Domestic gold price today 7/19/2025

As of 4:30 a.m. on July 19, 2025, the domestic gold bar price is based on the closing price yesterday, July 18. Specifically:

DOJI Group listed the price of SJC gold bars at 119.5-121 million VND/tael (buy - sell), an increase of 900 thousand VND/tael for buying - an increase of 400 thousand VND/tael for selling compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 119.5-121 million VND/tael (buy - sell), an increase of 900 thousand VND/tael in buying - an increase of 400 thousand VND/tael in selling compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 120-121 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 400 thousand VND/tael for both buying and selling.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 119.5-121 million VND/tael (buy - sell), the price increased by 900 thousand VND/tael in the buying direction - increased by 400 thousand VND/tael in the selling direction compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 118.4-121 million VND/tael (buy - sell), gold price increased by 500 thousand VND/tael in buying direction - increased by 400 thousand VND/tael in selling direction compared to yesterday.

As of 4:30 a.m. on July 19, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 115.9-118.4 million VND/tael (buy - sell); the price remained unchanged in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 116.1-119.1 million VND/tael (buy - sell); the gold price increased by 100 thousand VND/tael in both buying and selling directions compared to yesterday.

The latest gold price list today, July 19, 2025 is as follows:

| Gold price today | July 19, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 119.5 | 121 | +900 | +400 |

| DOJI Group | 119.5 | 121 | +900 | +400 |

| Red Eyelashes | 120 | 121 | +400 | +400 |

| PNJ | 119.5 | 121 | +900 | +400 |

| Bao Tin Minh Chau | 119.5 | 121 | +900 | +400 |

| Phu Quy | 118.4 | 121 | +500 | +400 |

| 1. DOJI - Updated: 7/19/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 119,500 ▲900K | 121,000 ▲400K |

| AVPL/SJC HCM | 119,500 ▲900K | 121,000 ▲400K |

| AVPL/SJC DN | 119,500 ▲900K | 121,000 ▲400K |

| Raw material 9999 - HN | 108,600 | 109,400 |

| Raw material 999 - HN | 108,500 | 109,300 |

| 2. PNJ - Updated: July 19, 2025 04:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 114,700 | 117,600 |

| HCMC - SJC | 119,500 ▲900K | 121,000 ▲400K |

| Hanoi - PNJ | 114,700 | 117,600 |

| Hanoi - SJC | 119,500 ▲900K | 121,000 ▲400K |

| Da Nang - PNJ | 114,700 | 117,600 |

| Da Nang - SJC | 119,500 ▲900K | 121,000 ▲400K |

| Western Region - PNJ | 114,700 | 117,600 |

| Western Region - SJC | 119,500 ▲900K | 121,000 ▲400K |

| Jewelry gold price - PNJ | 114,700 | 117,600 |

| Jewelry gold price - SJC | 119,500 ▲900K | 121,000 ▲400K |

| Jewelry gold price - Southeast | PNJ | 114,700 |

| Jewelry gold price - SJC | 119,500 ▲900K | 121,000 ▲400K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 114,700 |

| Jewelry gold price - Kim Bao Gold 999.9 | 114,700 | 117,600 |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 114,700 | 117,600 |

| Jewelry gold price - Jewelry gold 999.9 | 114,200 | 116,700 |

| Jewelry gold price - Jewelry gold 999 | 114,080 | 116,580 |

| Jewelry gold price - Jewelry gold 9920 | 113,370 | 115,870 |

| Jewelry gold price - Jewelry gold 99 | 113,130 | 115,630 |

| Jewelry gold price - 750 gold (18K) | 80,180 | 87,680 |

| Jewelry gold price - 585 gold (14K) | 60,920 | 68,420 |

| Jewelry gold price - 416 gold (10K) | 41,200 | 48,700 |

| Jewelry gold price - 916 gold (22K) | 104,500 | 107,000 |

| Jewelry gold price - 610 gold (14.6K) | 63,840 | 71,340 |

| Jewelry gold price - 650 gold (15.6K) | 68,510 | 76,010 |

| Jewelry gold price - 680 gold (16.3K) | 72,010 | 79,510 |

| Jewelry gold price - 375 gold (9K) | 36,410 | 43,910 |

| Jewelry gold price - 333 gold (8K) | 31,160 | 38,660 |

| 3. SJC - Updated: 7/19/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 119,500 ▲900K | 121,000 ▲400K |

| SJC gold 5 chi | 119,500 ▲900K | 121,020 ▲400K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 119,500 ▲900K | 121,030 ▲400K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 114,200 | 116,700 |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 114,200 | 116,800 |

| Jewelry 99.99% | 114,200 | 116,100 |

| Jewelry 99% | 110,450 | 114,950 |

| Jewelry 68% | 72,205 | 79,105 |

| Jewelry 41.7% | 41,668 | 48,568 |

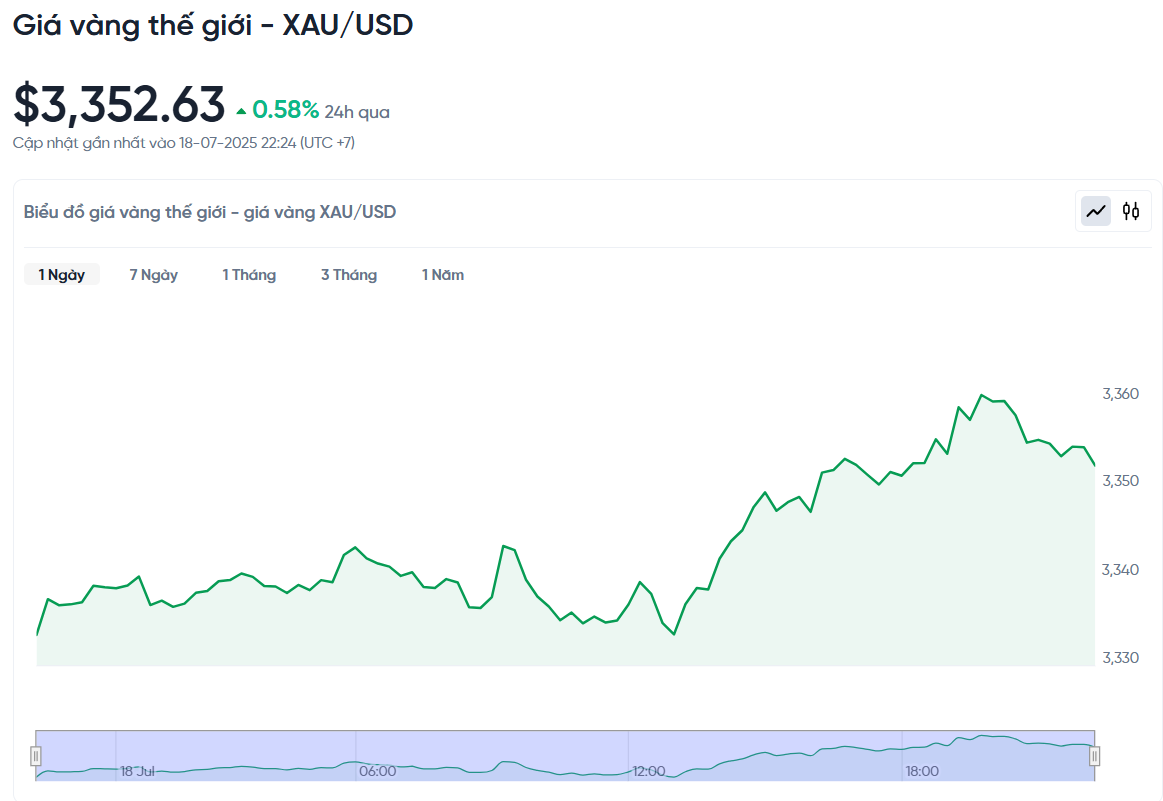

World gold price today July 19, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 a.m. on July 19, Vietnam time, was 3,352.63 USD/ounce. Today's gold price increased by 19.21 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,340 VND/USD), the world gold price is about 109.93 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 11.07 million VND/tael higher than the international gold price.

World gold prices increased sharply due to the weakening of the US dollar along with continued economic and geopolitical uncertainties, boosting demand for this safe-haven metal.

Specifically, spot gold prices increased by 0.58% to 3,352.63 USD/ounce, after decreasing by 1.1% in the previous trading session. US gold futures also increased by 0.5% to 3,360.50 USD/ounce.

"Across the precious metals, prices have been supported by a weaker US dollar. We do not see many factors that could cause gold prices to fall in the medium term given current developments, including unchecked US spending, persistent trade tensions, uncertain inflation and recent criticism of the Federal Reserve," said Edward Meir, an analyst at Marex.

The dollar fell 0.5% on the day, making gold cheaper for investors using other currencies. Earlier this week, President Trump said he had no plans to fire Fed Chairman Jerome Powell, but left the possibility open and continued to criticize the central bank chief for not cutting interest rates.

The market expects the Fed to cut interest rates twice this year, by a total of 50 basis points. Gold prices typically benefit from economic uncertainty, and lower interest rates increase the appeal of non-yielding assets.

On tariffs, Indonesia is still negotiating the details of a new trade deal with the United States. Meanwhile, US Treasury Secretary Janet Yellen assured the Japanese Prime Minister that the two countries can reach a good deal.

Among other precious metals, spot platinum fell 0.7% to $1,448.03 an ounce. Palladium rose 0.7% to $1,289.50, while silver rose 0.5% to $38.31 an ounce.

Gold Price Forecast

The first half of 2025 witnessed an impressive growth in world gold prices, increasing by 26%. Notably, in the first 6 months of the year alone, gold prices broke records 26 times, while in the whole of 2024, this figure was only 40 times. This shows the strong attraction of precious metals in the context of volatile global economics and politics.

According to the World Gold Council (WGC), the increase in gold prices comes from many reasons, including a weak USD, geopolitical tensions and high investment demand for gold.

All market participants are now stepping up gold trading. Average daily trading volume in the first half of the year reached $329 billion, the second highest on record. Central banks also continued to buy gold for their reserves, albeit at a slower pace than in previous quarters.

The WGC predicts that gold prices could hit $4,000 an ounce by the end of 2025, but also warns that gold could lose some of its momentum if geopolitical and economic conditions change. Analysts say that if international tensions continue to escalate, markets will experience significant volatility, and gold will remain the preferred safe-haven asset.

In June, the People's Bank of China (PBoC) continued to buy more gold, bringing the total amount purchased in the first half of the year to about 19 tons. As a result, the country's official gold reserves reached 2,299 tons, accounting for 6.7% of total foreign exchange reserves, up from 5.5% at the end of 2024. This shows that China is still promoting its strategy of diversifying reserves and reducing its dependence on the USD.

Although demand for gold jewelry has not really been active, the global gold investment market remains very attractive. ETFs and futures continue to attract money, while factors such as US-China tensions, fluctuations in the yuan exchange rate and the world economic situation will continue to affect gold prices in the third quarter.

In general, gold is still a sought-after asset due to its safe-haven role in a risky environment. However, investors need to closely monitor macroeconomic and political factors to make appropriate decisions.

Source: https://baonghean.vn/gia-vang-hom-nay-19-7-2025-gia-vang-trong-nuoc-va-the-gioi-tang-manh-do-bat-on-kinh-te-va-dia-chinh-tri-10302579.html

Comment (0)