Back in 1976, when Silicon Valley was still a wild land of electronic dreams, there were two young geniuses, enthusiastic but completely "empty" Steve Jobs and Steve Wozniak. They had an idea, an aspiration, but lacked someone who could keep their feet on the ground.

That person is Ronald Wayne.

Wayne was a 41-year-old veteran engineer at Atari, while Jobs and Woz were in their early 20s. He was the “adult in the room” who reconciled the young men’s disagreements, hand-sketched the first Apple logo (an intricate drawing of Isaac Newton sitting under an apple tree), and, most importantly, typed up the first partnership agreement that officially gave birth to Apple.

For that pivotal role, he was given a 10 percent stake. Jobs and Wozniak each held 45 percent. On paper, he was part of a trio that would shape the future.

But just 12 days later, the “grown-up” decided to back out. He sold his 10% stake to two young friends for $800. A few months later, he received another $1,500 to officially give up all interests related to Apple. History has recorded this as perhaps one of the worst financial decisions of all time.

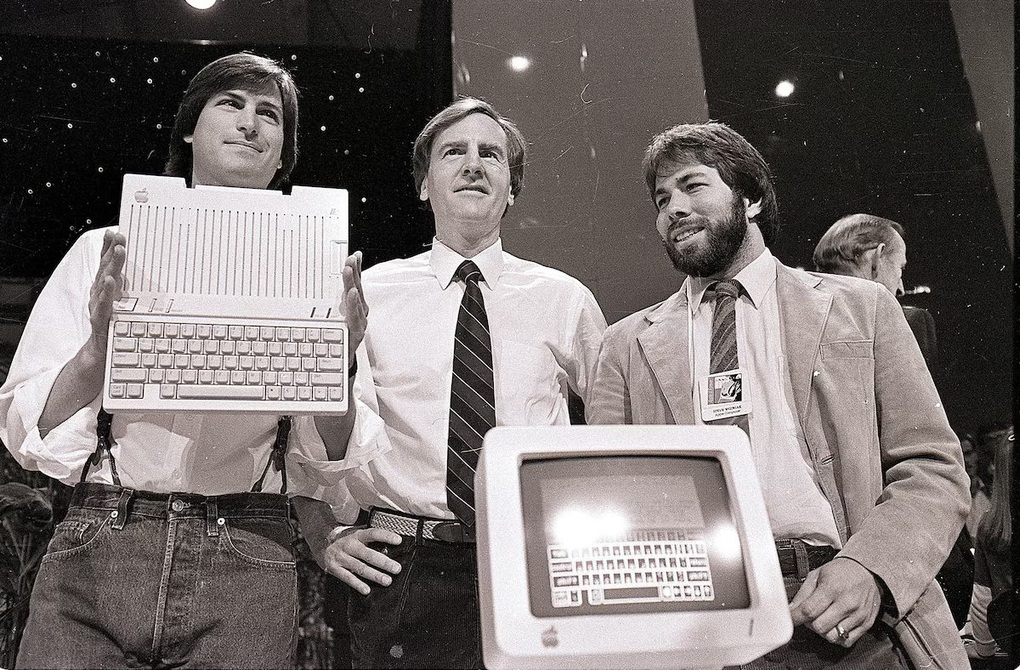

Steve Jobs, John Sculley and Steve Wozniak in 1984. Jobs and Wozniak were the two famous co-founders of Apple. The third co-founder, Ron Wayne, left after two weeks and sold his 10% stake for $800 (Photo: AP).

Why would an experienced person make a "stupid" decision?

Looking at it now, when Apple is a $3 trillion empire, Wayne’s actions seem like a joke. But if you put yourself in the shoes of a middle-aged man with a family, a house, and assets in 1976, his decision is completely logical and understandable.

Expert analysis shows that there are two core fears that drive him:

First is the tangible fear called “personal financial risk”.

In the early days, Jobs borrowed $15,000 (a huge sum at the time) to buy components for the first order from Byte Shop. The problem was, Byte Shop was notorious for being a "slow" partner, often late in paying.

Mr. Wayne recalled: "Jobs and Wozniak did not have two cents at that time, while I had a house, a car, and a bank account."

Under the law of the day, in a partnership, the owners had unlimited personal liability for the company’s debts. This meant that if Apple went bankrupt and couldn’t pay its $15,000 debt, the creditors would go after the only person with assets to seize the debt. That person was Ronald Wayne.

He was faced with a stark choice: bet his entire life savings on a dubious project of two young men, or protect his family's financial security. And he chose the safe option.

The second fear is the shadow of giants - the fear of being overshadowed.

This reason is perhaps the most profound and human of all. Wayne knew who he was and where he fit in. He recognized that Jobs and Wozniak were shining stars with an energy and vision that he could not match.

“I knew I was standing in the shadow of giants,” he shared. “And I would never have a project that was truly my own.”

He envisioned a future where he would be forced into the documentation department, slogging through paperwork for the next 20 years. That wasn’t the life he wanted. He wanted the freedom to be creative, to pursue his own projects. In a famously poignant quote, he said, “If I had stayed at Apple, I would have been the richest man in the cemetery.”

He chose self-reliance over wealth in bondage.

A life without regrets?

Today, at 91, Ronald Wayne lives a quiet life, living on Social Security and renting out part of his house. He's not rich, but as he says, "I've never been hungry."

Although he once claimed to have no regrets, he later admitted that if he had kept even a small portion of those shares, his financial life would have been "much easier."

Ronald Wayne’s story is more than just an anecdote about missed opportunities. It’s a true snapshot of the nature of entrepreneurship: a gamble between risk and reward, between security and ambition, between being in control of your own life and being part of something bigger.

Wayne didn't choose wrong, he just chose a different path - one that led not to the glass skyscrapers of Cupertino, but to a peaceful, self-sufficient life. And that, in a way, is also a priceless asset that no number can measure.

Source: https://dantri.com.vn/kinh-doanh/nguoi-dong-sang-lap-bi-lang-quen-cua-apple-va-sai-lam-lon-nhat-lich-su-20250625065226318.htm

![[Photo] Politburo works with the Standing Committee of Cao Bang Provincial Party Committee and Hue City Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/fee8a847b1ff45188749eb0299c512b2)

![[Photo] Prime Minister Pham Minh Chinh meets with Speaker of the New Zealand Parliament Gerry Brownlee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/cec2630220ec49efbb04030e664995db)

![[Photo] General Secretary To Lam presents the 45-year Party membership badge to comrade Phan Dinh Trac](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/e2f08c400e504e38ac694bc6142ac331)

![[Photo] General Secretary To Lam attends the opening ceremony of the National Achievements Exhibition](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/d371751d37634474bb3d91c6f701be7f)

![[Photo] Red flag with yellow star flutters in France on National Day September 2](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/f6fc12215220488bb859230b86b9cc12)

Comment (0)