry ownership or investment model, Techcombank's ecosystem is built on the basis of the ecosystem's common target customer segment, through a modern technology platform, and strong investment in AI, GenAI and data.

The core difference lies in the ability to use technology and comprehensively connect all touch points inside and outside the Bank, from online to offline, from financial to non-financial, to optimize customer experience, maximize lifetime value, and effectively control risks. To date, Techcombank and its partners in the ecosystem have been able to reach more than 25 million customers, creating a significant competitive advantage thanks to superior data capabilities.

Techcombank's partnership model is based on the principle of transparent ownership and independent decision-making mechanisms, thereby ensuring sustainable development for all parties involved. The resonance in the ecosystem helps optimize the cost of attracting and retaining customers and expanding the sales force, while expanding the profit scale in a breakthrough way - something that traditional banking models can hardly achieve.

With the vision of becoming a leading financial services group in Vietnam and the region, Techcombank continues to work with strategic partners to maximize the potential of digital platforms, leveraging the power of data and technology. In addition, the Bank is pioneering in developing important infrastructure and applications of blockchain technology as well as actively contributing to the development of a legal framework for cryptocurrencies and digital assets, opening up new business opportunities in the digital age, while promoting sustainable growth momentum for the future.

At the 2025 General Meeting of Shareholders, shareholders highly agreed with all the proposals proposed by the Board of Directors - Photo: VGP/HT

Outlook 2025 and other issues approved by the Congress

At the 2025 General Meeting of Shareholders, shareholders highly agreed with all the proposals proposed by the Board of Directors.

Notably, after paying the first cash dividend after 10 years in 2024, at VND 1,500/share (equivalent to VND 750/share after increasing charter capital by 100%), shareholders approved the proposal to pay a cash dividend of VND 1,000/share in 2025, equivalent to a dividend yield of 3.9% compared to the closing price on April 25. This continues to be the highest cash dividend announced among large joint stock commercial banks, demonstrating the Bank's internal strength and the confidence of the Board of Directors and the Board of Management in the Bank's operations in the coming time. The specific time and progress of implementation will be decided by the Board of Directors, ensuring compliance with legal regulations and the Bank's actual conditions, ensuring the interests of shareholders.

In the current challenging geopolitical context, shareholders have also approved the 2025 Business Plan, specifically, the pre-tax profit plan is VND 31,500 billion, equivalent to an increase of 14.4% compared to 2024. The bank's credit activities are expected to increase to VND 745,738 billion, an increase of 16.4% compared to the end of the year or higher, according to the credit growth level granted by the State Bank of Vietnam. Deposit growth will be managed in line with actual credit growth, in order to optimize the Bank's balance sheet. According to the plan presented at the General Meeting of Shareholders, Techcombank proposed a target of managing bad debt (NPL) below 1.5%.

Shareholders also approved the plan to increase charter capital through the issuance of shares under the Techcombank employee stock option program with the number of issued shares being 21,388,675 shares, equivalent to 0.30275% of the number of outstanding shares.

Techcombank, with the vision of "Transforming the financial industry, Enhancing the value of life", is one of the largest joint stock banks in Vietnam and one of the leading banks in Asia. Techcombank is currently rated AA- by FiinRatings, rated by Moody's as a base credit rating (BCA) of ba3 and rated BB- by S&P. Techcombank shares have been listed on the Ho Chi Minh City Stock Exchange under the stock code TCB since 2018.

Mr. Minh

Source: https://baochinhphu.vn/techcombank-trien-vong-phuc-hoi-thi-truong-bat-dong-san-va-chien-luoc-chuyen-doi-so-102250426190357376.htm

![[Photo] Prime Minister Pham Minh Chinh receives leaders of several Swedish corporations](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/14/4437981cf1264434a949b4772f9432b6)

Comment (0)