Asian stock markets opened in the green on the morning of July 18, following the excitement from Wall Street.

In Japan, the Nikkei 225 index rose 0.39% in early trading, while the Topix index rose 0.26% as of 8 a.m. Tokyo time. In South Korea, the Kospi added 0.21% while the Kosdaq index, which represents small-cap stocks, rose 0.28%. In Australia, the S&P/ASX 200 index opened up 0.44%.

Notably, Australia's S&P/ASX 200 index rose 0.58% to a record high of 8,689.4 points in early trading. The index has gained 6.62% so far this year, according to data from LSEG.

The US stock market increased for the 6th consecutive session (Photo: Reuters).

Mainland Chinese and Hong Kong stocks opened higher amid mixed trading across the region. China's CSI 300 Index rose 0.27%, while Hong Kong's Hang Seng Index - which represents many large Chinese companies - rose 1.28%.

Also this morning, Japan released data on core inflation in June at 3.3%, down from 3.7% in the previous month, mainly due to the cooling of rice prices. This figure was in line with the expectations of economists surveyed by Reuters. Headline inflation in Japan also decreased to 3.3%, from 3.5% recorded in May.

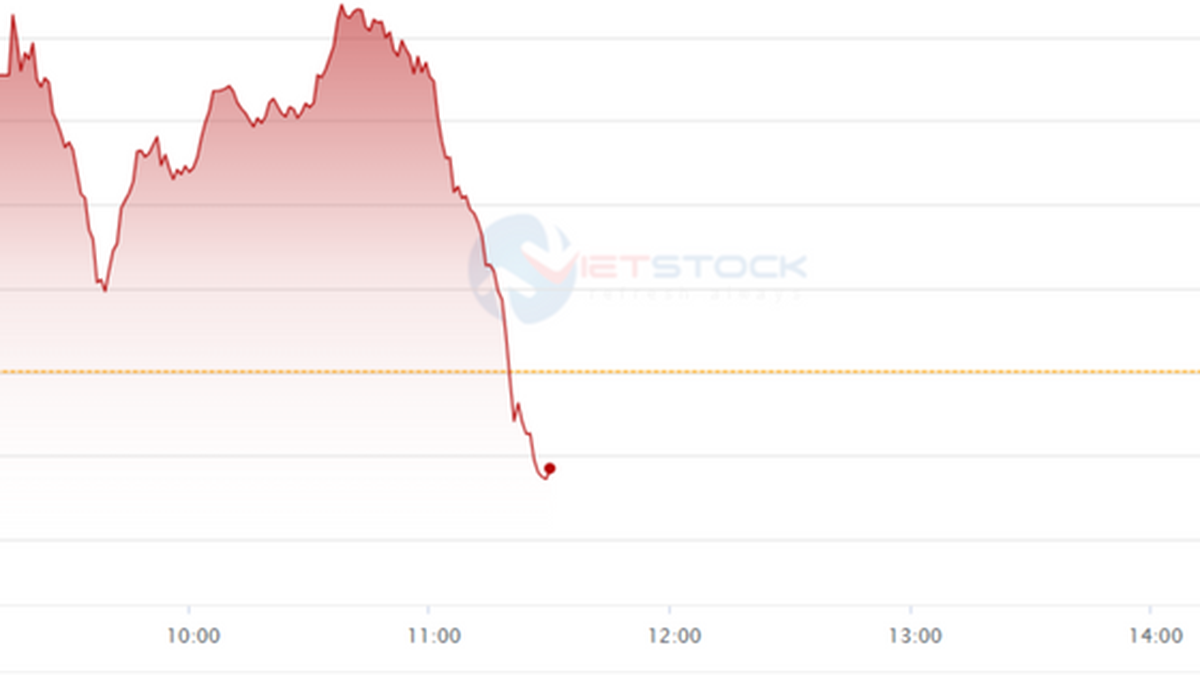

US stocks rallied strongly in the trading session on July 17, with the S&P 500 and Nasdaq Composite both closing at new record highs, thanks to a series of positive profit reports and solid economic data.

The Nasdaq Composite rose 153.78 points, or 0.74 percent, to 20,884.27, marking its sixth gain in seven sessions. The S&P 500 gained 33.66 points, or 0.54 percent, to 6,297.36, while the Dow Jones Industrial Average rose 229.71 points, or 0.52 percent, to 44,484.49.

Investor optimism was bolstered by a surprise rebound in U.S. retail sales in June. The market sees the U.S. economy as still resilient amid rising consumer inflation but steady producer prices. A series of earnings reports from major companies such as PepsiCo , United Airlines, JPMorgan and Goldman Sachs all beat expectations.

United Airlines rose 3.1% after the carrier forecast increased travel demand since early July, a rare bright spot in an industry weighed down by budget cuts and trade tensions.

Technology stocks, especially chipmakers, continued to be supported after TSMC, a maker of AI chips, reported record quarterly profits, highlighting the strong demand for artificial intelligence. US-listed TSMC shares rose 3.4%. Meanwhile, Marvell Technology rose 1.6% and Nvidia added 1%.

Expert Anthony Saglimbene from Ameriprise Financial commented that economic data and profit reports show that the US economic foundation is still very stable, and that is the reason the market can continue to increase.

However, the US Federal Reserve (Fed) still maintains a cautious stance. Fed Governor Adriana Kugler said that cutting interest rates is still on the table, as the impact of President Trump's new import tax policy begins to show through consumer price pressures.

According to the CME FedWatch tool, the possibility of the Fed cutting interest rates in September is currently priced by the market at about 54%, while the possibility of an adjustment in July is almost eliminated.

In the July 18 trading session, investors continued to watch financial reports from large businesses such as 3M and American Express, along with preliminary data on consumer confidence for July. The Dow Jones survey forecast that the index would reach 61.8 points, up from the previous level of 60.7.

Source: https://dantri.com.vn/kinh-doanh/chung-khoan-my-tang-6-phien-lien-tiep-chau-a-khoi-sac-xanh-20250718091416545.htm

![[Infographic] In 2025, 47 products will achieve national OCOP](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/16/5d672398b0744db3ab920e05db8e5b7d)

Comment (0)