Over the past two months,SHB's stock price has increased with leading liquidity in the market, attracting foreign capital. For many years, SHB has paid regular dividends at a rate of 10-18%.

July 31 marked the third consecutive ceiling price increase of the week for SHB shares, bringing the market price to 17,200 VND/share, officially surpassing the peak of June 2021. Since the beginning of the year, SHB shares have increased by more than 90%.

SHB shares ended the July trading session with a liquidity of 181 million units, with a buy surplus of more than 9 million shares. Since the beginning of the month, SHB has recorded many trading sessions of over 100 million shares, leading the VN30 group and the banking industry. In particular, on July 7, SHB recorded a record trading session of nearly 250 million shares. In particular, SHB shares received the attention of foreign investors with a net buying volume of more than 100 million SHB shares in the month.

SHB stock performance has been positive despite the volatile fluctuations of the Vietnamese stock market, showing investors' confidence in this bank's stock.

SHB stock performance over the past 2 years. Source: SHB

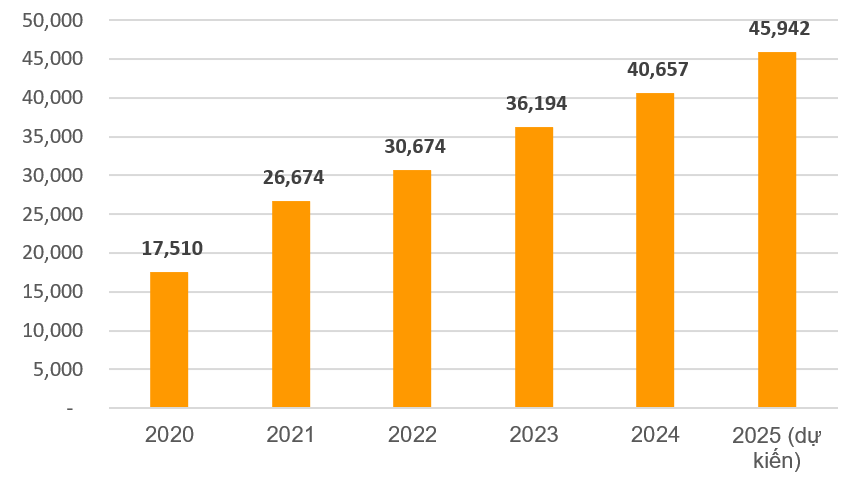

Previously, the State Bank approved SHB to increase its charter capital to VND45,942 billion through paying 2024 dividends in shares at a rate of 13%, expected to be implemented in the third quarter of 2025. Previously, SHB completed the first payment of 2024 dividends in cash at a rate of 5%. Accordingly, the total dividend rate for the whole year of 2024 is 18% and is expected to continue in 2025.

For many years, SHB has been a bank that has regularly paid dividends to shareholders at a rate of 10 - 18%. After the Covid-19 pandemic, SHB returned to paying dividends in shares and cash in 2023 - 2024, demonstrating its strong financial potential and long-term commitment to shareholders. SHB maintains its position in the Top 5 largest private banks in Vietnam.

SHB's charter capital over the years (unit: billion VND). Source: SHB

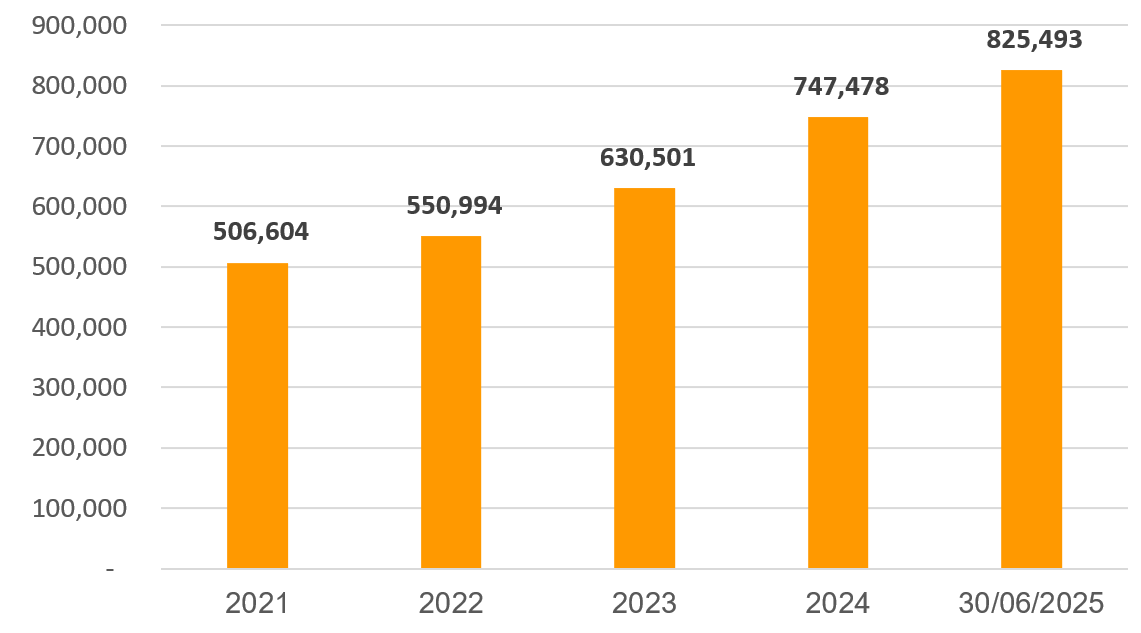

According to the financial report for the second quarter of 2025, as of June 30, 2025, SHB's total assets reached nearly VND 825 trillion, of which outstanding customer loans exceeded VND 594.5 trillion, up 14.4% compared to the beginning of the year and up sharply by 28.9% over the same period.

SHB not only focuses on its core business but also actively participates in the Government's programs and policies. Resolution 68 opens up great opportunities for commercial banks, especially in supporting the development of the private economic sector, through expanding credit and providing preferential loan packages for small and medium enterprises, while participating in the process of digital transformation and sustainable development.

A report from Yuanta Securities Company stated that SHB still has a lot of room for growth, despite its high cyclicality. Meanwhile, MBS Securities believes that the positive credit growth since the beginning of the year and the low interest rate environment, especially focusing on corporate customers, will continue to be the driving force for credit growth for banks.

Growth of SHB's total assets over the years (Unit: billion VND). Source: SHB

Accumulated for 6 months, SHB recorded pre-tax profit of VND 8,913 billion, up 30% over the same period in 2024, completing 61% of the 2025 plan. In the second quarter alone, pre-tax profit reached more than VND 4,500 billion, up 59% over the same period.

Operational efficiency continued to improve with ROE exceeding 18%. The cost-to-income ratio (CIR) was impressive at 16.4%, among the lowest in the industry. Safety indicators were also maintained well, with the loan-to-deposit ratio (LDR) and the ratio of short-term capital used for medium and long-term loans both within the limits set by the State Bank. The consolidated capital adequacy ratio (CAR) remained above 11%, far exceeding the minimum of 8%, ensuring safe capital capacity.

Asset quality has improved significantly, with the non-performing loan (NPL) ratio under Circular 31 being controlled at a low level. Group 2 debt has dropped sharply to only 0.3%, expanding room for further improvement in asset quality.

In parallel with business promotion, SHB has completed the credit risk measurement model and capital calculation method according to Basel II standards, using the advanced IRB method. The bank continues to complete the modern risk management framework, with the goal of fully meeting Basel II - IRB requirements by 2027, while improving the risk management capacity of the credit institution system under the direction of the State Bank.

In addition, SHB has effectively implemented liquidity risk management according to Basel III standards (LCR, NSFR) and modern asset and liability management tools (FTP, ALM). These tools help the bank control cash flow, ensure liquidity and timely provision against market fluctuations. SHB expects to continue to strongly apply these tools to improve operational efficiency and build a solid capital buffer, supporting long-term growth.

In 2025, SHB aims to achieve pre-tax profit of VND 14,500 billion, an increase of 25% compared to 2024. Total assets are expected to exceed VND 832 trillion and reach VND 1 million billion by 2026, marking a solid step forward in scale and position in the domestic and regional financial markets.

(Source: SHB)

Source: https://vietnamnet.vn/chat-luong-tai-san-nang-cao-kinh-doanh-hieu-qua-shb-tang-toc-but-pha-2427612.html

Comment (0)