Oil prices recover, approaching $70/barrel

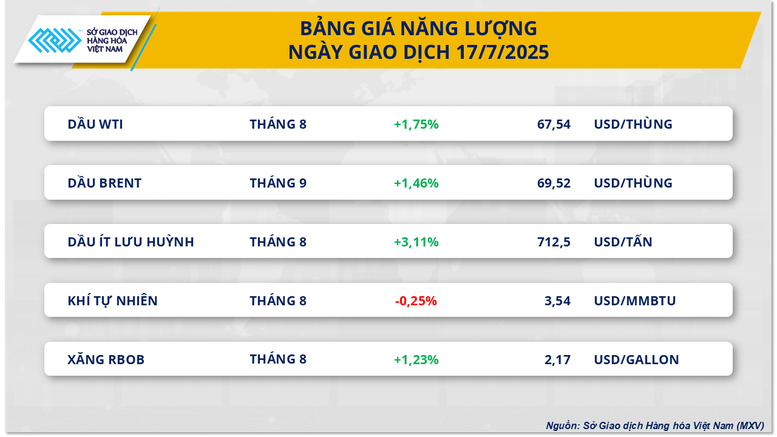

According to MXV, at the end of yesterday's session, green covered most commodities in the energy group when new security concerns appeared in the Middle East.

Of which, WTI oil price recorded an increase of up to 1.75%, stopping at 67.54 USD/barrel, Brent oil price also approached the threshold of 70 USD/barrel, climbing to 69.52 USD/barrel, corresponding to an increase of about 1.46%.

The main driver supporting the sharp increase in oil prices in recent sessions has come from concerns about supply disruptions in Iraq - the country with the second largest crude oil production in the OPEC group. Currently, drone attacks on oil fields in the semi-autonomous Kurdish region have caused a series of projects to temporarily suspend operations, thereby reducing the daily oil production in this region by more than half.

Regional tensions continue to escalate as relations between Israel and Syria have become particularly heated, especially after a series of Israeli airstrikes targeting the capital Damascus in recent days. The situation in the Gaza Strip as well as the risk of unsafe navigation in the Red Sea have threatened freedom of navigation and increased pressure on international trade flows.

Contrary to the general trend of the energy market, natural gas prices recorded a slight decrease of 0.25% in yesterday's session, down to 3.54 USD/MMBtu. Previously, this commodity had 4 consecutive sessions of price increase due to expectations of increased electricity demand following forecasts of a return of hot weather.

In a new weekly report released yesterday by the US Energy Information Administration (EIA), natural gas inventories in the US continued to increase by more than 1.3 billion cubic meters in the week ending July 11, much higher than the market expected. Meanwhile, a new storm in the Gulf of Mexico is also causing difficulties for LNG exports from ports in the southern US, including the Henry Hub in Louisiana.

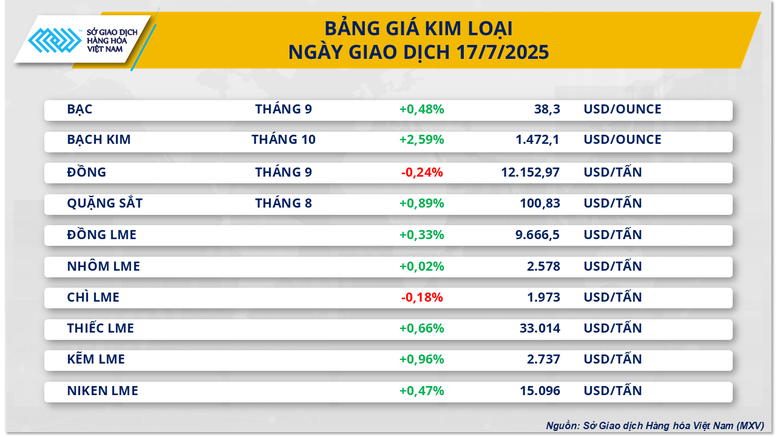

Platinum prices hit highest level in more than 11 years

Closing yesterday's trading session (July 17), the metal market witnessed overwhelming buying power with 8/10 items in the group increasing in price. Of which, platinum continued to increase by 2.6% to 1,472 USD/ounce, the highest level in more than 11 years.

The global platinum market continues to face a serious supply-demand imbalance, with the deficit expected to extend into the third consecutive year, a key factor supporting the price of this precious metal in recent times. Meanwhile, the demand for platinum jewelry in China is increasing. Actual records also show that the production of platinum jewelry in this market in the first quarter jumped 26% compared to the same period last year.

On the supply side, total platinum production in 2025 is expected to fall by 4% to around 7 million ounces, its lowest level in the past five years, due to declining mine output in major producing regions. Global platinum inventories are also expected to fall by 31% this year to 2.2 million ounces – equivalent to just three months of global demand, exacerbating concerns about a medium- to long-term supply shortage.

On the other hand, the persistently high interest rate environment dampened the session’s gains as the market digested fresh information on the health of the labor market. Initial jobless claims fell 7,000 to 221,000 in the week ended July 12, the lowest since mid-April and the fifth straight weekly decline, according to the U.S. Department of Labor. However, continuing claims for unemployment benefits in the week ended July 5 were still close to their highest level since late 2021, with a total of 1.96 million claims.

Remaining high interest rates continue to strengthen the US dollar, making dollar-denominated commodities such as platinum more expensive for buyers using other currencies. This is raising concerns about a possible slowdown in global demand for platinum, as the cost of buying increases in most markets outside the US.

Source: https://baochinhphu.vn/sac-xanh-tiep-tuc-lan-toa-tren-thi-truong-hang-hoa-nguyen-lieu-the-gioi-102250718090440346.htm

![[Infographic] In 2025, 47 products will achieve national OCOP](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/16/5d672398b0744db3ab920e05db8e5b7d)

Comment (0)