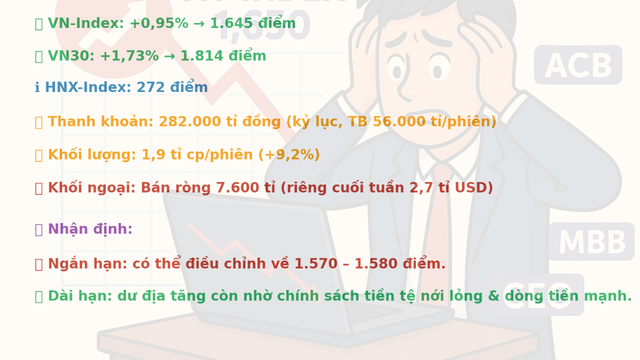

The stock market suddenly "plummeted" in the last trading session of the week (August 22), with the VN-Index losing more than 42.53 points with a series of large-cap stocks falling sharply, even hitting the floor. However, for the whole week, the index still increased by 0.95%, stopping at 1,645 points. The VN30 also increased by 1.73% to 1,814 points, while the HNX-Index closed at 272 points.

A notable highlight is the explosive market liquidity, setting a new record with a total transaction value of VND282,000 billion during the week, equivalent to an average of nearly VND56,000 billion per session. The order matching volume on HoSE also increased by more than 9% compared to the previous week, reaching an average of 1.9 billion shares per session.

On the contrary, foreign investors continued to sell strongly, with a value of more than 7,600 billion VND on HoSE. In the last session of the week alone, the selling pressure pushed liquidity up to 2.7 billion USD.

Many investors are concerned whether the weekend decline is just a short-term correction or signals a deeper decline.

Stock market summary and forecast for next week

According to experts from SHS Securities Company, after a series of hot increases, the market is sending out signals of peaking. VN-Index may be under pressure to correct to the 1,600 point zone. "Speculation is increasing, many stocks have reached the risk zone. After the hot increase period, short-term positions will weaken, the market must return to clinging to basic valuations and third quarter profit expectations" - the report stated.

VN-Index had a sharp decline at the end of the week but still stood above the psychological zone of 1,600 points.

Mr. Nguyen Thai Hoc, an analyst at Pinetree Securities, also said that focusing cash flow on the index's pillar group has caused many investors holding small and medium-sized stocks to not make a profit, or even suffer losses. According to him, in the short term, the VN-Index may retreat to the support zone of 1,570 - 1,580 points before finding new momentum to increase.

"After a sharp increase of nearly 4 months, a correction of 5% or more is normal. This is not a bad signal but helps the market rebalance. Next week will be strongly differentiated, many small and medium-sized stocks that have fallen deeply will have a chance to recover, while the banking and blue-chip groups that have increased sharply will continue to face selling pressure," said Mr. Hoc.

Stock market forecast to rise beyond all scenarios?

Sharing on his personal page on August 23, Mr. La Giang Trung, CEO of Passion Investment, said that the factor to monitor is not the increase or decrease of a few dozen points of the index, but cash flow and liquidity.

"When the US Federal Reserve (FED) signals an interest rate cut in September 2025 and the State Bank continues to loosen monetary policy to support growth, the market still has a lot of room to grow. Liquidity is now 2-3 times higher than in the 2020-2021 period, and valuations are only halfway there. The VN-Index can completely exceed any scenario that investors imagine," he said.

Mr. La Giang Trung, a seasoned "stock market" expert. This expert rarely makes market forecasts. However, his comments are mostly highly accurate.

Specifically, in 2022, Mr. Trung was one of the few experts who predicted that the VN-Index could fall from the 1,500-point range to the 900-point range when the FED tightened interest rate policy to control inflation, and in fact the market has developed exactly like that.

By the end of 2022, he assessed that the worst period had passed and entered a recovery cycle for 2 years 2023-2024.

What should investors do?

In general, according to experts, the sharp decline at the end of the week shows that the market is entering a "testing fire" phase after a long increase. Divergence will be more evident: banking groups, securities or large-cap stocks may be under profit-taking pressure, while many small and medium-sized stocks, especially those that have not increased much, have a chance to recover.

The positive point is that market liquidity has reached a record level, reflecting that cash flow is still there and has not been completely withdrawn. This is the basis for believing that the current correction is technical, helping the market accumulate for a new uptrend cycle.

For short-term investors, this is the time to manage risks, avoid chasing stocks that have increased rapidly, and consider gradually closing positions that have met expectations. On the contrary, medium- and long-term investors can consider the correction as an opportunity to restructure their portfolios, prioritizing businesses with good fundamentals that benefit from the trend of loosening monetary policy.

Overall, the VN-Index remains above the psychological level of 1,600 points. If cash flow continues to be abundant and macro policies are supportive, the possibility of a new price level forming in the third and fourth quarters cannot be ruled out.

Source: https://nld.com.vn/du-bao-moi-nhat-ve-thi-truong-chung-khoan-sau-phien-lao-doc-4253-diem-196250824111929305.htm

Comment (0)