Stock market faces adjustment pressure after the holiday - Photo: QUANG DINH

Joy is not shared equally

After conquering the record mark of 1,700 points, the market quickly faced strong correction pressure under the wave of profit-taking. Previously, continuous price peaks were recorded in many banking and securities stocks.

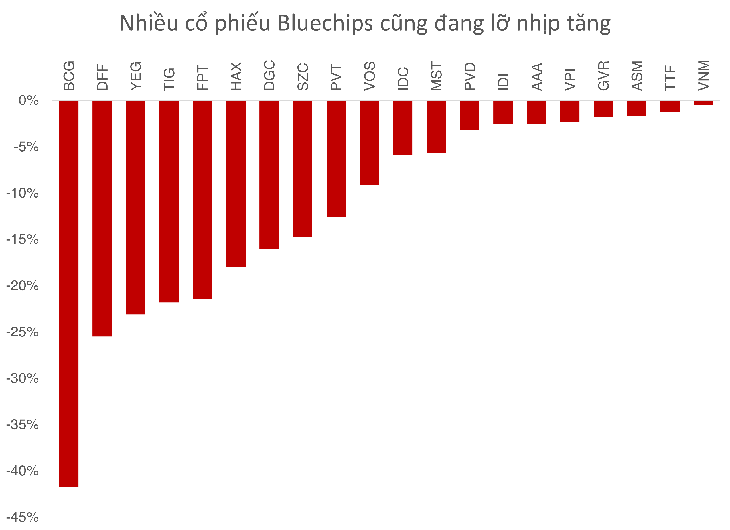

However, many other stocks have not yet had time to "climb the wave" with the general excitement and now have to face a challenging correction of the general market.

Statistics from the three exchanges up to September 5 show that more than 500 stocks still had negative growth despite the general index going up, equivalent to nearly 34% of the total stock codes in the entire market.

Many stocks are illiquid, but there are also many cases where trading is active but the price goes against the index.

Like BCG (Bamboo Capital) has decreased by 42% since the beginning of 2025 due to facing risks related to legal and senior leadership.

Another name, YEG (Yeah1), best known for the show "Anh trai vu ngan cong gai" also lost more than 23% of its value since the beginning of the year despite positive business results.

In the first half of 2025, YEG's after-tax profit increased 2.6 times, reaching nearly VND 56.6 billion.

Not only midcap or penny stocks, even famous bluechips are not in sync with the growth of VN-Index.

FPT has decreased by 21.4% since the beginning of the year due to profit-taking activities of large investors since the beginning of 2025.

Vinamilk , with its new brand identity, is still down about 1%. Meanwhile, the giant in the industrial park and rubber sector, GVR, along with the codes SZC and IDC, are still showing the after-effects of the tariff shock on the entire industry group.

Mr. Khang, an investor, said: "My portfolio has not really recovered from the shocking decline in April 2025. Industrial park stocks account for a large proportion of my portfolio, and cash flow is still very cautious with information about tariffs."

Along with that, many industry groups such as oil and gas, chemicals, and consumer goods such as PVT, PVD, DGC, and HAX are almost "forgotten" by the market.

Expert perspective: cash flow will be more differentiated

Mr. Nguyen Anh Khoa - Director of Analysis, Agriseco Securities - believes that the differentiation will be more evident in the coming time:

"The banking and real estate groups are re-examining the short-term price base, in line with the signal of declining liquidity in the entire market. This reflects that the state of new buying money is not too positive. The motivation to simultaneously support all three large-cap groups to increase in price is not strong enough," said Mr. Khoa.

According to Mr. Khoa, the market may enter a more distinct phase of differentiation, with cash flow likely to shift to midcap stocks with fundamental factors or expectations of positive third-quarter business results, such as construction materials, retail, and seaports.

Technically, VN-Index is likely to fluctuate within a wide range, with psychological resistance around 1,700 points and short-term support at 1,610 (±10) points.

According to Mr. Khoa, the market valuation is still not at the "bubble" level, and there is still room for growth. In previous strong price growth cycles (2017 - 2018, 2020 - 2021), the time for the leading group to increase points lasted from 1 to 1.5 years. Therefore, cash flow can still spread to other industries, but it is difficult to expect the whole market to break out simultaneously.

From another perspective, Mr. Nguyen The Minh - Director of Individual Customer Analysis, Yuanta Vietnam Securities - emphasized the change in cash flow structure: "Currently, the market is being led by domestic institutional cash flow, despite foreign net selling. In the past 2 years, domestic institutions have been the group with the strongest impact on VNIndex fluctuations, different from the period 2019 - 2023 when individuals played the main role".

According to Mr. Minh, deeper participation by organizations helps the market become more stable and professional, but also makes the differentiation process fierce, when cash flow focuses mainly on stocks with clear prospects.

Mr. Minh also noted that in September and October, investors around the world tend to trade cautiously. This is also the basis for investors to prepare a defensive strategy during the fall period - which is often volatile - and seize the opportunity of the "Santa Claus rally" at the end of the year.

While the banking and securities groups, or Vingroup and Gelex groups, are continuously making breakthroughs, many industries and businesses are still struggling to find growth again.

This divergence raises the question: can the market maintain its current euphoria, or will money start to shift to neglected sectors?

Source: https://tuoitre.vn/chung-khoan-kho-nhan-20250908113937027.htm

![[Photo] General Secretary To Lam receives Assistant to the President of Russia, Chairman of the Federal Maritime Council of Russia Nicolai Patrushev](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/16/813bd944b92d4b14b04b6f9e2ef4109b)

![[Photo] Prime Minister Pham Minh Chinh attends the closing ceremony of the exhibition of national achievements "80 years of the journey of Independence - Freedom - Happiness"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/15/a1615e5ee94c49189837fdf1843cfd11)

![[Photo] National conference to disseminate and implement 4 Resolutions of the Politburo](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/16/5996b8d8466e41558c7abaa7a749f0e6)

![[Photo] General Secretary To Lam attends the National Conference to disseminate and implement 4 Resolutions of the Politburo](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/16/70c6a8ceb60a4f72a0cacf436c1a6b54)

Comment (0)