Experts discuss and analyze new legal regulations and obligations of business households after the abolition of lump-sum tax.

The workshop was jointly organized by the Vietnam Tax Consultants Association (VTCA), MISA Joint Stock Company and Vietnam Prosperity Joint Stock Commercial Bank (VPBank).

According to Mr. Nguyen Quang Khai, Deputy Director of Retail Solutions, MISA Joint Stock Company, Resolution No. 68-NQ/TW of the Party has identified the private economy as an important driving force of the socialist-oriented market economy, and at the same time clearly stated the policy of eliminating lump-sum tax for business households by 2026 at the latest, implementing electronic tax via cash registers, abolishing business license fees, and encouraging households to convert to business models to create an equal, transparent and sustainable environment.

Mr. Khai emphasized that the abolition of lump-sum tax is both a challenge and an opportunity. The challenge is that business households must change their long-standing habits, invest tools and time in transparent declaration; but the opportunity is much greater: when transparent, households have the conditions to access credit capital from banks, easily cooperate with businesses, participate deeply in the value chain, enhance their reputation in the market and develop sustainably instead of maintaining a small, stagnant state.

From a management perspective, Ms. Nguyen Thi Thu Ha, former Director of the Department of Propaganda and Taxpayer Support (Tax Department) said that in order to adapt to the new regulations, business households need to proactively grasp their legal rights and obligations, be aware of the consequences of non-compliance, and choose the appropriate method: what to do themselves, what to hire services such as electronic invoices, accountants or tax agents.

In response to concerns from many small businesses about costs and technology, Mr. Khai said that there are now support solutions with low costs, only about 100,000 VND/month. These integrated e-invoice software for sales are very simple, just need a mobile phone to scan the code, issue invoices and send data directly to the tax authorities. This is a practical tool to help businesses get acquainted with transparent data management.

Ms. Nguyen Thi Thu Ha, former Director of the Department of Propaganda and Taxpayer Support (Tax Department)

Ms. Nguyen Thi Thu Ha also noted that for specific industries such as food and beverage, small-scale processing, and seafood, which have few input invoices, the challenge will be greater. However, the reality of doing business has helped the owner clearly understand the profit and loss, the difference is that now it is necessary to record and monitor in a systematic way. In particular, Decree No. 70/2025/ND-CP has created convenience when it stipulates that invoices issued from cash registers in retail do not require the declaration of buyer information, in line with the characteristics of small businesses.

Another important content is the regulation on e-commerce activities. According to Decree No. 117/2025/ND-CP, e-commerce platforms are divided into two types: with payment function and without payment function. For platforms with payment function, the platform will deduct, declare and pay taxes as soon as the transaction is confirmed, and at the same time issue electronic invoices, transfer data to tax authorities, buyers and business households.

In this case, the household does not have to issue invoices themselves and does not have to re-declare taxes that have been deducted by the floor such as value added tax or personal income tax, unless additional specific taxes such as special consumption tax or environmental protection tax arise. For floors without payment functions, the household still has to issue invoices and declare according to regulations. Thus, there are currently three forms of business households: Traditional business, business on floors with payment functions and business on floors without payment functions.

In terms of finance, Mr. Ngo Binh Nguyen, Director of VPBank Household Business Segment, said that the bank has designed many suitable credit packages and financial products: V20K loan package with preferential interest rates from 3.99%/year for mortgage loans, VPBank CommCredit credit card with cashback up to 12%, and Super Profit accumulation tool with yield of 3.5%/year for short-term idle cash flow.

At the workshop, experts also discussed and analyzed new legal regulations and obligations of business households after the abolition of lump-sum tax in some specific cases, technological solutions to support households in making invoices, managing books, declarations and financial solutions to support cash flow, capital and digital transformation for households.

Experts agree that abolishing lump-sum tax is not only a technical reform in tax administration, but also a major institutional turning point, contributing to promoting the national digital transformation process, improving tax discipline, and creating a fair and transparent business environment. This is also an opportunity for millions of households and individuals to change their thinking, improve their operations, and gradually integrate deeply into the modern market economy for sustainable and long-term development.

Source: https://doanhnghiepvn.vn/kinh-te/bo-thue-khoan-buoc-ngoat-minh-bach-hoa-ho-kinh-doanh/20250826040426873

![[Photo] Multi-colored cultural space at the Exhibition "80 years of the journey of Independence - Freedom - Happiness"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/fe69de34803e4ac1bf88ce49813d95d8)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting of National Steering Committee on International Integration](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/9d34a506f9fb42ac90a48179fc89abb3)

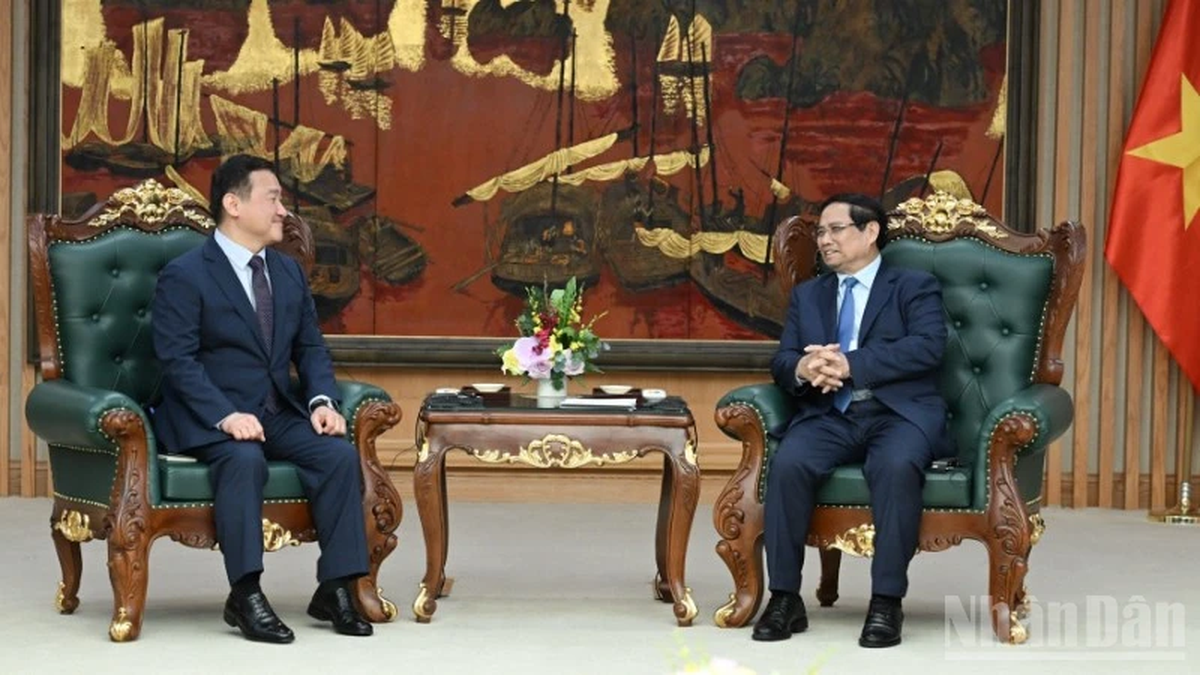

![[Photo] Prime Minister Pham Minh Chinh receives CEO of Samsung Electronics](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/373f5db99f704e6eb1321c787485c3c2)

Comment (0)