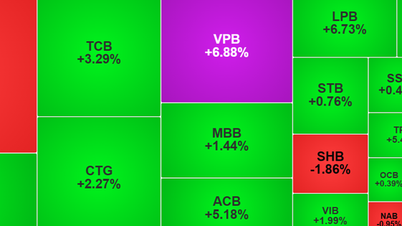

The stock market continued its strong growth on July 8. VN-Index surpassed 1,400 points with an increase of more than 13 points, the highest index in more than 3 years. Liquidity reached more than 28,000 billion VND.

At the event this afternoon, Mr. Tran Hoang Son - Director of Market Strategy of VPBank Securities Company (VPBankS) - expressed his opinion that VN-Index will reach a new high of 1,500-1,550 points in the second half of the year. This happens after the market may enter a technical correction phase at the resistance zone of 1,430-1,450 points.

Experts make positive macro assessments, stock market flourishes (Photo: BTC).

He believes that in the next two months, the Vietnamese stock market will be evaluated for upgrading. That factor helps Vietnam follow the growth trend of emerging markets. The index has also quickly overcome the April decline and surpassed the peak.

Investor confidence quickly returned, with liquidity recovering very quickly. The number of accounts in the market also exceeded 10 million.

Regarding enterprises, profit growth this year will follow the general trend of monetary and fiscal policies, possibly reaching an increase of 15-16%. Many enterprises, including banking and finance, securities, real estate, and steel, will likely continue to recover.

Mr. Son also pointed out that at the end of this year and early next year, the market still has opportunities from IPOs (initial public offerings) to attract foreign capital. New IPO deals could reach 47.5 billion USD in areas such as financial services, consumer goods, and information technology. In the past, in the period of 2017-2018, stories such as Vinamilk 's capital sale had a very good growth rate.

Investors also have high expectations for the upgrade. With many positive factors, the above company predicts that the Vietnamese stock market will be upgraded in September.

However, the market may also be upgraded in March next year, due to issues related to the difference in settlement time and securities distribution time on KRX as well as the small number of faulty transactions. FTSE needs more time to evaluate the error handling.

If upgraded, experts predict that passive and active capital flows into Vietnam could reach 3-7 billion USD. The disbursement of this amount in a short period of time will create a huge boost for the market.

Talking about the most notable point in the Vietnamese economic picture in the first half of the year, Mr. Nguyen Xuan Thanh - Senior Lecturer at the Fulbright School of Public Policy and Management, Fulbright University Vietnam - said that the market has reacted quite positively to the growth macro figures. In addition, most of the positive reaction also comes from the results of tariff negotiations.

The positive macro figures in the first half of the year came from two major drivers. First, despite high tariffs, exports increased sharply thanks to businesses boosting production activities. Second, public investment was very positive, with good developments in the next 3-4 years.

Source: https://dantri.com.vn/kinh-doanh/chung-khoan-hung-phan-co-the-chinh-phuc-1500-diem-20250708190219551.htm

Comment (0)