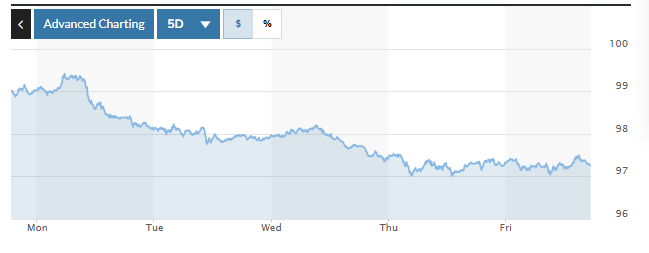

Meanwhile, in the US market, the US Dollar Index (DXY) measuring the greenback's fluctuations against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF) is currently at 97.25.

|

| Chart of DXY Index fluctuations over the past week. Photo: Marketwatch |

USD exchange rate in the world last week

The US dollar has been on a broad-based decline over the past week. The key factor has been growing expectations that the Fed will cut interest rates under pressure from relatively weak economic data and the risk of political intervention in the US Federal Reserve. At the same time, capital flows into Asian markets and emerging currencies have reinforced the downward trend in the US dollar.

The dollar fell earlier in the week after Fed Governor Michelle Bowman said the US central bank should consider cutting interest rates in the near future, amid growing expectations that Iran's response to the US airstrikes on several nuclear facilities in Iran will be limited.

The US dollar continued to fall on June 25, while the euro rose to its highest level since October 2021, after a ceasefire between Iran and Israel was announced, although Fed Chairman Jerome Powell reiterated that he expected inflation to start rising again this summer.

The dollar fell to multi-year lows against the euro and sterling on June 26, but rose against the yen as traders assessed expectations of a Fed rate cut and a return to focus on U.S. fiscal policy. Currency moves were relatively mild after the greenback fell sharply following a ceasefire between Israel and Iran.

The US dollar fell to a three-and-a-half-year low against the euro and the pound on June 27 amid a sharp sell-off as traders re-priced the possibility of a larger rate cut by the Fed than previously expected.

The US dollar recovered earlier losses against the euro on July 28, after US President Donald Trump announced that the United States would end trade negotiations with Canada.

The big question now is whether the Fed will actually demonstrate a dovish stance by moving to lower interest rates in the coming months or will hold steady, and this will continue to be the main driver shaping the USD trend.

|

| Illustration photo: Reuters |

Domestic USD exchange rate today

In the domestic market, at the beginning of the trading session on June 29, the State Bank announced the central exchange rate of the Vietnamese Dong to the USD at 25,048 VND.

* The reference USD exchange rate at the State Bank's transaction office for buying and selling is kept at: 23,846 VND - 26,250 VND.

USD exchange rates at commercial banks are as follows:

USD exchange rate | Buy | Sell |

25,880 VND | 26,270 VND | |

Vietinbank | 25,765 VND | 26,275 VND |

BIDV | 25,910 VND | 26,270 VND |

* The EUR exchange rate at the State Bank's exchange office remains unchanged at: 27,825 VND - 30,754 VND.

EUR exchange rates at commercial banks are as follows:

EUR exchange rate | Buy | Sell |

Vietcombank | 29,764 VND | 31,364 VND |

Vietinbank | 29,706 VND | 31,416 VND |

BIDV | 30,094 VND | 31,342 VND |

* The Japanese Yen exchange rate at the State Bank's exchange office remains unchanged, currently at: 165 VND - 182 VND.

Japanese Yen Exchange Rate | Buy | Sell |

Vietcombank | 174.42 VND | 185.50 VND |

Vietinbank | 176.40 VND | 186.10 VND |

BIDV | 177.47 VND | 185.33 VND |

HUYEN TRANG

*Please visit the Economics section to see related news and articles.

Source: https://baodaknong.vn/ty-gia-usd-hom-nay-29-6-dong-usd-trai-qua-mot-dot-giam-gia-toan-dien-257232.html

Comment (0)