On the morning of June 25, the National Assembly passed the Law amending and supplementing a number of articles of the Law on Bidding; the Law on Investment under the public-private partnership model; the Customs Law; the Law on Value Added Tax; the Law on Export Tax and Import Tax; the Investment Law; the Law on Public Investment; and the Law on Management and Use of Public Assets (1 law amending 8 laws).

This Law comes into force from July 1, 2025.

Previously, in the report on receiving, explaining and revising the draft Law, Minister of Finance Nguyen Van Thang said that based on receiving the opinions of the review and the opinions of the National Assembly deputies (NA deputies) on amending the value-added tax (VAT) rate of 0% for on-site exported goods not subject to the Customs Law, the Government has researched, evaluated and proposed to add an article to the draft Law to amend and supplement the Law on Value Added Tax (adding a 0% VAT policy for on-site exported goods).

Accordingly, the name of the draft Law is "Law amending and supplementing a number of articles of the Law on Bidding; Law on Investment under the public-private partnership model; Law on Customs; Law on Value Added Tax; Law on Export Tax and Import Tax; Law on Investment; Law on Public Investment; Law on Management and Use of Public Assets".

State-owned enterprises are given autonomy in purchasing and bidding activities.

Regarding some specific contents of the amendment to the Law on Bidding, the Minister said that regarding the regulation allowing the selection of contractor selection methods, taking into account the opinions of the Economic and Financial Committee and National Assembly Deputies, the Government has revised and completed this regulation in the direction of stipulating the principle of giving investors priority to apply contractor selection methods with the simplest and most convenient processes and procedures, such as designated bidding, contractor selection in special cases, and ordering.

In addition to the above-mentioned priority forms, investors can choose other forms such as open bidding, competitive bidding and other forms suitable to the scale and nature of the bidding package. At the same time, continue to expand the cases where the form of designated bidding, contractor selection in special cases, restricted bidding, ordering... can be applied to ensure flexibility in implementation organization.

The above regulation has expanded the autonomy of investors in deciding on forms of contractor selection according to the provisions of the Law, while creating a flexible and proactive mechanism, ensuring the implementation of the policy of increasing decentralization and delegation of authority, contributing to accelerating project implementation progress.

The draft law also stipulates the empowerment of state-owned enterprises to make their own decisions on procurement and bidding activities. Accordingly, the draft law is amended in the direction that for the selection of contractors not using state budget capital, state-owned enterprises have the right to make their own decisions on the basis of ensuring publicity, transparency, efficiency and accountability. At the same time, it adds provisions to strengthen inspection and supervision to ensure strict management, risk prevention and effective use of capital by enterprises.

Amending and supplementing a number of articles of the Law on Investment under the Public-Private Partnership (PPP Law) on the mechanism for sharing increased and decreased revenue, taking into account the opinions of National Assembly deputies and the Economic and Financial Committee, to create a basis for the Government to guide this content, the Government has revised the draft in the direction of stipulating a framework of rates, specifically a reduction of 75-90% and an increase of 110%-125% for competent authorities to decide during the project preparation process and negotiation with investors, ensuring flexibility.

For science and technology PPP projects, the regulation does not require investors to share the increased revenue in the first 3 years after the time of operation and business. At the same time, allowing the application of a 100% sharing of the difference between the actual revenue and the revenue in the financial plan in the same period if the actual revenue is lower is an outstanding policy to promote public-private cooperation in this field to institutionalize Resolution 57-NQ/TW.

Early amendment of Land Law

Amending and supplementing a number of articles of the Investment Law on the authority to approve investment policies, the Minister said that the Draft Law has strongly decentralized the authority to approve investment policies of the Prime Minister to the Provincial People's Committees for 7 groups of investment projects. At the same time, the draft Decree guiding the Investment Law will also simplify to the maximum the administrative procedures for approving investment policies and granting Investment Registration Certificates.

The Minister said that the Government is summarizing the implementation of the Investment Law; at the same time, the proposal to study the abolition of the procedure for accepting investment policies will be studied and comprehensively evaluated during this process.

Regarding the amendment and supplementation of a number of articles of the Law on Public Investment on the task of preparing for site clearance, accepting the opinions of the Economic and Financial Committee and the opinions of the National Assembly Deputies, the Government accepts the direction of not regulating the content of the task of preparing for site clearance in the Law.

"The Government will continue to study and propose policies to amend the Land Law and other relevant laws to speed up the implementation of compensation, support and resettlement for public investment projects," Minister Thang informed.

Regarding the decentralization of authority and the acceptance of opinions from competent authorities, the draft Law stipulates the authority of the Government to adjust the annual public investment plan using central budget capital in cases where it does not exceed the total central budget expenditure of the whole country as decided by the National Assembly. At the same time, the authority to adjust the annual plan is decentralized from People's Councils at all levels to People's Committees at all levels to ensure consistency with the provisions of the Law on State Budget (amended).

(According to PLO)

Source: https://baoyenbai.com.vn/12/352266/Chu-dau-tu-duoc-trao-quyen-chon-nha-thau-tr111ng-truong-hop-dac-biet.aspx

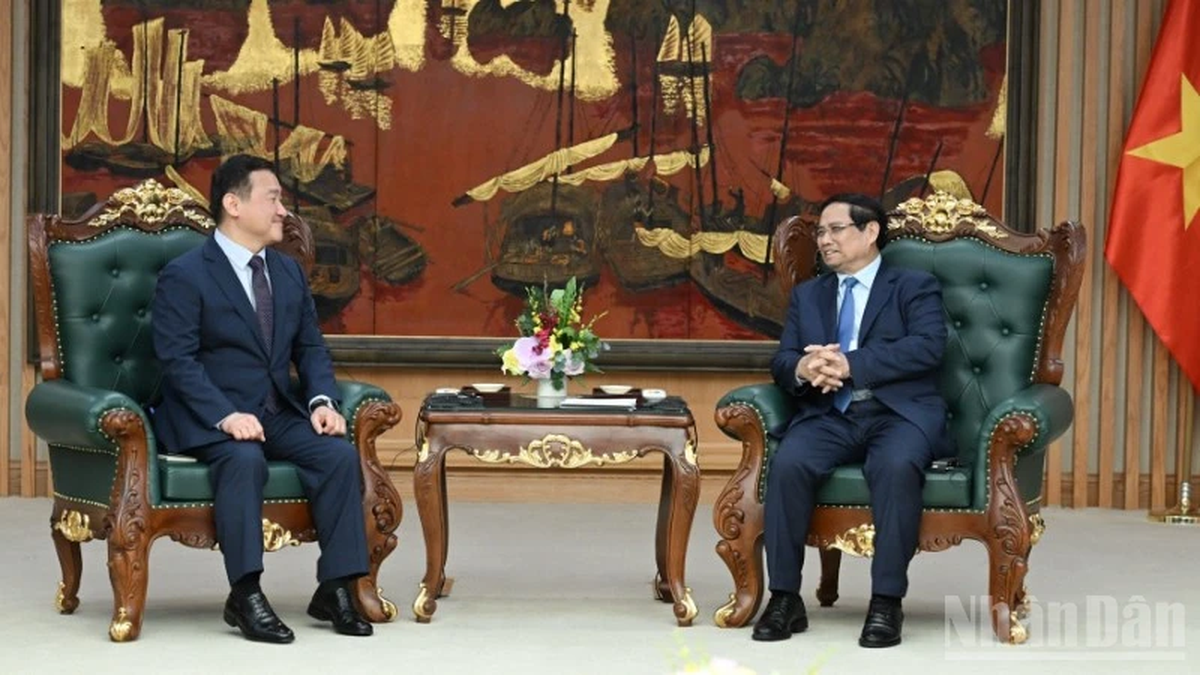

![[Photo] Prime Minister Pham Minh Chinh receives CEO of Samsung Electronics](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/373f5db99f704e6eb1321c787485c3c2)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting of National Steering Committee on International Integration](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/9d34a506f9fb42ac90a48179fc89abb3)

![[Photo] Brilliant red of the exhibition 95 years of the Party Flag lighting the way before the opening](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/27/e19d957d17f649648ca14ce6cc4d8dd4)

![[Photo] General Secretary To Lam attends Meeting with generations of National Assembly deputies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/27/d869c6b3e4da42399e2cd0f4ca26050c)

Comment (0)