Mandatory collection of biometrics of business representatives

According to the regulations of the State Bank of Vietnam in Circular No. 17/2024/TT-NHNN, from July 1, 2025, the legal representative of an institutional customer must provide and verify the correct identification documents (GTTT) and biometrics (STH) for the organization to continue withdrawing money and making payment transactions by electronic means on the organization's payment account at the bank.

After this period, if the update is not completed, money transfer and withdrawal transactions via e-Banking services will be suspended to ensure compliance with legal regulations and enhance security.

For the legal representative of an institutional customer, who is also an individual customer, the GTTT and STH have been collected and compared at the bank. For the convenience of the customer, based on the information provided/registered by the customer at the bank, the banks have proactively updated the comparison results matching the GTTT and STH from the individual customer data to the data of the legal representative of the institutional customer.

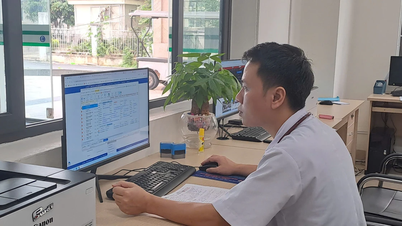

There are 2 ways to perform biometric authentication:

At the transaction counter: The legal representative of the customer organizes directly to any bank branch/transaction office nationwide to perform;

Or do it on the bank's App (only applicable to Vietnamese citizens).

Documents required to perform biometric authentication include: Citizen ID card or Chip-based ID card (for Vietnamese citizens); Original or notarized valid passport (for foreign nationals).

Banks also remind customers that, in order to avoid being taken advantage of by scammers, bank employees when assisting customers in updating data should never send a link requesting a login, providing a user name, password, ID card number, OTP code, or any other personal information.

"Death" of magnetic cards

In compliance with the regulations of the State Bank, from July 1, 2025, banks will officially stop transactions using magnetic strips on domestic cards, including: magnetic technology cards, magnetic strips on Chip/Chip contactless cards.

This change is intended to improve transaction security and comply with government regulations.

In fact, banks and card users have had a long time to prepare for this by offering free conversion from magnetic cards to chip cards for customers.

In case the customer has not converted, to avoid transaction interruption, the bank recommends that the customer check the card by:

If the card only has a magnetic strip (no chip), customers need to bring their ID card/Citizen ID card to the nearest bank transaction point to convert to a chip card for free.

Magnetic stripe cards are cards with a magnetic strip on the back, which stores information and makes transactions by swiping the card on a POS or ATM machine. However, magnetic stripe cards have limitations in terms of security and scope of use.

Chip card (EMV) is a type of card that uses an electronic chip attached to the card surface, storing and encrypting transaction information in a safe and modern manner according to international standards Europay, MasterCard and Visa.

Chip cards generate a unique code for each transaction, helping to prevent fraud and duplication of information.

The information on the chip card is protected by an electronic chip, which is very difficult to copy or counterfeit compared to traditional magnetic cards. Therefore, the level of security is higher, minimizing the risk of information theft when making online transactions.

Enabling controlled testing in the banking sector

Decree No. 94/2025/ND-CP (Decree 94) takes effect from July 1, 2025, regulating the controlled testing mechanism in the banking sector for the implementation of new products, services, and business models through the application of technology solutions (Fintech).

The results of the pilot implementation of Fintech solutions are used as a practical basis for competent state agencies to research, develop and perfect the legal framework and related management regulations if necessary.

Financial technology solutions (Fintech solutions) participating in testing in the testing mechanism include: Credit scoring; Data sharing via open application programming interface (Open API); Peer-to-peer lending.

Applicable subjects include: Credit institutions, foreign bank branches as prescribed in the Law on Credit Institutions; Fintech companies; competent state agencies; customers and other organizations and individuals related to the testing mechanism.

The aim of the pilot mechanism is to promote innovation and modernization of the banking sector, thereby realizing the goal of financial inclusion for people and businesses in a transparent, convenient, safe, efficient and low-cost manner.

The Decree stipulates standards and principles for the operation of the Testing Mechanism, sets out principles, processes, procedures, approval criteria, and control measures for testing innovative Fintech solutions participating in the Testing Mechanism;

Use the results and input information of the Testing Mechanism to amend and supplement current regulations, issue new regulations, reform the legal framework of the Banking industry in an adaptive direction, facilitating Fintech activities;

Promote innovation of new products, services, and business models in the banking sector in Vietnam based on the application of Fintech technology/solutions, facilitating banking operations, ensuring network security, and protecting consumer rights.

Source: https://baolaocai.vn/3-thay-doi-quan-trong-cua-nganh-ngan-hang-ke-tu-ngay-17-post404049.html

Comment (0)