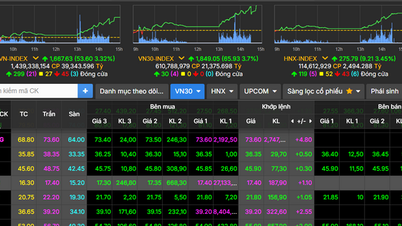

The market started the new week with difficulties, the VN-Index fell by more than 31 points in the context of the increasing USD exchange rate, causing investor concerns.

While the market was facing the possibility of strong fluctuations, the VN30 group of stocks immediately increased strongly, helping the market increase by nearly 54 points.

The remaining trading sessions of the week reflected the apparent balance of the market before the holiday, when supply and demand struggled on a low amplitude. Despite facing slight profit-taking pressure when approaching historical peaks, the VN-Index closed the trading week from August 25 to 29 at 1,682.21 points, up 36.74 points (+2.23%), marking the fourth consecutive week of increase.

However, liquidity decreased. Cumulatively, the average weekly liquidity on the Ho Chi Minh City Stock Exchange reached VND41,770 billion, down 25.96%.

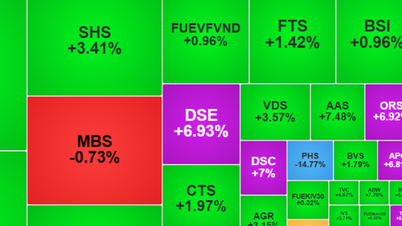

The market had a positive week with a wide coverage when 18/21 industry groups increased points. Securities was the industry group with the strongest increase, followed by retail and steel. On the other hand, oil and gas, industrial real estate, and chemicals were the industry groups under adjustment pressure this week.

Foreign investors extended their net selling streak with a value of VND11,138 billion at the end of the week.

According to experts from Vietnam Construction Securities Joint Stock Company, with the above developments, it is not impossible that the inertia of increasing points could push the VN-Index towards the resistance level of 1,720 points next month.

"However, at the present time, we continue to maintain a cautious stance, limit opening new buying positions, patiently wait for the VN-Index to accumulate in the balance zone before boldly disbursing for new net buying positions," this business expert recommended.

Experts from ASEAN Securities Joint Stock Company said that VN-Index will continue to fluctuate in the short term as the market is affected by profit-taking, especially from foreign investors.

With the short-term trading school, investors prioritize holding strategies to optimize profitability. Holding moves should focus on stocks that are attracting strong cash flows, maintaining short-term uptrends, and belonging to leading industries such as banking, securities, and real estate.

With the long-term buy and hold school, investors can maintain their current position, especially with low-cost stocks. Increasing the proportion should be done in the next decline phase of the leading stocks with profit growth prospects in the period of 2025 - 2026.

Source: https://hanoimoi.vn/tuan-tang-thu-4-lien-tiep-cua-thi-truong-chung-khoan-714684.html

![[Photo] National Assembly Chairman Tran Thanh Man welcomes and holds talks with Chairman of the National People's Congress of China Zhao Leji](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/31/9fa5b4d3f67d450682c03d35cabba711)

![[Photo] The first meeting of the Cooperation Committee between the National Assembly of Vietnam and the National People's Congress of China](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/31/f5ed4def2e8f48e1a69b31464d355e12)

![[Photo] General Secretary To Lam receives Chairman of the National People's Congress of China Zhao Leji](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/31/5af9b8d4ba2143348afe1c7ce6b7fa04)

![[Photo] Marching together in the hearts of the people](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/31/8b778f9202e54a60919734e6f1d938c3)

Comment (0)