The stock market continued to explode in the trading session on July 10, with billions of dollars continuing to flow into the stock market. Foreign investors strongly bought key stocks, such as Vingroup (VIC), Vincom Retail (VRE), HDBank (HDB), Saigon Hanoi Bank ( SHB ), VPBank (VPB)...

Cash flows are pouring into the Vietnamese stock market as the Government pushes ahead with a series of large projects, with capital ranging from several billion to tens of billions of USD. Public investment is strongly promoted, Vietnam's GDP in the first quarter of 2025 increased by 6.93%, the highest in 6 years compared to the same period; credit growth is at a high level...

Although exports may face difficulties due to global instability and declining consumer demand, the cash flow into the economy is still very large. Many corporations are implementing projects of unprecedented scale, while state budget revenues are also at a high level. These are considered to be a boost for the economy.

Vietnam's economy is also considered more positive than many other countries, amid the trade war and global instability. Vietnam is one of three countries that have reached a trade agreement with the US.

In addition to the strong cash flow, with billions of dollars pumped into each session by both domestic and foreign investors, the Vietnamese stock market has also recorded positive signals. The possibility of upgrading from a frontier market to an emerging market is clearer than ever.

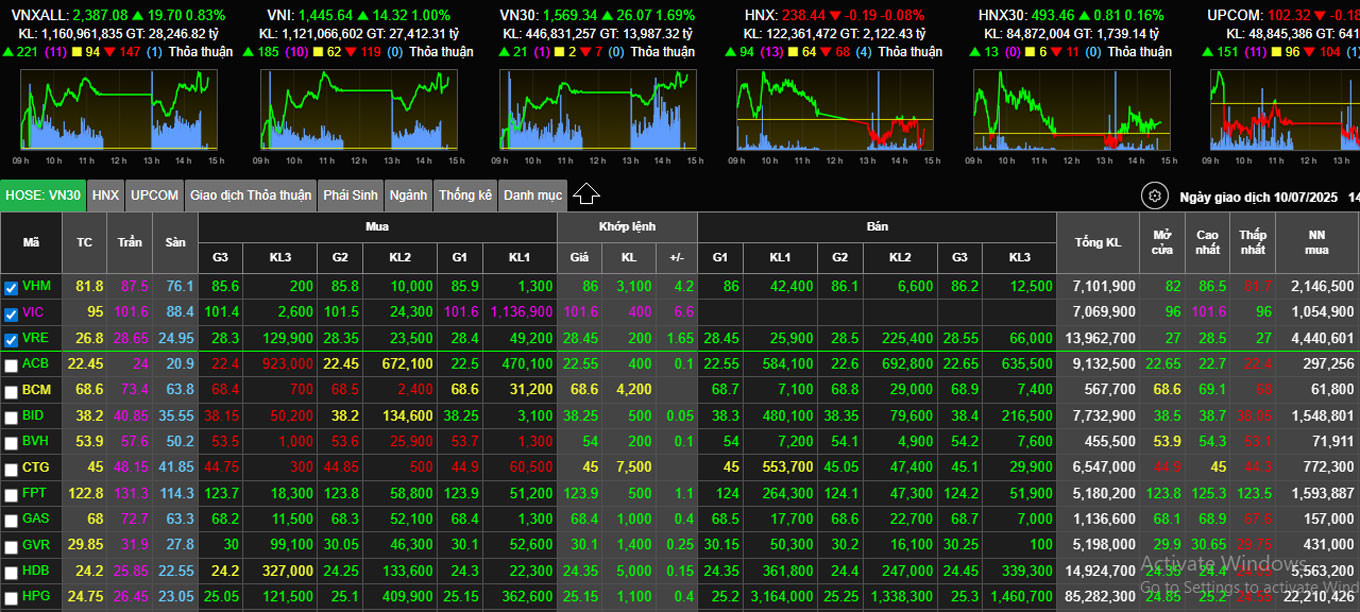

In the trading session on July 10, Vingroup (VIC) shares - chaired by billionaire Pham Nhat Vuong - hit the ceiling price, exceeding 100,000 VND, helping to push the VN-Index above 1,445 points - the highest level in more than 3 years and only slightly lower than the historical peak of 1,500 points.

At the end of the trading session on July 10, VN-Index increased by more than 14.32 points (+1%) to 1,445.64 points. Liquidity reached more than 27.4 trillion VND on HoSE.

Many organizations predict that the VN-Index will continue to rise and may reach 1,500 points by the end of the year. Investors are quite excitedly waiting for the wave of VN-Index reaching 1,500 points.

In a recent forecast, Vietcombank Securities (VCBS) stated that the VN-Index is currently valued at the same level as the regional average and in the most positive scenario could exceed 1,660 points in 2025.

Supporting this new wave, according to many securities companies, are stocks in the banking, securities, consumer retail, and real estate sectors. The banking sector benefits from high credit growth and good bad debt handling ability thanks to Resolution 42 on piloting bad debt handling.

Securities stocks benefit from the market's excitement and foreign capital flowing into Vietnam.

Besides, public investment groups also benefit and large real estate enterprises have huge projects that are being and will be implemented.

In the session on July 10, Vingroup shares increased by 6.6% to VND101,600/share, thereby helping billionaire Pham Nhat Vuong's assets increase to 10.7 billion USD, making him the 263rd richest person in the world. VIC shares have increased by about 140% since the beginning of the year.

Enterprises belonging to the "Vin group" have recently won many large projects, including the Can Gio coastal urban area with a scale of several thousand hectares.

Billionaire Vuong recently transferred a large amount of shares to establish Vinspeed to participate in the North-South high-speed railway project worth more than 60 billion USD.

On May 15, the People's Committee of Bac Ninh province approved a consortium - including Vingroup Corporation - to invest in an urban area with a scale of more than 41,000 billion VND in this province.

VinFast has also recently received good news with a surge in product sales. The VinFast Ha Tinh factory will start operating from the third quarter of 2025 and mass production from the fourth quarter.

Vingroup also has major merger and acquisition activities. On May 13, VPL shares of Vinpearl JSC were listed on HoSE, reaching a capitalization of hundreds of thousands of billions of VND, surpassing a series of giants such as FPT, Hoa Phat Group, VPBank, MBBank, ACB...

Vinpearl - the resort tourism brand of Vingroup Corporation - is currently owned by Vingroup with more than 85.5% of its charter capital. With the appearance of Vinpearl, billionaire Pham Nhat Vuong's Vingroup ecosystem now has 4 representatives in the top of the largest capitalized enterprises in Vietnam, besides Vingroup, Vinhomes, Vincom Retail. If VinFast (VFS) is included, the total capitalization of "Vin family" enterprises reaches over 100 trillion VND.

Source: https://vietnamnet.vn/tai-san-ty-phu-pham-nhat-vuong-but-pha-san-200-ty-usd-huong-toi-dinh-lich-su-2420218.html

![[Maritime News] More than 80% of global container shipping capacity is in the hands of MSC and major shipping alliances](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/16/6b4d586c984b4cbf8c5680352b9eaeb0)

Comment (0)