USD exchange rate today 11/8/2025

At the time of survey at 4:30 a.m. on August 11, the central exchange rate at the State Bank was currently 25,228 VND/USD, unchanged from yesterday's trading session.

Specifically, at Vietcombank , the USD exchange rate is 26,010 - 26,400 VND/USD, unchanged in both directions, compared to yesterday's trading session.

NCB Bank is buying USD cash at the lowest price: 1 USD = 25,840 VND

VietinBank is buying USD transfers at the lowest price: 1 USD = 25,835 VND

HSBC Bank is buying USD cash at the highest price: 1 USD = 26,097 VND

HSBC Bank is buying USD transfers at the highest price: 1 USD = 26,097 VND

HSBC Bank is selling USD cash at the lowest price: 1 USD = 26,333 VND

HSBC Bank is selling USD transfers at the lowest price: 1 USD = 26,333 VND

MB Bank is selling USD cash at the highest price: 1 USD = 26,485 VND

MB Bank is selling USD transfers at the highest price: 1 USD = 26,485 VND

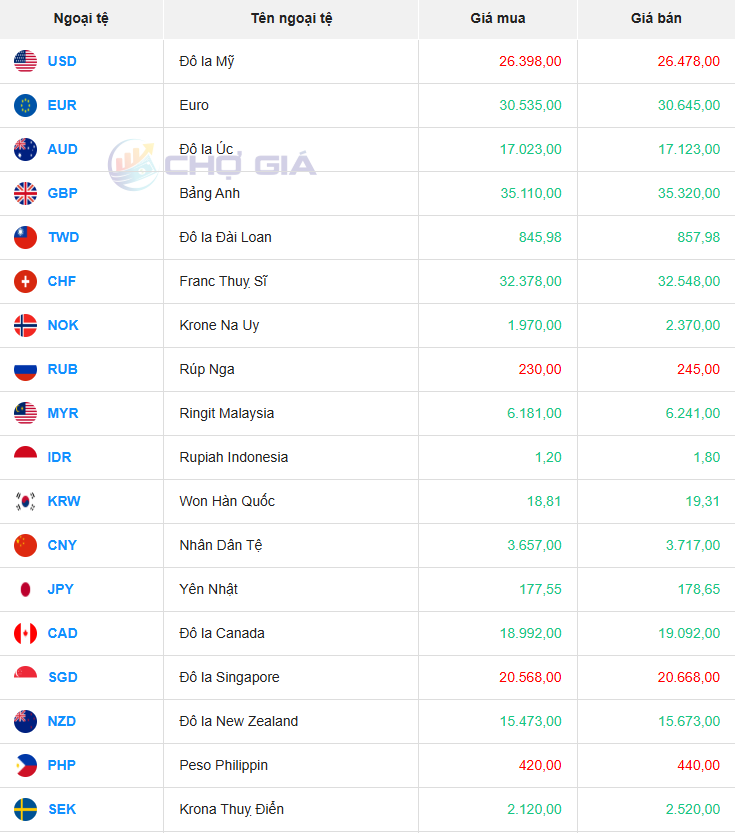

In the "black market", the black market USD exchange rate as of 4:30 a.m. on August 11, 2025 remained unchanged compared to yesterday's trading session, trading around 26,398 - 26,478 VND/USD.

USD exchange rate today August 11, 2025 on the world market

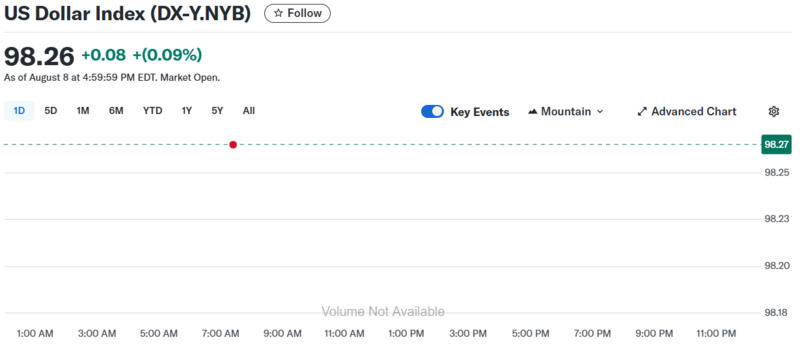

The Dollar Index (DXY), which measures the USD against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF), stopped at 98.26 - unchanged from August 10, 2025.

The greenback had a slight recovery in the last session of the week after Bloomberg reported that Fed Governor Christopher Waller is emerging as the leading candidate for the position of Fed Chairman during Mr. Trump's term. Mr. Waller is highly regarded by the financial community and if appointed, is expected to bring more positive impacts to the USD.

Meanwhile, the Japanese Yen continued to weaken against the USD, as the market remained unclear about when the Bank of Japan (BoJ) would take its next step in interest rate policy. A summary of comments from the BoJ meeting in late July showed that policymakers remained concerned about the negative impact of higher US tariffs on the domestic economy. This increased the possibility that the BoJ would delay raising interest rates, putting pressure on the Yen. In addition, the optimistic sentiment in global markets also reduced demand for safe assets.

Traders now price in a roughly 94% chance of a September rate cut from 48% a week ago, according to CME Group's FedWatch Tool. In total, the market is forecasting a cut of about 60.5 basis points by 2025, reflecting expectations of looser monetary policy to support economic growth.

Source: https://baohatinh.vn/ty-gia-usd-hom-nay-1182025-thi-truong-trong-nuoc-on-dinh-post293455.html

![[Photo] Parade blocks pass through Hang Khay-Trang Tien during the preliminary rehearsal](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/27/456962fff72d40269327ac1d01426969)

![[Photo] Images of the State-level preliminary rehearsal of the military parade at Ba Dinh Square](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/27/807e4479c81f408ca16b916ba381b667)

Comment (0)