According to Mr. Doan Tien Quyet, data analysis expert of VPI, the gasoline price forecasting model applying the Artificial Neural Network (ANN) model and the supervised learning algorithm in Machine Learning of VPI predicts that the retail price of E5 RON 92 gasoline may increase by 660 VND (3.2%) to 21,290 VND/liter, while RON 95-III gasoline may increase by 595 VND (2.8%) to 21,835 VND/liter.

VPI's model predicts that retail oil prices this period will also follow an upward trend, with kerosene likely to increase by 4.3% to VND19,734/liter, followed by diesel which may increase by 3.9% to VND19,897/liter, while fuel oil is forecast to increase only slightly by 0.5% to VND17,728/kg. VPI predicts that the Ministry of Finance and the Ministry of Industry and Trade will continue not to set aside or use the Petroleum Price Stabilization Fund this period.

In the world market, oil prices in the session on June 24 fell to the lowest level in two weeks, in which Brent crude oil futures fell 6.1% to 67.14 USD/barrel; US light sweet crude oil (WTI) also fell 6% to 64.37 USD/barrel.

Oil prices plunged on hopes that a ceasefire between Israel and Iran would reduce the risk of disruptions to oil supplies in the Middle East. However, the truce is now in doubt as US President Donald Trump accused both Israel and Iran of violating it just hours after the agreement was announced. Both oil futures fell more than 7% earlier in the session on June 23.

Meanwhile, on the afternoon of June 22, Vietnam time, the price of Brent crude oil futures and the price of US light sweet crude oil (WTI) reached 81.40 USD/barrel and 78.40 USD/barrel, respectively, reaching their highest levels in 5 months when Iran planned to close the Strait of Hormuz, which is the transit point for about 20% of global crude oil supply, in retaliation for the US bombing.

Sugandha Sachdeva, founder of New Delhi-based research firm SS WealthStreet, said the geopolitical escalation is a fundamental catalyst for Brent crude to surge higher, potentially to $100 a barrel or even $120. In a recent report, investment bank Goldman Sachs said Brent could peak at $110 a barrel if oil flows through the vital waterway were to halve in a month and remain down 10% for the next 11 months.

Source: https://doanhnghiepvn.vn/kinh-te/vpi-du-bao-gia-xang-van-duy-tri-da-tang-trong-ky-dieu-hanh-ngay-mai-26-6/20250625093157226

![[Photo] Prime Minister Pham Minh Chinh chairs meeting of National Steering Committee on International Integration](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/9d34a506f9fb42ac90a48179fc89abb3)

![[Photo] Multi-colored cultural space at the Exhibition "80 years of the journey of Independence - Freedom - Happiness"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/fe69de34803e4ac1bf88ce49813d95d8)

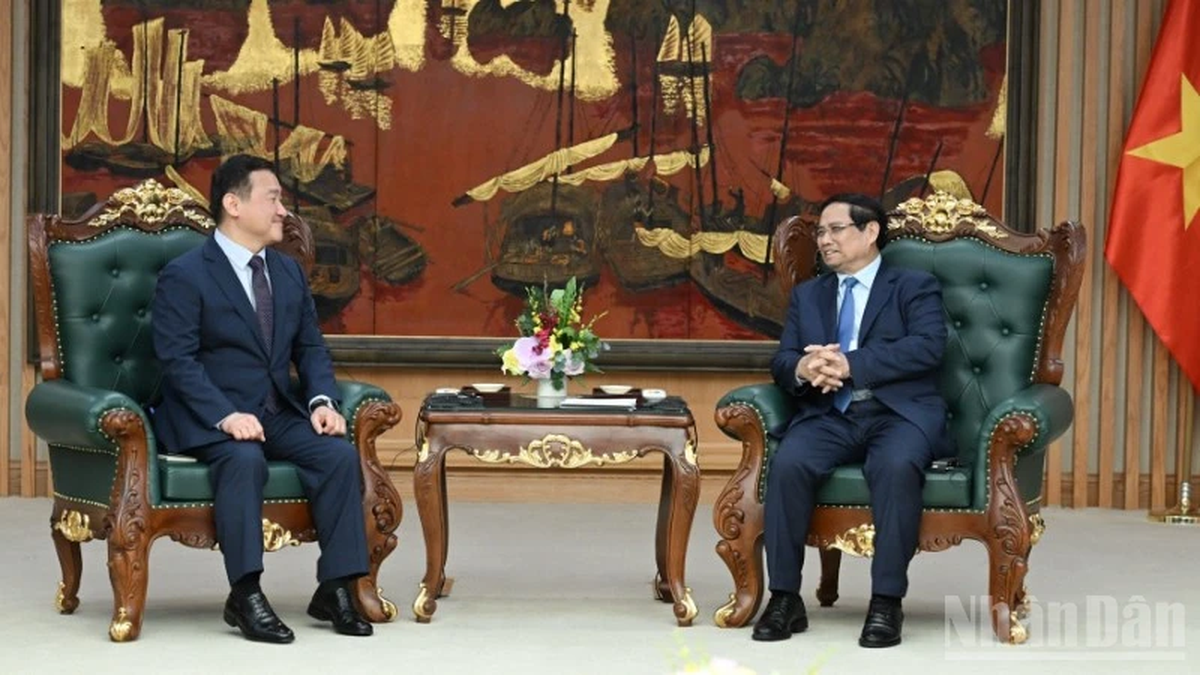

![[Photo] Prime Minister Pham Minh Chinh receives CEO of Samsung Electronics](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/373f5db99f704e6eb1321c787485c3c2)

Comment (0)