At the end of the trading week from September 1 to September 6, SJC gold bar prices were listed by businesses at 133.9-135.4 million VND/tael (buy - sell). This is a new record for this commodity. The difference between buying and selling prices remained at 1.5 million VND/tael.

Last week, precious metals continuously set records in price. At the beginning of the week, the price of gold bars was listed at 127.8-129.3 million VND/tael (buy - sell). Thus, in general, last week, each tael of gold increased by 6.1 million VND in both buying and selling directions. If calculated in the last 2 weeks, each tael of gold increased by about 10 million VND, equivalent to an increase of nearly 8%.

Meanwhile, the listed price of gold rings is 126.7-129.2 million VND/tael (buy - sell), also a record for this item. In many private enterprises, the listed selling price of gold rings is 130.7 million VND/tael.

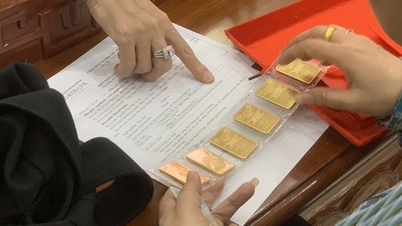

Gold jewelry is on display at a store (Photo: Tien Tuan).

Domestic gold prices increased sharply along with the international market. Accordingly, the world gold price closed last week at 3,585 USD/ounce. Previously, there was a time when this metal reached 3,600 USD/ounce, the highest ever.

Gold prices have risen 37% since the beginning of the year due to a weakening US dollar, central bank purchases, loose monetary policy and global geopolitical and economic uncertainty, according to Reuters.

New data released on Friday showed that US job growth slowed sharply, with just 22,000 jobs added in August, while the unemployment rate rose to 4.3%. The August figure was also significantly lower than the 79,000 jobs added in July.

Traders are betting on a 90% chance that the US Federal Reserve (Fed) will cut interest rates by 25 basis points (0.25%) as early as September.

"The outlook for gold is currently positive as employment concerns outweigh inflation concerns in the short term and possibly in the medium term. However, we are still quite a way from the $4,000/ounce mark, unless there is a major shock to the market," said Tai Wong, an independent metals trader.

This week, 18 experts participated in Kitco News’ gold price survey for next week. Fourteen (78%) said gold will continue to rise, three (17%) said it will fall, and one (5%) said it will be flat.

Meanwhile, the online survey received 219 votes from retail investors. Of those, 160 (73%) predicted prices would rise, 33 (15%) predicted a fall, and 26 (12%) said prices would remain flat.

“I am bullish on gold next week,” said Colin Cieszynski, chief investment strategist at SIA Wealth Management. “Weak U.S. jobs data has increased pressure on the Fed to cut rates at its upcoming meeting. This has started to pull down Treasury yields and the dollar, paving the way for gold to continue its upward move.”

“Gold prices could fall, but not significantly,” said Rich Checkan, president and COO of asset management firm Asset Strategies International. “I think there will be a slight correction due to profit-taking and caution ahead of the Fed rate decision on the 17th.”

Michael Brown, senior strategist at trading house Pepperstone, is less bullish on the outlook for next week, noting that gold has risen too quickly in a short period of time and there is a risk of a correction. He also said that the dip should be viewed as a buying opportunity.

In addition, analysts also believe that the Fed's independence is a key factor in shaping gold prices, especially after US President Donald Trump sought to fire Fed Governor Lisa Cook and repeatedly pressured the Fed to aggressively cut interest rates.

At the Government meeting on September 6, Deputy Governor of the State Bank of Vietnam Doan Thai Son explained that the recent increase in gold prices was due to the very high increase in world gold prices. At the same time, the expectation and market sentiment that gold prices would continue to increase caused people's demand for gold to increase very high.

Another reason pointed out is the scarce domestic supply due to the State Bank temporarily stopping the sale of SJC gold to the market in the context of the transition to a new management mechanism.

Deputy Governor Pham Thanh Ha also said that the agency coordinates with the Ministry of Public Security, the Government Inspectorate and other relevant agencies to implement the Prime Minister's direction on gold market management, ensuring strict compliance with regulations.

Previously, the Government issued Decree 232, granting the right to import and produce gold bars to a number of banks and enterprises that meet the conditions. This Decree took effect from October 10.

Source: https://dantri.com.vn/kinh-doanh/vang-tang-10-trieuuluong-trong-hai-tuan-qua-du-bao-tang-manh-tuan-toi-20250906234409831.htm

![[Photo] Amazing total lunar eclipse in many places around the world](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/8/7f695f794f1849639ff82b64909a6e3d)

Comment (0)