These two products are important pieces, helping VIB complete the personalized financial ecosystem, empowering users to proactively manage their finances in a smart, safe and effective way.

Super Pay and Super Cash are two pieces in VIB's personalized financial ecosystem (Photo: VIB).

SuperPay: Proactive payment solution, flexible installments, safe transactions

No longer limited by traditional definitions such as credit, debit or prepaid cards, SuperPay integrates the trio of solutions PayFlex, Pay Ease and PaySafe, helping users proactively choose how to spend and manage their personal finances.

PayFlex - Empowering users to choose their payment source: Allows users to proactively choose their payment source (from a payment card or VIB Visa credit card) with just one PayFlex registered card, providing maximum flexibility and smart control over cash flow. Cardholders can proactively choose their payment source for each type of transaction, take full advantage of credit card benefits such as interest-free periods, preferential installment payments, accumulate reward points for large spending, and closely manage their daily spending budget via debit card.

Super Pay helps users proactively choose how to spend and manage personal finances (Photo: VIB).

PayEase - Empowering flexible installment payments: Understanding customers' diverse spending needs, VIB offers the PayEase solution, allowing users to fully decide on installment payments. With just a few steps on the MyVIB application or via Hotline, customers can choose transactions, amounts and installment terms according to their needs with a maximum term of up to 36 months. VIB cooperates with more than 100 major partners, providing a 0% interest installment payment program, helping users realize all big plans without worrying about financial pressure.

PaySafe - Empowering secure transactions: With PaySafe, cardholders have full control over card security by enabling, disabling online payment features, locking, unlocking cards, setting limits, to prevent risks and enhance the safe experience when making transactions. Cardholders can proactively decide whether online transactions require OTP authentication or not and the appropriate OTP receiving method.

With VIB, cardholders can receive OTP via notification from the MyVIB app or email, in addition to the traditional method of SMS messages. Thanks to that, cardholders can easily make card payment transactions even when abroad and without SMS roaming service.

Super Cash: A breakthrough solution that allows transferring limits of up to 1 billion VND between credit cards and cash loans

Super Cash is a solution to proactively access cash flow when needed. This is a product that allows credit limit rotation between credit card and cash loan.

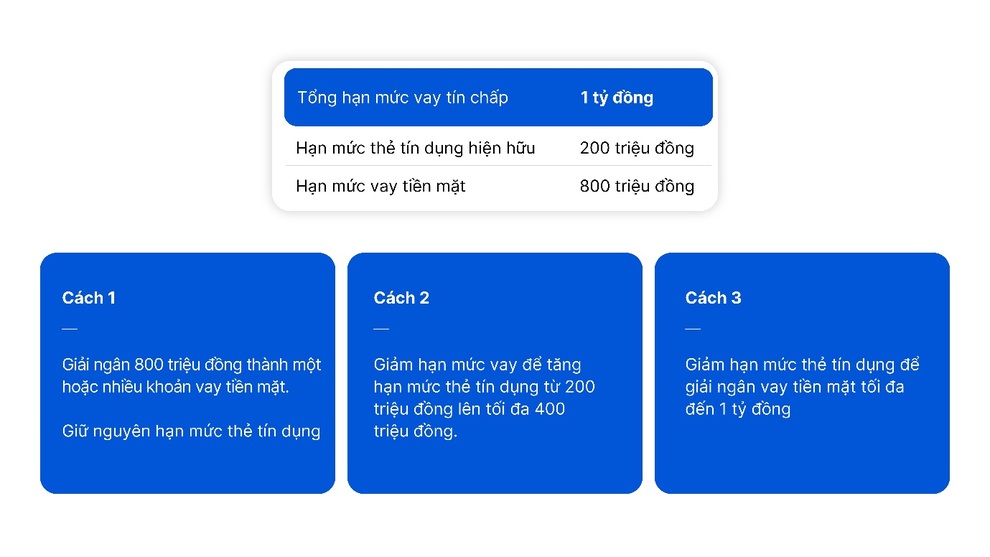

Three ways to use credit limit with Super Cash (Photo: VIB).

With Super Cash, users will be granted a maximum credit limit of up to 1 billion VND including credit card and cash loan. Depending on usage needs, users can rotate the limit from card to cash or vice versa when needing quick capital without having to open a new loan.

For example, when in need of emergency cash, users only need a few steps on the Max by VIB application to convert part of the credit limit into a loan, the money will be disbursed into the account within 5 minutes. When needing to increase the card limit to travel , pay tuition or spend large amounts, users can proactively transfer the limit from the loan to the credit card for payment.

With simplified online procedures on the Max application, Super Cash offers a proactive and flexible lending experience that was previously only available in fintech models. Users do not need complicated paperwork, no conversion fees or early settlement fees. Interest rates from 425 VND/million/day (equivalent to 15.5-22.5%/year). With flexible terms from 1 day to 5 years, SuperCash is a smart reserve fund managed by the user, with no early loan settlement fees. SuperCash is currently granted a limit to customers who already have a credit card or mortgage loan at VIB.

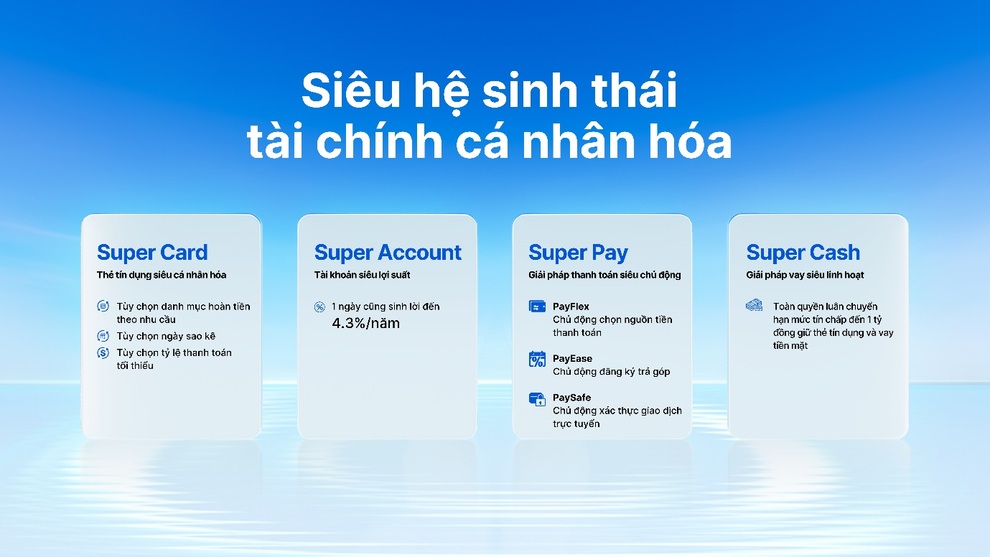

1 super ecosystem - 4 powerful pieces: Personalized for every need

The “Super Quartet” forms a unified personalized ecosystem of VIB (Photo: VIB).

During its growth journey over the years, VIB has affirmed its position by continuously listening to customers' needs and launching financial products applying breakthrough technology.

Among them, Super Card - Personalized credit card allows customers to proactively set up a refund category, statement date, payment deadline depending on their needs and cash flow; or Super Account - Super Profit Account with profit up to 4.3%/year on flexible spending cash flow.

With the launch of Super Pay and Super Cash, VIB continues to complete the super personalized financial ecosystem with two new pieces: SuperPay - Proactive payment solution, flexible installments, safe transactions; SuperCash - Breakthrough solution allowing transfer of limits up to 1 billion VND between credit cards and cash loans.

Source: https://dantri.com.vn/kinh-doanh/vib-ra-mat-hai-san-pham-tai-chinh-ca-nhan-hoa-super-pay-va-super-cash-20250722134707924.htm

Comment (0)