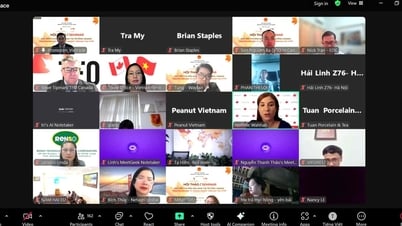

Dr. Vo Thi Thuy Trang delivered a speech at the training session on optimizing tax costs.

Here, delegates were presented by Dr. Vo Thi Thuy Trang, university lecturer, Financial Control, financial consulting, accounting and tax for businesses on the topic: Optimizing tax costs, building an optimal accounting - tax model and some notes for accountants, business owners, and business households according to Decree 70/2025/ND-CP dated March 20, 2025 of the Government on amending and supplementing a number of articles of Decree 123/2020/ND-CP of the Government on invoices and documents. Decree 70/2025/ND-CP takes effect from June 1, 2025, marking a strong change in tax management, expanding the scope of application of electronic invoices, in the direction of technology. Accordingly, it is mandatory to use electronic invoices generated from cash registers that connect data with tax authorities for business households and individuals paying taxes by lump-sum method with annual revenue of 1 billion VND or more.

Representatives of many establishments and businesses participated in the training.

Thereby, Dr. Vo Thi Thuy Trang introduced basic contents such as: characteristics of tax, how to optimize costs, optimize tax, tax planning; the relationship between tax base, tax rate and tax amount. The speaker emphasized 9 notes on invoices in Decree 70/2025/ND-CP, including electronic invoices; business households with revenue of 1 billion VND/year or more use invoices generated from cash registers; time of invoice issuance; cases where goods are returned; issuance of invoices for promotional goods, gifts, and gifts requiring a total invoice; invoices to correct errors requiring an adjusted invoice; buyers do not take invoices; e-commerce invoices in case of export; editing and supplementing forms.

Along with that, the optimal accounting - tax accounting model such as the organization of accounting - tax accounting apparatus in the enterprise is also shared by the speaker for enterprises to choose the accounting - tax accounting model suitable for their operations to optimize tax costs.

Source: https://baobinhthuan.com.vn/tap-huan-toi-uu-chi-phi-thue-xay-dung-mo-hinh-ke-toan-130838.html

![[OCOP REVIEW] Tu Duyen Syrup - The essence of herbs from the mountains and forests of Nhu Thanh](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/6/5/58ca32fce4ec44039e444fbfae7e75ec)

Comment (0)